Starter guide to crypto tax and who needs to pay it

What is crypto tax? Who needs to pay it — and how? Learn the ins and outs of Crypto.com Tax to file returns and get an overview of the tax rules for the US, Canada, the UK, and Australia.

Nic Tse

Nic Tse

What is crypto tax? Who needs to pay it — and how? Learn the ins and outs of Crypto.com Tax to file returns and get an overview of the tax rules for the US, Canada, the UK, and Australia.

Crypto tax refers to the taxation of cryptocurrency transactions, such as buying, selling, receiving, or exchanging cryptocurrencies like Bitcoin, Ethereum, or other digital assets. The taxation rules and regulations vary by country; but generally, crypto assets are treated as property for tax purposes and are subject to capital gains tax when sold or traded for a profit.

Key takeaways:

- In many countries, cryptocurrency is considered property for tax purposes; as such, capital gains from selling or trading cryptocurrency may be taxable.

- Crypto tax can vary depending on country of residence.

- Find a 5-step guide below for doing crypto taxes.

- Learn how the Crypto.com Tax tool can help with what is often the hardest part: calculating taxes.

- Included are tax guides for the US, Canada, the UK, and Australia.

Who needs to pay crypto tax?

The requirement to pay taxes on cryptocurrency transactions depends on the laws and regulations of the country or countries applicable to a user. In many countries, cryptocurrency is considered property for tax purposes, and capital gains from selling or trading cryptocurrency may be taxable.

Tax laws can change rapidly, and it’s important for users to research the specific laws and regulations in their jurisdiction to determine if, and in what way, they are required to pay taxes on their cryptocurrency transactions. It’s also a good idea to consult with a tax professional for personalised advice.

How to calculate crypto tax in 5 steps:

The process for users to pay crypto tax varies by country, but generally involves reporting taxable cryptocurrency transactions on their tax return as either capital gains or income. This depends on the type of transaction and jurisdiction.

Here is a general outline of the steps involved in paying crypto tax:

- Gather records: Keep detailed records of all cryptocurrency transactions, including the date, type of transaction, and the cost basis (the original value of the asset).

- Determine taxable events: Review all transactions to determine which ones are taxable. In most cases, selling or exchanging cryptocurrency for fiat currency, goods and services, or other cryptocurrencies is considered a taxable event.

- Calculate income, capital gains, and losses: For each taxable event, a user should note if they have received assets as income or capital gains. Calculate any capital gains by subtracting the cost basis from the proceeds of the sale. Also calculate the capital losses by subtracting the purchase price from the sales price.

- Report income or gains on the tax return: Report any gains or income from cryptocurrency transactions on the tax return, usually under the section for income or capital gains and losses. Users may need to complete additional tax forms or schedules to report their cryptocurrency transactions, depending on their jurisdiction.

- Pay any tax owed: If a user owes tax on their cryptocurrency, they’ll need to pay the amount owed to the tax authority in their jurisdiction.

