Let ETH do the work

Put idle assets to work and contribute to the security of the Ethereum blockchain. In return, enjoy regular reward payouts with no lockup periods.

With liquid staking, native coins of a PoS network are staked through staking service providers and delegated to one of many validators participating in the consensus protocol. The service provider then issues liquid synthetic tokens corresponding to the staked tokens. Liquid staking takes the traditional staking model further by allowing token holders to extract utility from their staked assets and enabling use of their staked assets for other activities. In traditional staking, once tokens are staked, they are locked up and cannot be used or traded until the staking period ends. However, with liquid staking, token holders can continue to utilise their staked assets in certain ways while still potentially receiving staking rewards.

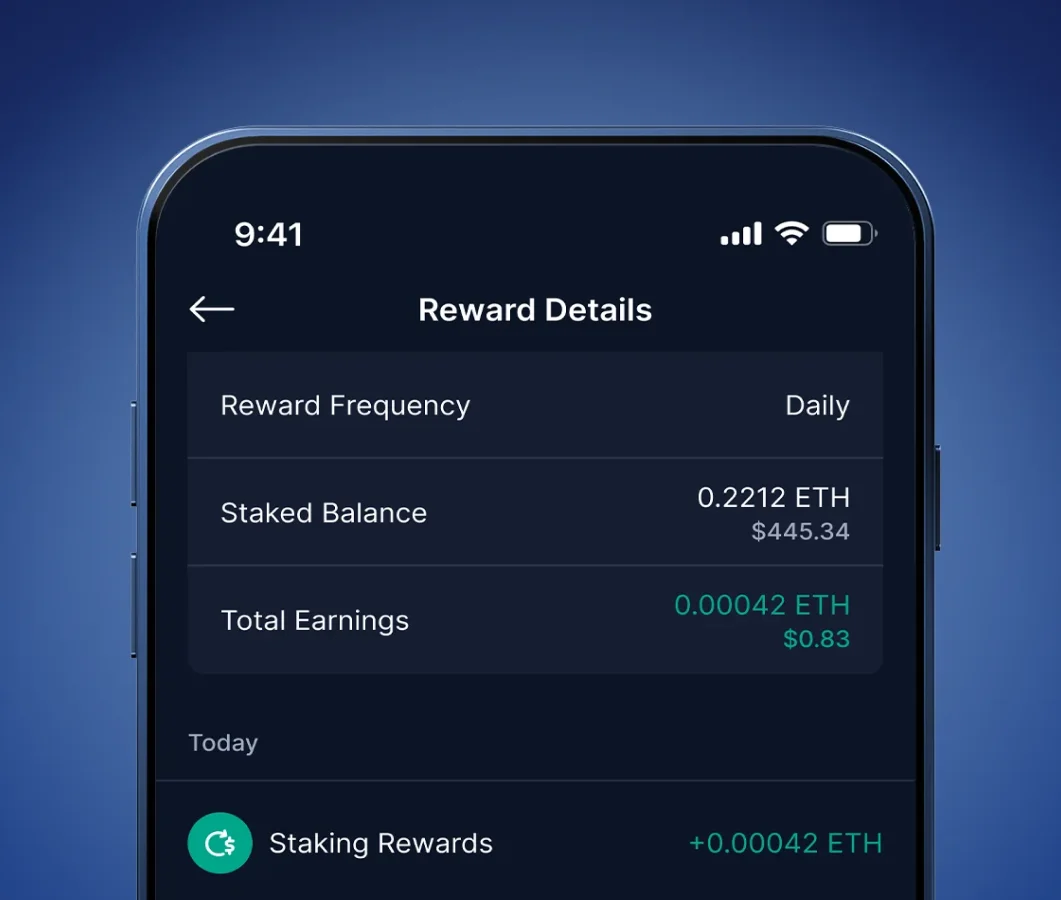

With Crypto.com, users can stake Ethereum and generate rewards while maintaining the flexibility to use their staked assets. Crypto.com Staked ETH (CDCETH) is available at launch. Wrapped Staked ETH (CDCETH) is a tradeable receipt token that represents users’ staked ETH. So users can still trade while they earn. Eligible users can wrap their staked ETH, for CDCETH without conversion fees, even when it’s undergoing unbonding. They can then start using CDCETH for various purposes, such as trading CDCETH with other cryptocurrencies — all with just a few taps. Liquid staking is available to users in the Crypto.com App in most jurisdictions. Visit the FAQ for details. Or, learn more about liquid staking here.

How does ETH staking work?

Staking is a crucial aspect of Proof of Stake (PoS) protocols. It allows users to participate in the network by locking up their tokens and becoming validators, who are responsible for verifying transactions and adding them to the blockchain.

In return for their services, validators receive rewards in the form of newly minted tokens. Staking incentivises users to hold onto their tokens and actively participate in the network, which helps to secure the protocol and maintain its integrity.

