Crypto Market Pulse (28/08/2023)

Australian central bank completes CBDC pilot. ARK Invest and 21Shares apply for ETH futures ETFs. Central African Republic considers tokenising its natural resources.

Weekly Market Index

Last week’s crypto market prices rose by +5.45%. Volume and volatility decreased by -23.21% and -75.68%, respectively.

Chart of the Week

The recent launch of Friend.tech has rekindled interest in social related Dapps. The chart below ranks the top 10 social media Dapps by unique active wallets (UAW) interacting or performing a transaction with the Dapp’s smart contracts over the past 30 days.

Weekly Performance

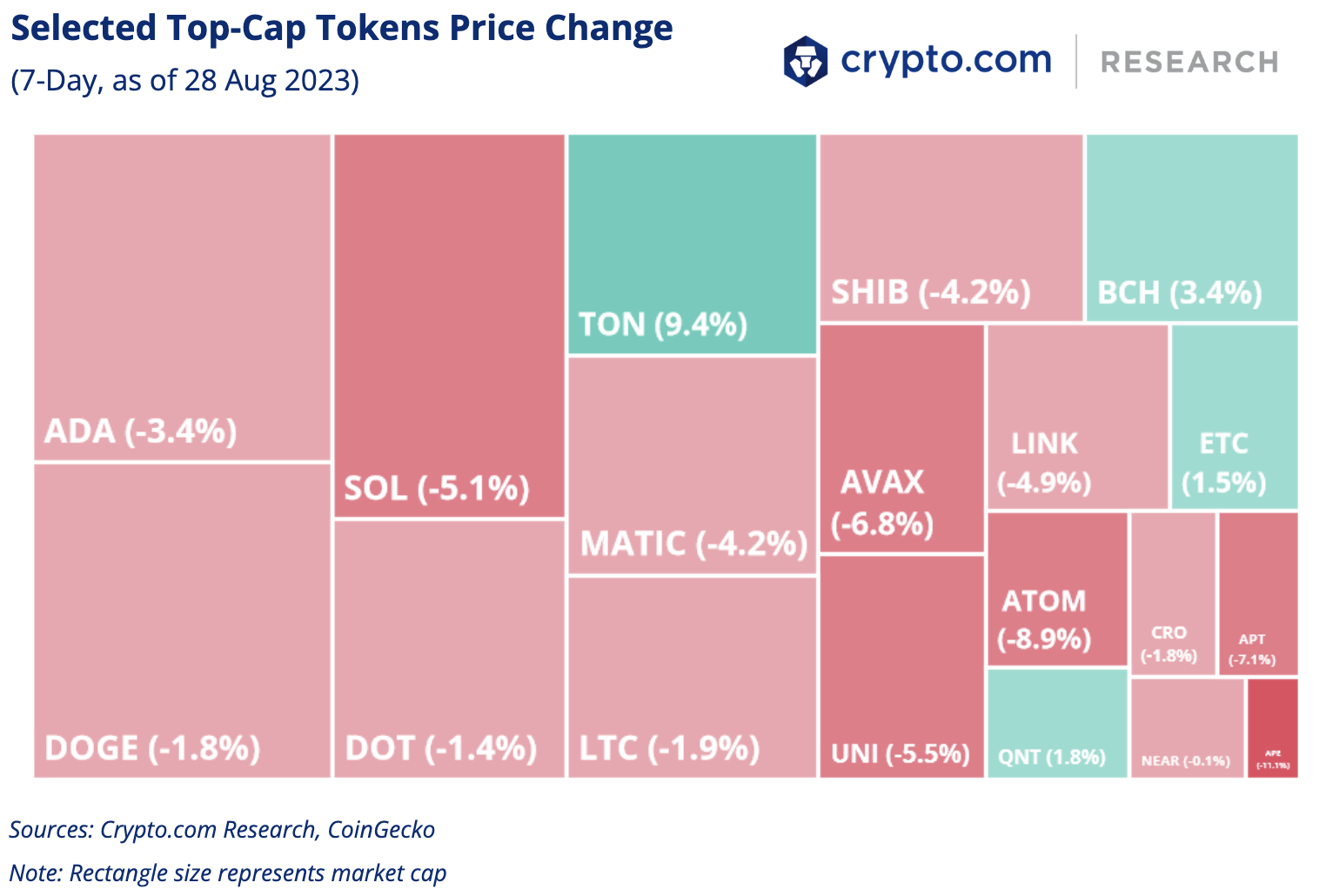

Bitcoin (BTC) and Ethereum (ETH) prices fell slightly at -0.4% and -1.8%, respectively, in the past seven days. Price action for other selected top-cap tokens was also mostly negative.

Selected key categories were also down slightly on market cap change in the past seven days.

News Highlights

- The Reserve Bank of Australia has completed its pilot of a central bank digital currency exploring use cases for a potential digital dollar, finding it useful in four main areas, including enabling complex payments and asset tokenisation.

- Investment firms ARK Invest and 21Shares have teamed up to apply for two Ethereum futures exchange-traded funds (ETF) after reports emerged last week that the United States securities regulator could soon begin approving applications.

- Central African Republic’s legislative body has granted approval for the tokenisation of land and natural resources, hoping to position the nation as a preferred business destination in Africa.

- E-commerce giant Shopify is allowing users to pay in USD Coin (USDC) via integration with Solana Pay, the payment protocol built on the Solana blockchain.

Recent Research Reports

| Research Roundup Newsletter [July 2023] | Real-World Assets: Bridging Real-World Value to DeFi | Crypto Market Sizing Report H1 2023 |

- Research Roundup Newsletter [July 2023]: We present to you our latest issue of Research Roundup, featuring trending market insights in July, charts of the month, and our latest research exploring real-world assets.

