Solana Staking: A Guide to Staking SOL

Learn how to make the most of your SOL with staking on Solana — including current return rates.

Key Takeaways:

- Staking SOL tokens involves delegating them to a validator, which participates in the Solana network’s Proof of Stake (PoS) consensus mechanism to secure the blockchain and validate transactions.

- Potential benefits of staking include earning rewards, generating passive income, and gaining governance rights within the Solana ecosystem.

- Staking rewards depend on factors like the amount staked, the performance of the chosen validator, and overall network participation.

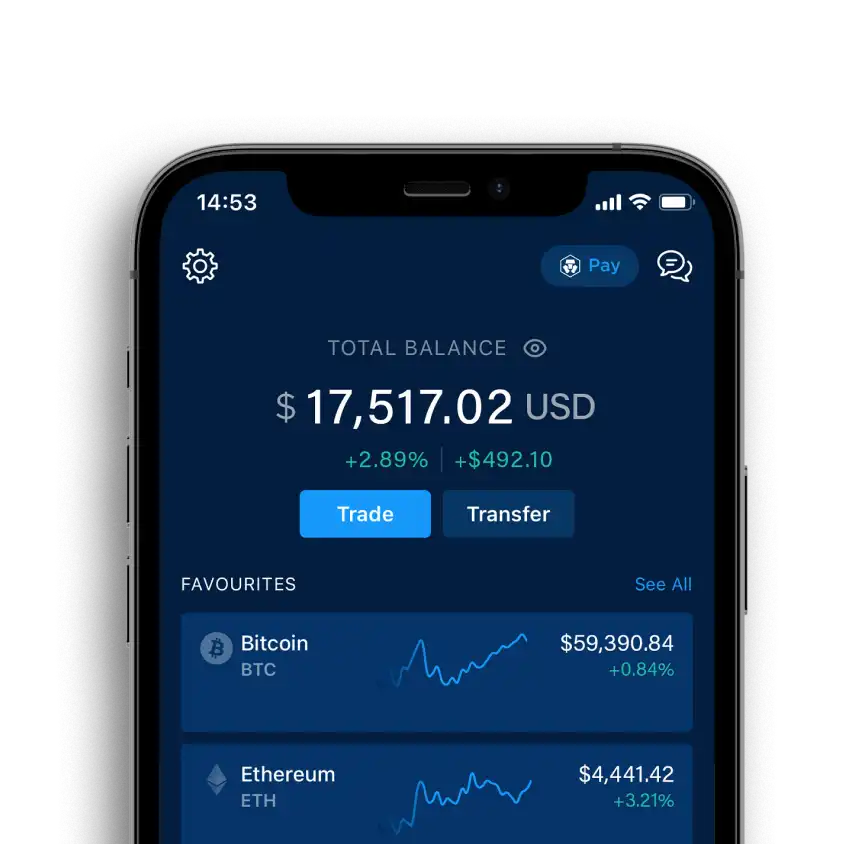

- Staking can be done directly through Solana wallets or platforms like Crypto.com, which may offer additional flexibility and/or security in the staking process.

- Challenges of staking include validator reliability, slashing penalties, liquidity constraints, and network congestion, all of which require careful management and diversification of stakes.

What Is Solana Staking and How Does It Work?

Solana staking is the process of users committing SOL tokens to the network’s validation process. By staking their tokens, users become active participants in securing the Solana blockchain and facilitating the verification of transactions. This process is essential for maintaining the network’s integrity and ensuring its smooth operation.

Learn more about staking in our University article.

The mechanics of Solana staking involve a user delegating their tokens to a validator; this node is responsible for processing transactions, adding new blocks to the blockchain, and ensuring the overall health of the network. When users stake their tokens, they entrust them to a validator of their choice, who then participates in the consensus mechanism on their behalf.

The staking process is facilitated by the Solana blockchain’s Proof of Stake (PoS) consensus algorithm, which differs from the energy-intensive Proof of Work (PoW) used by Bitcoin and other cryptocurrencies. In a PoS system, the likelihood of being selected to validate transactions and earn rewards is proportional to the number of tokens staked. This incentivises token holders to participate in the network’s security and governance.

