Key Takeaways:

- Bitcoin is a peer-to-peer (P2P) digital currency system conceived in 2008 by an anonymous person or group with the moniker Satoshi Nakamoto.

- Using the Proof of Work (PoW) consensus mechanism, the network rewards miners for maintaining the system.

- Bitcoin is the first payment network that is fully autonomous and self-sustaining, where no single party can intervene in or terminate it.

- Since the inception of Bitcoin, hundreds of thousands of altcoins have been created, each offering its own use cases and benefits.

What Is Bitcoin?

On a technical level, Bitcoin can be thought of as numbers stored on the Internet. It was conceived in 2008 when someone under the name ‘Satoshi Nakamoto’ (whose real identity is still a mystery) published a white paper called ‘Bitcoin: A Peer-to-Peer Electronic Cash System’. The title of the paper captures the two key features of Bitcoin:

- Peer-to-Peer (P2P): Bitcoin allows direct P2P payments without third-party intermediaries, such as banks or payment processors. This is a major reason why Bitcoin is commonly regarded as a decentralised currency.

- Electronic Cash: There have been many past attempts to develop electronic cash, but Bitcoin stands out for its clever use of existing technologies like cryptography and distributed systems, making it highly secure and efficient.

How Does Bitcoin Work?

Bitcoin uses blockchain technology. Regular users can access the system to make transactions, while miners work behind the scenes to power and maintain the network. Anyone can partake in mining.

Users send and receive money via the Bitcoin system, with the difficult behind-the-scenes work handled by miners.

Miners need to run computers with a lot of processing power in order to store data, handle and broadcast transactions, and solve a complex mathematical puzzle to reach what is known as ‘consensus‘. This mechanism is called Proof of Work (PoW). When someone sends a new transaction to the Bitcoin network, miners pick up the transaction and complete the steps above behind the scenes.

Miners do not volunteer to maintain this decentralised network for free. They are incentivised to do so by receiving mining rewards and transaction fees upon completing the equation and validating transactions. They are, of course, paid in Bitcoin.

To gain a deeper understanding of the technological aspects of Bitcoin, check out this University article.

Why Is Bitcoin Revolutionary?

Bitcoin is the first payment network that is fully autonomous and self-sustaining, where no single party or incidence can intervene or terminate the system. Users can access it anytime, anywhere in the world, as long as they have Internet access.

Bitcoin paved the way for the most significant technological revolution since the Internet — a global digital currency without intermediary fees.

Other interesting features of Bitcoin (and cryptocurrencies in general) include:

- Limited Supply: As of March 2023, there are 19 million BTC in circulation out of a total supply of 21 million. This scarcity is why Bitcoin is often called ‘digital gold’.

- Fast Settlement: For Bitcoin, settlement takes around one hour versus two days for wire transfers.

- Smart Contracts: Developers have the ability to build applications on the network, also known as smart contracts.

Why Are There So Many Different Cryptocurrencies?

Alternative coins (altcoins) are cryptocurrencies that are not Bitcoin. Altcoins exist for various purposes. They have different visions, users, or benefits that others do not have.

Examples like Litecoin (LTC) and Bitcoin Cash (BCH) share Bitcoin’s features, but they offer faster transaction speeds. Ethereum (ETH) and EOS focus on providing an open platform for writing smart contracts and building decentralised applications (dapps).

A basic classification system for cryptocurrencies:

- Cryptocurrencies/Payment Tokens: Used to pay for goods and services, or to transfer money.

- Security Tokens: Represent credit or debt; for example, a share in future company earnings or future capital flows.

- Utility Tokens: Give holders access to the underlying decentralised application (dapp) or crypto ecosystem.

For example, Cronos Coin (CRO) acts as a utility token for users to reserve a Crypto.com Visa Card and access other benefits. It also acts as a payment token for Crypto.com Pay, allowing users to purchase Gift Cards, Mobile Airtime, and more using cryptocurrencies, with up to 10% back.

Today, there are well over 20,000 different cryptocurrencies, and the space is still constantly innovating and adapting. Track all the top cryptocurrencies in our Crypto.com App and on the Crypto.com Price page.

Is Bitcoin Safe?

While there is no simple answer, the Bitcoin network is reasonably safe and has endured real-life usage for over a decade. It is equally important for users to be cautious of how they store crypto and protect their keys.

To keep their cryptocurrency holdings safe, users can store them in crypto wallets using an institutional-grade storage solution that offers customer service support. Additional security and data privacy best practices can be found here.

How to Buy Bitcoin

There are many different ways to purchase Bitcoin, and the right choice for the buyer depends on their individual preferences.