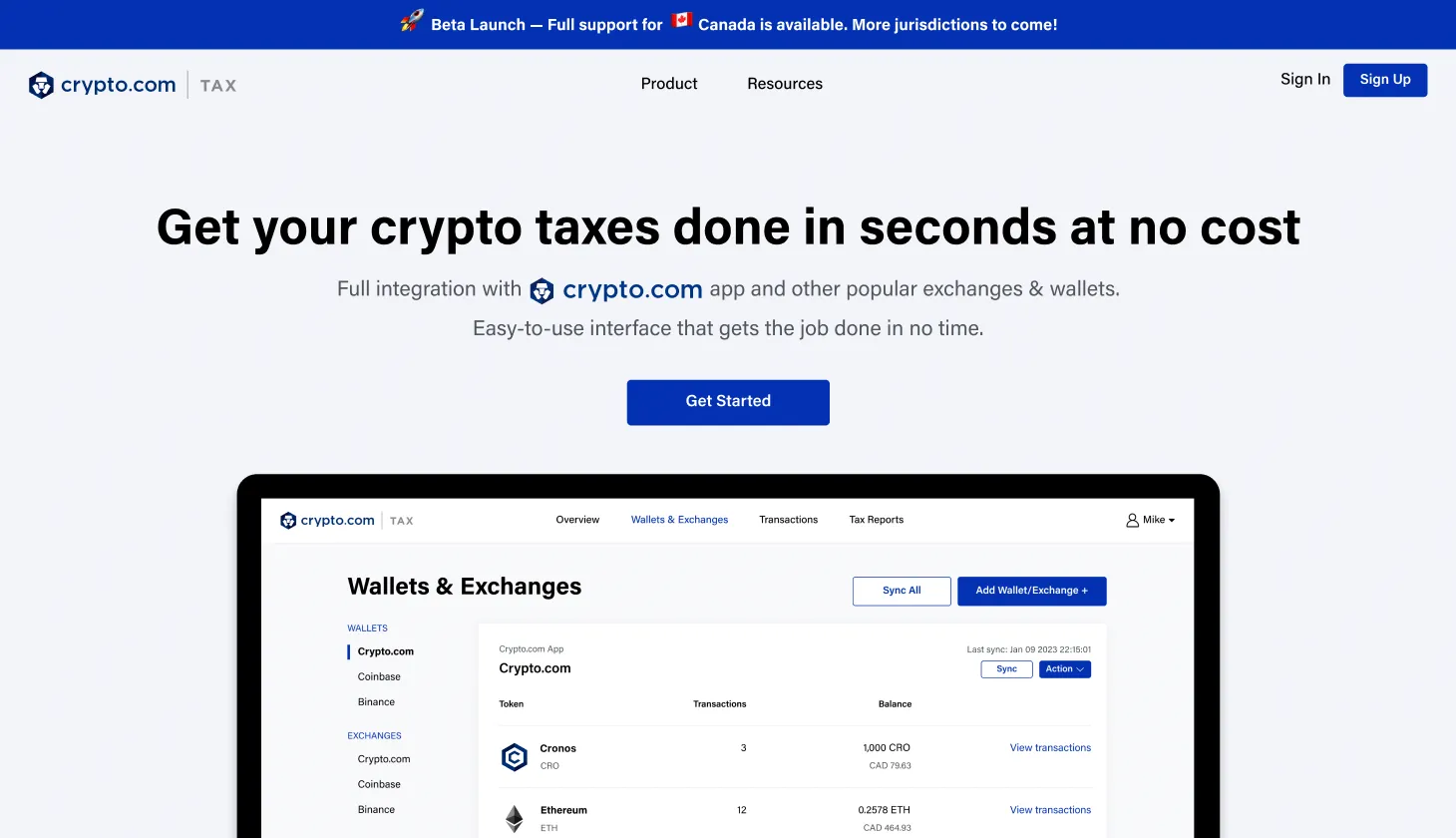

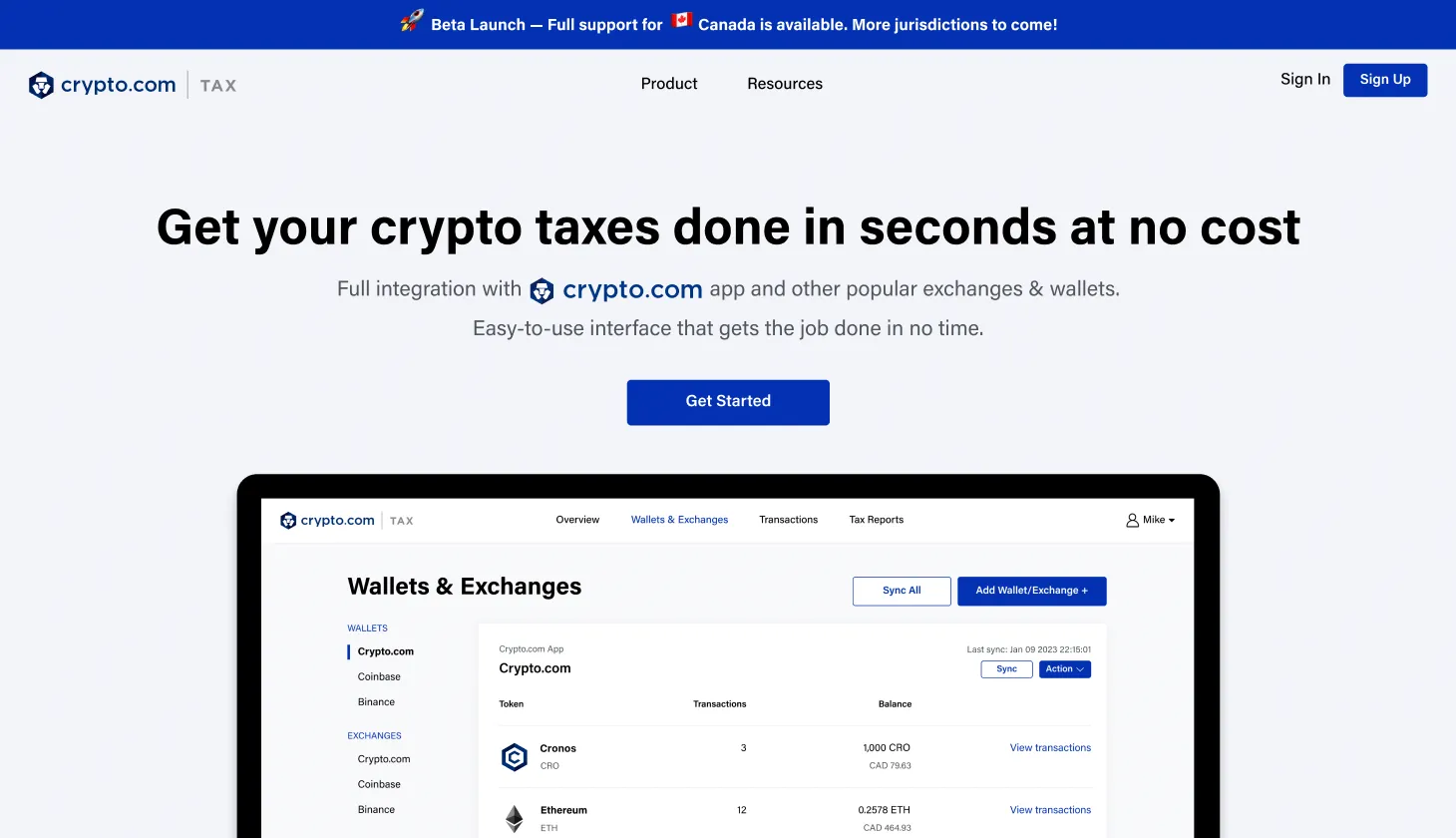

Or have Crypto.com Tax do it instead for free

The Crypto.com Tax tool helps to calculate and report cryptocurrency taxes. Crypto.com Tax is free for anyone in supported jurisdictions who needs to prepare their crypto taxes. No matter how many transactions have occurred in a particular tax year, the Crypto.com Tax tool will calculate the tax report at no cost.

Click to see all supported exchanges and wallets.

How to use Crypto.com Tax

- Sign up for a Crypto.com account. For users who already have one, sign in.

- Select the jurisdiction and tax year to be calculated.

- Connect all cryptocurrency exchange accounts to Crypto.com Tax. This allows the tool to access transaction history and calculate capital gains and losses.

- Review and confirm the imported transaction history from the connected exchange accounts.

- Use the tool to calculate capital gains and losses. The tool takes into account cost basis, holding period, and any other relevant tax information in order to calculate taxes owed.

- Generate a report of the capital gains and losses to use for filing taxes.

- If necessary, make any adjustments to the transaction history in the tool.

- Download and save a copy of the report for record-keeping.

The interface is simple and intuitive, aiming to create the best user experience when dealing with tax matters. All results are transparent for review prior to generating the final results.

For final filing, users can generate 5 types of reports with Crypto.com Tax:

1. Capital gains/losses — CSV file including the number of proceeds, cost basis, selling expense, and capital gains/losses

2. Transaction history — CSV file to keep books and records

3. Income report — to keep track of a user’s cryptocurrency received

4. Gifts, donations, and payments report — to keep records of all cryptocurrency sent

5. Expenses report — to keep track of particular fee charges (e.g., gas fees from failed transactions)

US crypto tax forms

1. Form 8949

2. Schedule D

3. TurboTax online CSV file

4. Tax Act CSV file

Crypto tax guides by country

Below are individual country guides to some of the biggest crypto communities around the world, including current tax rates (at the time of writing).

However, it’s important to keep in mind that these guides provide only a general overview; the tax laws surrounding cryptocurrency can be complex and are subject to change, so users should consult with a tax professional to determine the exact amount of tax they’ll need to pay in their jurisdiction.