- Crypto Market Sizing Report H1 2023: Global crypto owners reached 516 million by the first half of 2023.

- Real-World Assets: Bridging Real-World Value to DeFi: Real World Assets is a promising application for blockchain technology that is gaining traction. We explore notable projects like Centrifuge, Ondo, Tangible, and Toucan.

- Alpha Navigator: Quest for Alpha [July 2023]: Risk assets continued their positive price action in July, although BTC dipped slightly. Macro calendar is quiet up until mid-August when we have the US CPI and release of FOMC minutes.

Recent University Articles

| Top Web3 Tokens to Know in 2023 | 10 Bearish Crypto Trading Indicators to Know | Bitcoin as a Store of Value: A Comparison to Gold and Other Assets |

- Top Web3 Tokens to Know in 2023: Discover promising Web3 tokens in the crypto landscape that may redefine the decentralised ecosystem in the coming years.

- 10 Bearish Crypto Trading Indicators to Know: Discover 10 popular bearish crypto trading indicators that, when combined with other indicators, can help enhance the trading experience.

- Bitcoin as a Store of Value: A Comparison to Gold and Other Assets: Explore the potential of Bitcoin as a store of value — its durability, portability, and other characteristics.

Catalyst Calendar

Author

Research and Insights Team

Disclaimer:

The information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.

The brands and the logos appearing in this report are registered trademarks of their respective owners.

Share with Friends

Related Articles

NFT & Gaming — 🌟 Loaded Lions set a new Guinness World Record; ‘Crypto.com Land – Fractured Fate’ sold out in minutes

DeFi & L1L2 Weekly — 📈 The number of unique addresses interacting with Ethereum L2s reached a new high; Helium partnered with US telecommunications giant AT&T

📉 Bitcoin supply on centralised exchanges reached a 3-year low; Crypto.com signed a binding agreement with Trump Media to support Truth.Fi-branded ETFs

Ready to start your crypto journey?

Get your step-by-step guide to setting upan account with Crypto.com

By clicking the Submit button you acknowledge having read the Privacy Notice of Crypto.com where we explain how we use and protect your personal data.