How to Trade With Time-Weighted Average Price (TWAP) in the Crypto.com App

Retail investors can now set Time-Weighted Average Price (TWAP) orders in the Crypto.com App. Here’s how to give it a try for better price averages.

Key Takeaways

- TWAP divides large orders into smaller, equally sized trades executed at regular intervals, reducing the risk of slippage and significant price movements.

- Retail traders can now benefit from TWAP trading, as it is accessible to all Crypto.com App users for both fiat and crypto transactions.

- Traders can customise TWAP settings, including time intervals (ranging from five minutes to 24 hours) and trade sizes, making it suitable for various trading needs.

- While TWAP reduces market impact, traders should be aware of market volatility, algorithmic complexity, and potentially higher transaction costs when implementing this strategy.

Introduction

The cryptocurrency market is known for its high volatility and rapid price fluctuations. For retail traders and institutional investors alike, executing large orders without significantly affecting the market price can be a challenge. This is where Time-Weighted Average Price (TWAP) trading comes into play.

TWAP is a trading strategy that spreads out large orders over a specific period, aiming to minimise market impact and achieve an average execution price. In this article, we explore the concept of TWAP trading, how it works, its advantages, and how to easily set up a TWAP order in the Crypto.com App.

What Is TWAP Trading?

TWAP is a trading algorithm that divides a large order into smaller, equally sized trades executed at regular intervals over a predefined period. The goal is to achieve an execution price close to the average price of the asset over that time frame, thereby reducing the market impact of the order.

TWAP Calculation

TWAP is calculated by taking the average price of an asset over a specified time period. For example, if a trader wants to execute an order over the course of an hour, the algorithm will divide the total order into smaller trades executed every few minutes. The price of each trade is then averaged to determine the TWAP.

Below is the formula for the TWAP algorithm:

where \(P_i \) is the price at each interval, and \(n \) is the number of intervals.

How TWAP Works in Cryptocurrency Trading

Order Execution

When a trader wants to buy or sell a large quantity of a cryptocurrency, placing the entire order at once can lead to significant slippage and market impact.

TWAP trading mitigates this by:

Breaking Down Orders: Dividing the large order into smaller chunks.

Regular Intervals: Executing these smaller trades at consistent, predetermined intervals.

Market Analysis: Adjusting the trading intervals based on market conditions to avoid periods of high volatility.

Example

Suppose a trader wants to buy 10 Solana (SOL) over the next 10 hours. Using a TWAP strategy, the order might be split into 10 trades of 1 SOL each, executed every hour. This way, the purchase is spread out, reducing the likelihood of significant price movement caused by the large order.

Advantages of TWAP Trading

Reduced Market Impact

By spreading out the trades over time, TWAP minimises the effect on the market price, helping to achieve a better overall execution price.

Mitigation of Slippage

Slippage occurs when the execution price of a trade differs from the expected price due to market movements. TWAP trading reduces the risk of slippage by distributing trades over a longer period.

Simplicity and Efficiency

TWAP is relatively straightforward to implement and can be automated using trading bots or algorithms, making it an efficient strategy for handling large orders.

Flexibility

Traders can customise the TWAP strategy based on their specific needs, such as adjusting the time frame or the size of each trade.

Who Uses TWAP Orders in the Crypto Market?

Institutional investors, such as hedge funds and asset managers, often use TWAP trading to execute large orders without significantly impacting the market. This helps in maintaining the confidentiality of their trading activities and avoiding front running.

High-frequency traders also use TWAP algorithms to optimise their trading strategies and achieve better execution prices, leveraging the volatility of the cryptocurrency market.

Traditionally, retail investors haven’t used TWAP orders as frequently, as they often weren’t available to them. Now, with TWAP orders available to all Crypto.com users, retail investors can also benefit from TWAP trading.