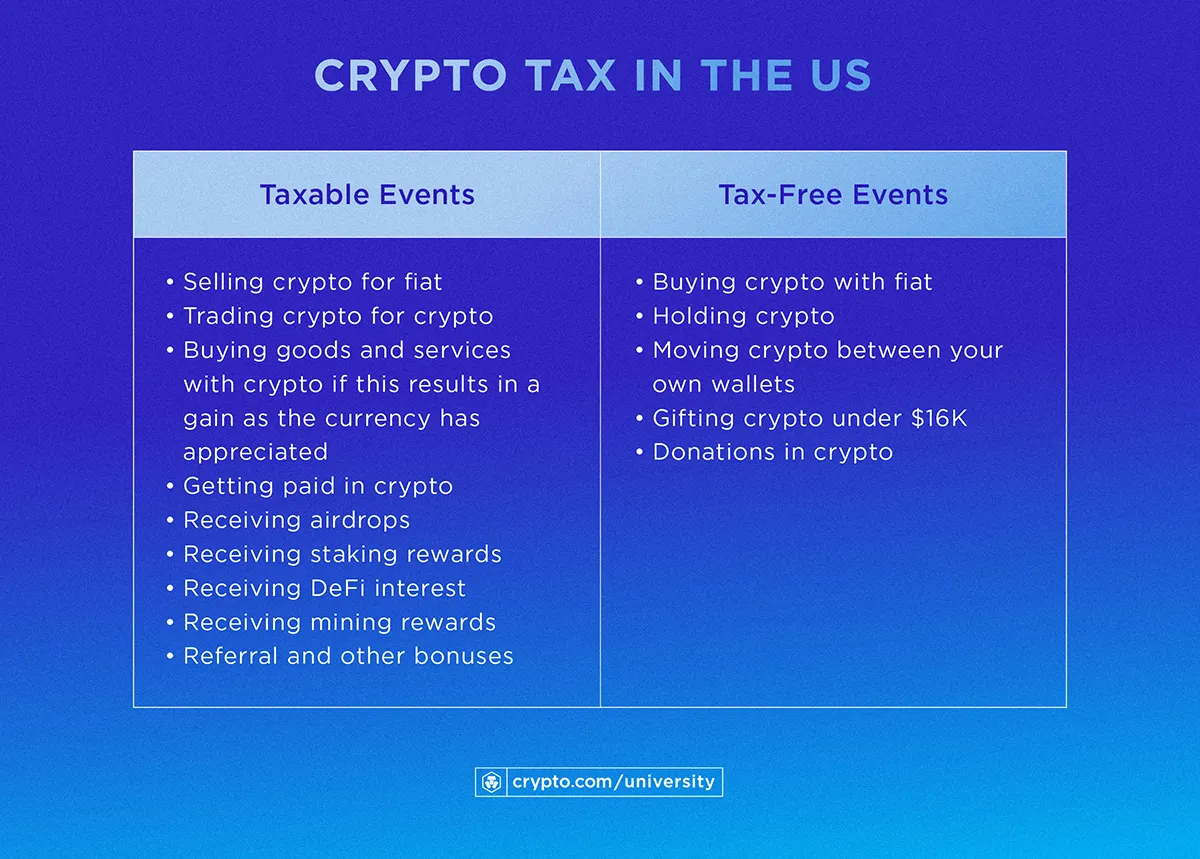

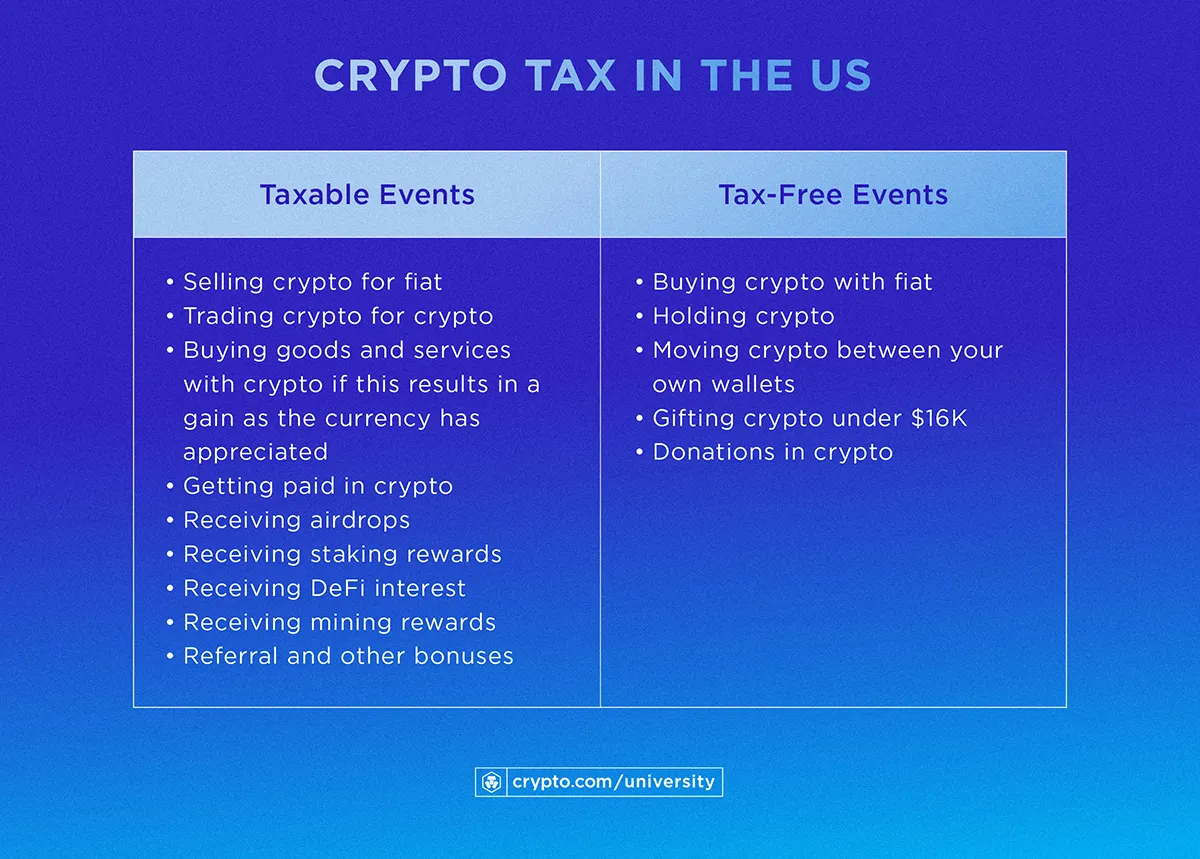

How much Is crypto tax in the US?

In the US, cryptocurrency may be subject to income or capital gains tax, or when sold or traded for a profit. The amount of crypto tax to pay in the US depends on several factors, including the user’s marginal tax rate and the types of transactions conducted.

Source: IRS

Capital Gains Tax

Anytime someone disposes of crypto in the US, a capital gains tax applies. This refers to selling, trading, or buying goods and services with cryptocurrency. The tax only needs to be paid on the gains made since buying the crypto. The exact tax rate depends on a user’s income tax bracket, which ranges from 10%–37% for short-term capital gains, which is considered to be anything held for less than a year.

Long-term capital gains (gains from selling a cryptocurrency held for more than a year) are taxed at lower rates of 0%, 15%, or 20%, depending on a user’s income.

Finally, users can also offset their crypto gains with their losses. Beware, however, that lost or stolen crypto is not recognised as a loss by the Internal Revenue Service (IRS).

Income Tax

Getting paid in crypto, airdrops received, staking rewards, DeFi interest rewards, mining rewards, and even referral bonuses all fall under income tax in the US.

For this, users will pay their federal tax income rate, plus potentially their state tax income rate.

Visit our in-depth guide on US crypto taxes.