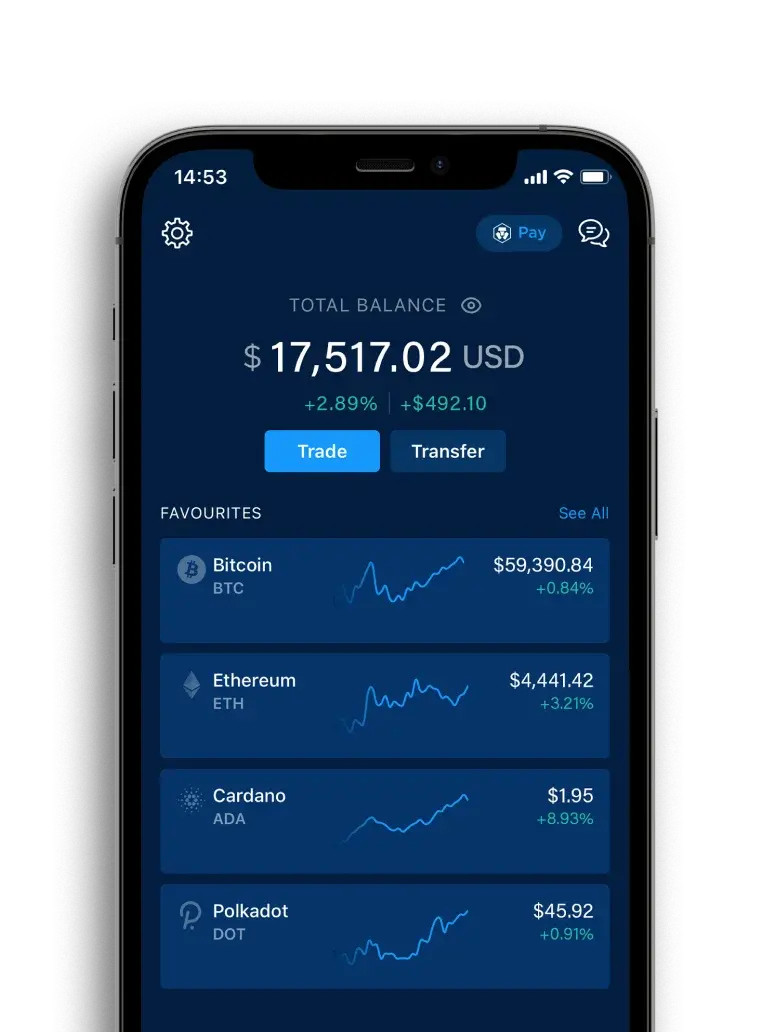

- Brokerages are a type of financial service that allows individuals to buy and sell cryptocurrency. They typically provide access to a variety of currencies and features like interest-bearing accounts. The Crypto.com App is a brokerage trusted by over 80 million users and is a great place for beginners to start their crypto journey.

- Exchanges facilitate cryptocurrency trading for individuals and institutions. They also provide an array of features, such as charting and analysis tools, to help users make informed decisions. The Crypto.com Exchange is known for its industry-leading matching engine and security infrastructure.

- Peer-to-peer marketplaces provide an anonymous way for people to connect and trade cryptocurrency with each other without the need for a third-party intermediary. The DeFi Wallet is a non-custodial app that gives users full control of their private keys.

- Cryptocurrency ATMs are similar to traditional ATMs but dispense cryptocurrency instead of cash.

How Is Cryptocurrency Different From Traditional Finance?

Below are the key points characterising the cryptocurrency market in which Bitcoin operates:

- The only asset class that is traded 24 hours a day, seven days a week.

- A global market without geographical barriers.

- The first payment network that is fully autonomous, self-sustaining, and decentralised.

- A liquid and highly efficient market (for major cryptocurrencies).

- A new and high growth market that attracts a profusion of talent and capital.

- A highly volatile market, bringing a unique set of both advantages and disadvantages to market participants.

Crypto.com’s converter feature is used to check the price of Bitcoin in real-time. It’s located at the top-right corner of the Crypto.com Price page.

In the Crypto.com App, users can conveniently buy Bitcoin and 250-plus other coins using a credit/debit card, Apple Pay, Google Pay, or 20-plus fiat currencies transferred from their bank account. To do so, users can tap ‘Buy’ from the home screen, and select the token to purchase and payment method.

Visit the Help Centre for more information, and download the Crypto.com App here.

Due Diligence and Do Your Own Research

All examples listed in this article are for informational purposes only. You should not construe any such information or other material as legal, tax, investment, financial, cybersecurity, or other advice. Nothing contained herein shall constitute a solicitation, recommendation, endorsement, or offer by Crypto.com to invest, buy, or sell any coins, tokens, or other crypto assets. Returns on the buying and selling of crypto assets may be subject to tax, including capital gains tax, in your jurisdiction. Any descriptions of Crypto.com products or features are merely for illustrative purposes and do not constitute an endorsement, invitation, or solicitation.

Past performance is not a guarantee or predictor of future performance. The value of crypto assets can increase or decrease, and you could lose all or a substantial amount of your purchase price. When assessing a crypto asset, it’s essential for you to do your research and due diligence to make the best possible judgement, as any purchases shall be your sole responsibility.