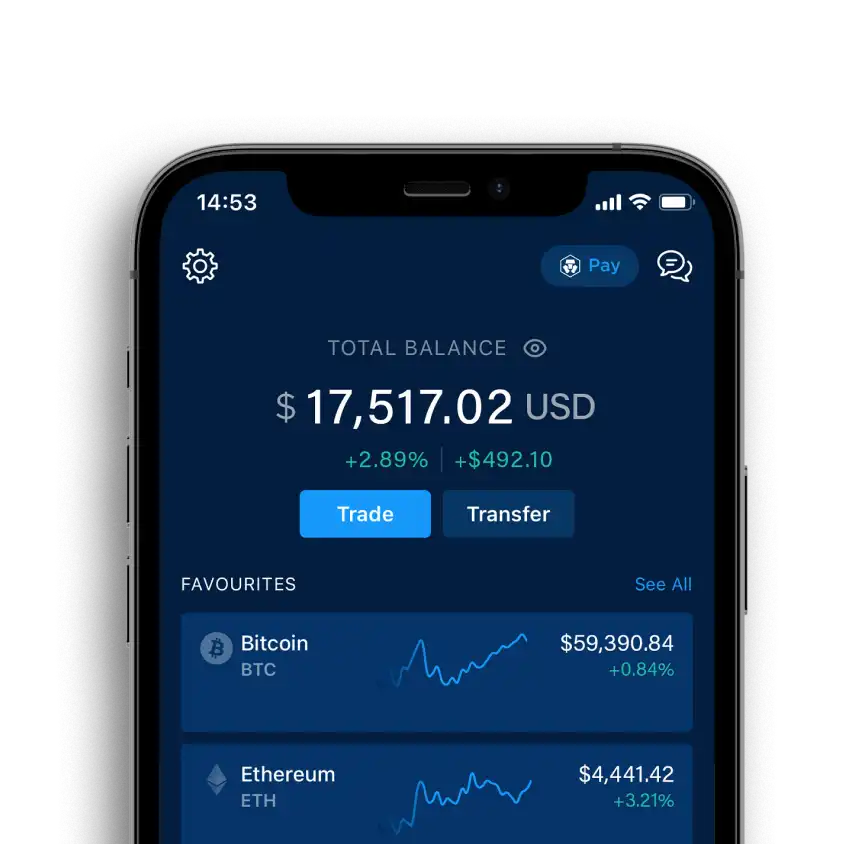

How to Set Up a TWAP Order in the Crypto.com App

TWAP orders are available to all users on spot trades and can be used on both buy and sell transactions. TWAP can be used for both fiat and crypto orders, with time intervals ranging from a minimum of five minutes to a maximum of 24 hours.

Here are the steps:

1. In the Crypto.com App, select the cryptocurrency you wish to trade.

2. Select the TWAP order.

3. Set up a run time between five minutes and 24 hours for your TWAP order.

4. Confirm the details by hitting the ‘Confirm’ button.

Your TWAP order is now set.

For more details, visit our FAQ on TWAP orders.

Considerations Before Using TWAP Orders

Market Volatility

While TWAP aims to reduce market impact, high volatility in the cryptocurrency market can still affect the execution price. Traders should be aware of market conditions and adjust their strategy accordingly.

Algorithmic Complexity

Implementing a TWAP strategy requires a robust understanding of algorithmic trading. Make sure you fully understand TWAP trading before executing your first order.

Conclusion

Time-Weighted Average Price (TWAP) trading is a valuable strategy for managing large orders in the cryptocurrency market. By spreading out trades over a specified period, TWAP minimises market impact, reduces slippage, and achieves an average execution price close to the market average.

Whether you’re an institutional investor, high-frequency trader, or retail investor, with Crypto.com’s TWAP orders you can enhance trading efficiency and effectiveness in volatile markets.

Due Diligence and Do Your Own Research

All examples listed in this article are for informational purposes only. You should not construe any such information or other material as legal, tax, investment, financial, cybersecurity, or other advice. Nothing contained herein shall constitute a solicitation, recommendation, endorsement, or offer by Crypto.com to invest, buy, or sell any coins, tokens, or other crypto assets. Returns on the buying and selling of crypto assets may be subject to tax, including capital gains tax, in your jurisdiction. Any descriptions of Crypto.com products or features are merely for illustrative purposes and do not constitute an endorsement, invitation, or solicitation.

Past performance is not a guarantee or predictor of future performance. The value of crypto assets can increase or decrease, and you could lose all or a substantial amount of your purchase price. When assessing a digital asset, it’s essential for you to do your research and due diligence to make the best possible judgement, as any purchases shall be your sole responsibility.

Compartilhar com amigos

Artigos relacionados

How to Participate in Solana Governance: A Step-by-Step Guide

How to Participate in Solana Governance: A Step-by-Step Guide

How to Participate in Solana Governance: A Step-by-Step Guide

Bitcoin vs Bitcoin Cash — A Closer Look at Their Shared Origins and Diverging Paths

Bitcoin vs Bitcoin Cash — A Closer Look at Their Shared Origins and Diverging Paths

Bitcoin vs Bitcoin Cash — A Closer Look at Their Shared Origins and Diverging Paths

Solana Tokenomics: Everything to Know

Solana Tokenomics: Everything to Know

Solana Tokenomics: Everything to Know

Pronto para começar sua jornada cripto?

Receba o guia passo a passo para abriruma conta na Crypto.com

Ao clicar no botão Enviar, você reconhece que leu o Aviso de Privacidade da Crypto.com onde explicamos como usamos e protegemos seus dados pessoais.