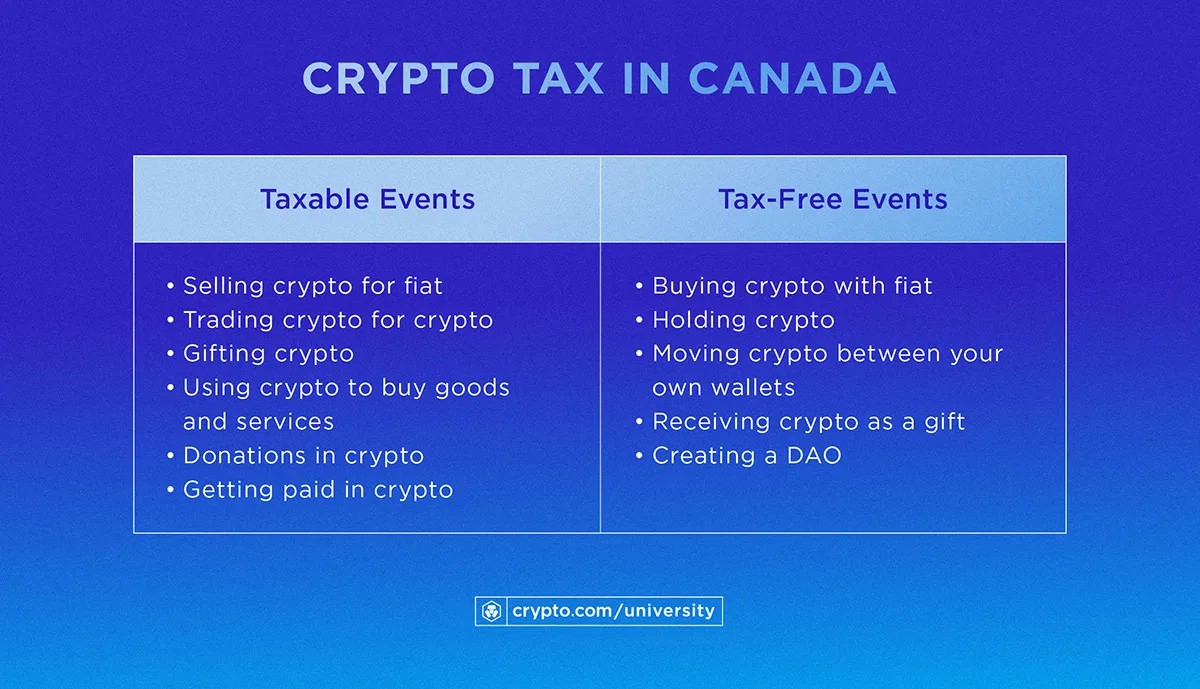

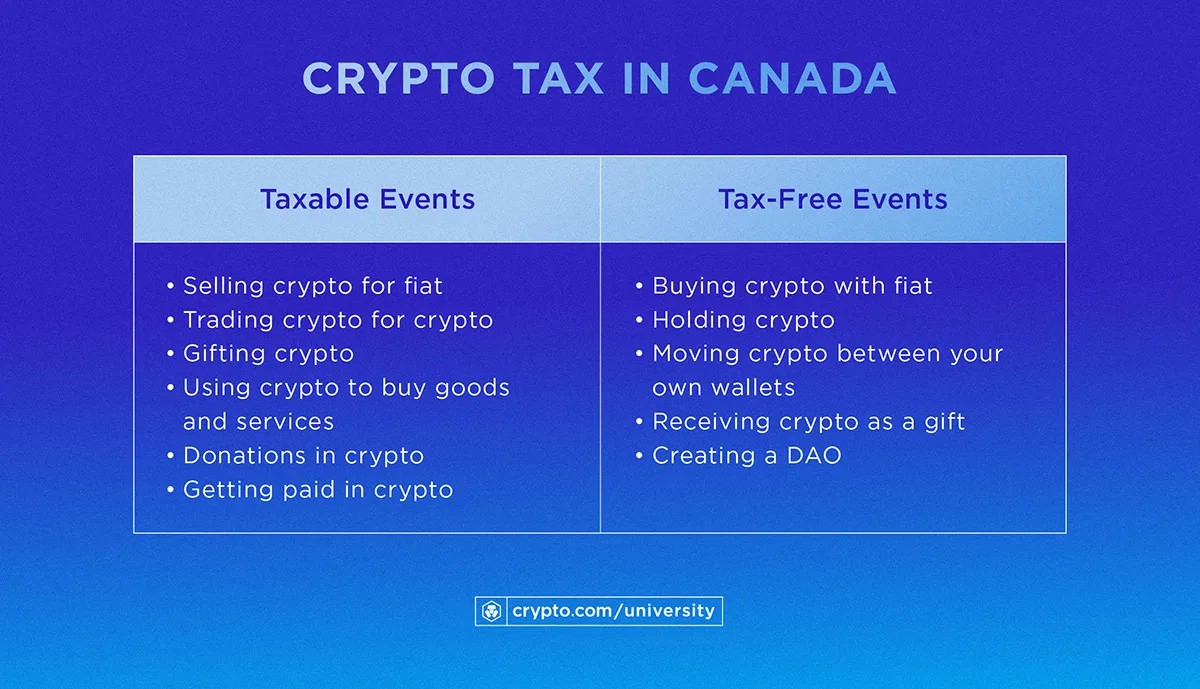

How much is crypto tax in Canada?

In Canada, cryptocurrency is considered a taxable commodity and can be subject to income and capital gains tax. The amount of tax a user needs to pay on cryptocurrency transactions in Canada depends on several factors, including the user’s marginal tax rate, whether the gains are for personal or business reasons, and the type of transaction conducted.

Source: Canada.ca

Capital Gains Tax

In Canada, only 50% of personal gains from cryptocurrency transactions is taxed. For example, if someone bought CA$10,000 worth of BTC but later sold it for CA$14,000, only half of the CA$4,000 gain is taxed.