Learn more about PoS in this University article.

Benefits of Solana Staking

Staking SOL tokens on the Solana network offers several compelling benefits, including rewards and potentially governance rights. By staking tokens, users become eligible to potentially receive a portion of the newly minted SOL tokens as a reward for contributing to the network’s security and validation process.

Their participation in staking helps to secure the Solana network by increasing its decentralisation and making it more resistant to attacks or manipulation. Additionally, in some cases, staking tokens may grant voting rights, allowing users to participate in the decision-making process regarding the future development and governance of the Solana ecosystem.

What Are Solana Staking Rewards?

Solana staking rewards are the incentives users may receive for participating in the network’s validation process. These rewards are distributed in the form of newly minted SOL tokens, which are added to a user’s staked balance over time.

The amount of rewards earned is primarily determined by the following factors:

- Staked Amount: The more SOL tokens a user stakes, the higher their potential rewards.

- Validator Performance and Commission: The performance and reliability of the validator node a user chooses to stake with can impact their rewards. Validators with higher uptime and better performance tend to receive a larger share of rewards. In addition, the potential rewards received are a net of commission fees paid to the validators.

- Network Participation: The overall participation rate of the Solana network also plays a role. If more token holders stake their tokens, the rewards are distributed amongst a larger pool of participants, potentially reducing individual rewards.

It’s important to note that Solana staking rewards are subject to fluctuations based on network conditions and the overall demand for staking. Additionally, validators may charge a commission fee, which is deducted from the rewards before distribution to stakers.

How to Stake SOL

Option 1: Selecting a Validator

For those who want full control over the staking process, go to Crypto.com Onchain, which is a non-custodial (also called self-custodial) wallet. Users select their own validator, with fees, returns, and slashing risk varying by validator. See below for more details on slashing.

To begin staking SOL tokens with self-custody, follow these general steps:

- Open Crypto.com Onchain.

- Users need to ensure there is a sufficient amount of SOL tokens in their wallet to stake. SOL tokens can be purchased in the Crypto.com App and on the Exchange.

- Research and choose a reputable validator node to delegate tokens to. Consider factors like their track record, commission fees, and overall performance.

- Follow the staking process within the chosen wallet or platform, specifying the amount of SOL tokens to stake and the selected validator.

- Users should keep an eye on their staked tokens and the rewards they’re earning. Some wallets or platforms may provide dashboards or analytics to track a user’s staking progress.

Option 2: Stake SOL Directly On-Chain With Crypto.com

Or, users can stake SOL directly on-chain in the Crypto.com App, which doubles as a custodial wallet. Crypto.com vets and manages the validator selection process for users, ensuring stable returns and minimising slashing risk. Crypto.com Staking enables crypto holders to receive regular on-chain rewards from their assets up to three times a week. It also offers users the flexibility of unstaking staked assets at any time in a secure and convenient manner.

Besides Solana (SOL), there are more than 20 tokens available in on-chain Staking, including Cronos (CRO), Polygon (MATIC), Ethereum (ETH), and Polkadot (DOT). Staking SOL on-chain currently receives 6.58% APR. Note that this APR rate is an estimation as of September 2024 and will be updated regularly in the App based on past data.

Here’s a list of all tokens users can stake (and their current interest) with Crypto.com. Note that staking is not available in all jurisdictions.

It’s essential for users to familiarise themselves with the specific staking process for the wallet or platform they choose, as the steps may slightly vary. Additionally, be mindful of any potential lockup periods or unbonding periods, which can affect the liquidity of a user’s staked tokens.

Common Challenges and Risks in Solana Staking

While Solana staking offers attractive rewards, it’s important to be aware of potential challenges and risks. These include validator reliability, slashing penalties, and liquidity constraints.

Validator Reliability: The performance and reliability of the validator node a user chooses can significantly impact their staking rewards. Choosing an unreliable or underperforming validator may result in lower rewards or even the loss of staked tokens. Crypto.com has a due diligence process and only selects reputable validators to work with, significantly reducing this risk when staking SOL with Crypto.com.