Additionally, staking can help navigate the volatility of the token's price by reducing the supply of tokens available for trading.

Every protocol has a different staking structure and mechanism. They are maintained and supported by various third-party projects that are distinct and separate from Crypto.com.

To learn more about how staking works visit the Crypto.com Staking hub.

Stake your ETH

on your terms

More about Ethereum

What Is Ethereum?

What Is Ethereum?

How to Stake Ethereum

How to Stake Ethereum

What Is Ethereum’s EIP-4844 Update?

What Is Ethereum’s EIP-4844 Update?

Frequently Asked Questions

There are no specific minimum or maximum limits for ETH staking with Crypto.com. However, please note that there may be a minimum stake requirement due to the system's minimal decimal precision. Staking your ETH with Crypto.com allows you to earn rewards and support the Ethereum network's operations. Conduct your own research and review the platform's terms, rewards structure, and potential fees before staking your ETH. Ref 1: Staking crypto on Crypto.com App

Crypto.com does not impose a waiting time. However, please note that there may be an activation queue imposed by the Ethereum (ETH) network.

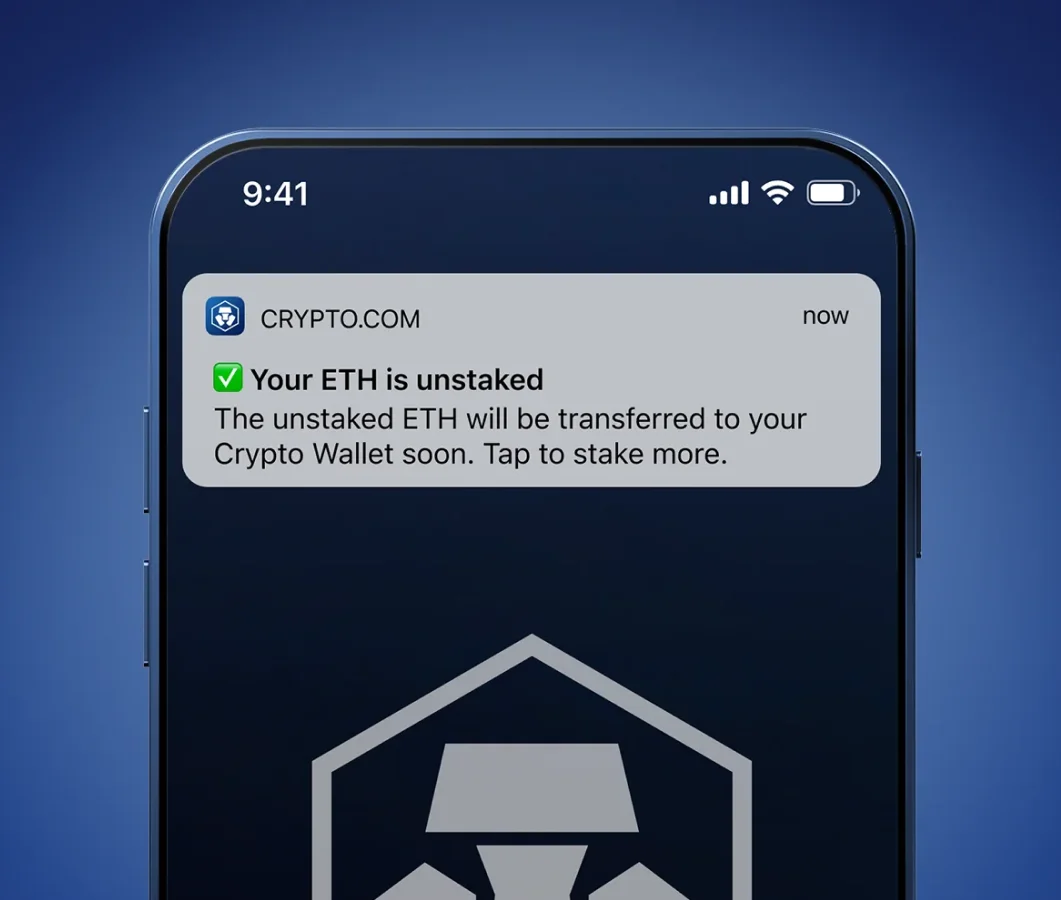

When it comes to ETH staking at Crypto.com, there is no specific lockup period imposed. You have the flexibility to stake and unstake your ETH as per your preference. However, it's worth noting that while Crypto.com doesn't enforce a lockup period, there may be an unstaking queue imposed by the Ethereum network itself. This means that when you initiate the unstaking process, it may take a couple of days for your ETH to become available for withdrawal. Ref 1: Staking crypto in the Crypto.com App Ref 2: How to Stake Ethereum

Read more about on-chain staking in our crypto staking article.