Selling, trading, gifting, and buying goods and services with crypto, or any other disposition of cryptocurrency, are considered taxable events in Canada.

Some crypto transactions are tax-free, like buying crypto or moving it between personal wallets. See the table above for a summary.

Income tax

Crypto transactions might be taxed as income if they show signs of business transactions (e.g., a user promotes a product or service, or makes a transaction for commercial reasons). Mining and staking of crypto are also usually considered business income. In this case, 100% of crypto income is taxed.

The federal tax rates in Canada range from 15%–33% and may be even higher for residents of some provinces, who also pay a provincial tax.

Visit our in-depth guide on Canadian crypto taxes.

How much is crypto tax in the UK?

For UK tax purposes, cryptocurrency can be taxed as capital gains and/or income. Capital gains from cryptocurrency transactions are added to a user’s other capital gains and taxed according to their marginal tax rate. Similarly, cryptocurrency received as income will be added to a user’s taxable income and taxed according to their marginal tax rate.

The amount of tax a user will need to pay on cryptocurrency transactions in the UK depends on several factors, including the user’s marginal tax rate and the type of transaction conducted.

Source: Gov.UK

Capital Gains Tax

Selling, trading, buying goods and services, and gifting crypto are all taxable events that may be subject to capital gains tax in the UK.

The good news: UK taxpayers have a generous £12,300 tax-free allowance for capital gains, which also applies to crypto assets. For anything above, a user is taxed at a rate of 10% or 20%, depending on their tax bracket.

Not all crypto transactions are taxable, however. For example, buying crypto with fiat, holding crypto, transferring it between personal wallets, donating crypto to charity, or gifting it to a spouse are all tax-free events.

Users can also offset their crypto losses against their gains — but be careful, as lost or stolen crypto is not considered a loss and must be filed as a negligible value claim.

Income tax

For crypto taxed as income, a user will pay between 20%–45% in tax. This includes any income paid in crypto, as well as from mining, staking, and airdrops.

The law still remains unclear on DeFi transactions, like income from yield farming and liquidity pools. While these transactions are subject to tax, it is not entirely clear if this is as capital gains or income tax.

A tax-free allowance can also apply to income tax, and — depending on an individual’s circumstances — the first £12,570 of their income may be tax-free.

Visit our in-depth guide on UK crypto taxes.