Slashing Penalties: In some cases, validators may be penalised for malicious behaviour or non-compliance with network rules. These penalties, known as ‘slashing’, can result in a portion of a user’s staked tokens being deducted or burned.

Liquidity Constraints: Depending on the staking platform or validator, there may be lockup periods or unbonding periods that restrict the immediate withdrawal of a user’s staked tokens. This can limit their liquidity and ability to respond to market conditions.

Network Congestion: During periods of high network activity or congestion, the validation process may be impacted, potentially affecting the distribution of rewards or the overall staking experience.

Staking with Crypto.com reduces several of these risks, including validator reliability, slashing penalties, and liquidity constraints.

Best Practices for Successful Solana Staking

To maximise the chances of success and optimise the Solana staking experience, consider implementing the following best practices:

- Instead of staking tokens with a single validator, consider spreading the stake across multiple reputable validators. This diversification can help mitigate the risk of validator downtime or underperformance.

- Stay up to date with the latest news, updates, and developments in the Solana ecosystem. Follow official channels, community forums, and reputable sources to stay informed about any changes that may have an impact on staking.

- Users should regularly monitor their staked tokens and the performance of their chosen validators and be willing to adjust their strategy as needed based on changing conditions or validator performance.

- If a user’s staked tokens grant them voting rights, they can actively participate in the governance process. This allows users to have a say in the future direction and development of the Solana network.

- Explore the option of joining staking pools, which allow users to pool their tokens with other stakers and potentially earn higher rewards while reducing individual risk.

- Implement robust security measures to protect all cryptocurrency holdings, such as using hardware wallets, enabling two-factor authentication (2FA), and following best practices for private key management.

Conclusion

Solana staking presents an exciting opportunity for token holders to potentially earn rewards while contributing to the security and decentralisation of the Solana network. By understanding the mechanics, benefits, and best practices outlined in this guide, crypto holders can navigate the Solana staking landscape with confidence.

Remember, staking is not a risk-free endeavour, and it’s crucial for users to conduct thorough research, diversify their portfolios, and stay informed about the latest developments. As the Solana ecosystem continues to evolve and gain traction, the potential for staking rewards and network participation may increase. Stay vigilant, adapt to changing conditions, and seize the opportunities that align with investment goals.

Due Diligence and Do Your Own Research

All examples listed in this article are for informational purposes only. You should not construe any such information or other material as legal, tax, investment, financial, cybersecurity, or other advice. Nothing contained herein shall constitute a solicitation, recommendation, endorsement, or offer by Crypto.com to invest, buy, or sell any coins, tokens, or other crypto assets. Returns on the buying and selling of crypto assets may be subject to tax, including capital gains tax, in your jurisdiction. Any descriptions of Crypto.com products or features are merely for illustrative purposes and do not constitute an endorsement, invitation, or solicitation.

Past performance is not a guarantee or predictor of future performance. The value of crypto assets can increase or decrease, and you could lose all or a substantial amount of your purchase price. When assessing a crypto asset, it’s essential for you to do your research and due diligence to make the best possible judgement, as any purchases shall be your sole responsibility.

Partilha com amigos

Artigos relacionados

How to Participate in Solana Governance: A Step-by-Step Guide

How to Participate in Solana Governance: A Step-by-Step Guide

How to Participate in Solana Governance: A Step-by-Step Guide

Bitcoin vs Bitcoin Cash — A Closer Look at Their Shared Origins and Diverging Paths

Bitcoin vs Bitcoin Cash — A Closer Look at Their Shared Origins and Diverging Paths

Bitcoin vs Bitcoin Cash — A Closer Look at Their Shared Origins and Diverging Paths

Solana Tokenomics: Everything to Know

Solana Tokenomics: Everything to Know

Solana Tokenomics: Everything to Know

Pronto para iniciar a sua jornada com a crypto?

Obtenha o seu guia passo a passo para configuraruma conta com Crypto.com

Ao clicar no botão Enviar, o utilizador reconhece ter lido o Aviso de Privacidade da Crypto.com onde explicamos como utilizamos e protegemos os seus dados pessoais.