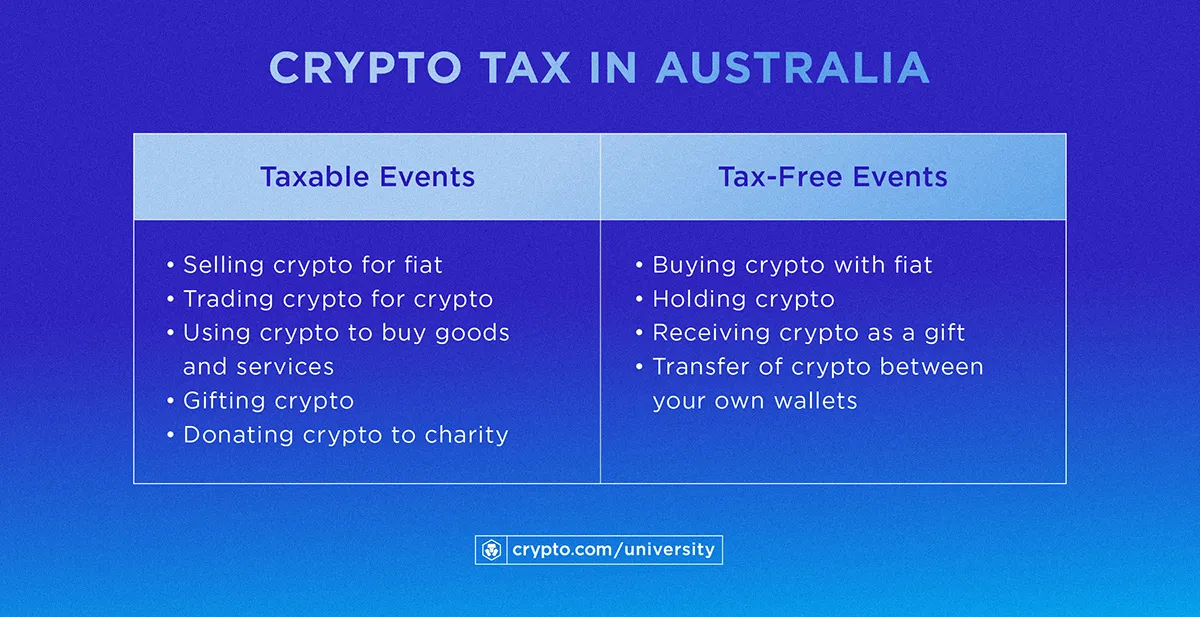

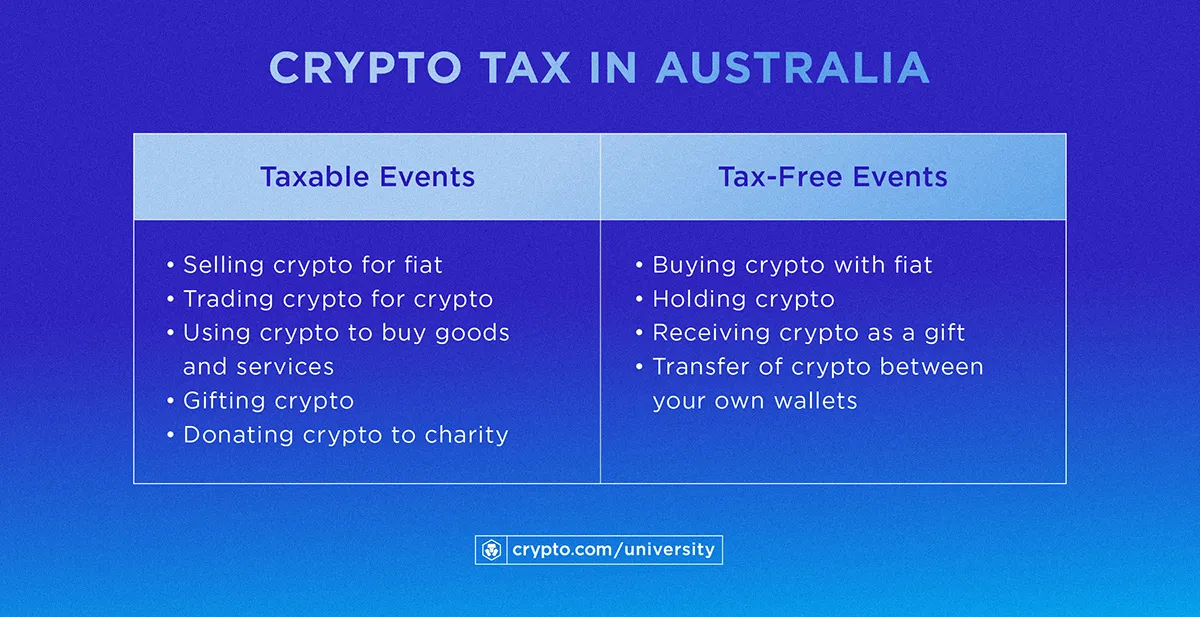

How much is crypto tax in Australia?

In Australia, cryptocurrency is considered a taxable asset and subject to capital gains tax and/or income tax. The amount of tax a user will need to pay on cryptocurrency transactions in Australia depends on several factors, including the user’s marginal tax rate and the type of transaction conducted.

Source: ATO.gov.au

Capital Gains Tax

Selling crypto for fiat, swapping crypto for crypto, spending crypto on goods and services, and gifting crypto are all taxable events in Australia.

Capital gains, including those made from crypto, are added to a user’s income to calculate their tax bracket. While capital gains are distinct from income, they are taxed at the same percentage as a user’s income tax bracket. However, if they hold an asset like cryptocurrency for at least a year, they’ll receive a 50% discount on the taxable capital gains for that asset.

Income tax

Crypto earnings that qualify as income are taxed at the user’s income tax rate. The income tax rates in Australia range from 19%–45%, starting from earnings over the minimum threshold of A$18,201.

Visit our in-depth guide on Australian crypto taxes.

Important information:This is informational content sponsored by Crypto.com and should not be considered as investment advice. Trading cryptocurrencies carries risks, such as price volatility and market risks. Before deciding to trade cryptocurrencies, consider your risk appetite. Services, features and other benefits referenced in this article may be subject to eligibility requirements, token holdings, and may change at the discretion of Crypto.com.

Past performance may not indicate future results. There's no assurance of future profitability, and content may not reflect current opinions.

Share with Friends

Ready to start your crypto journey?

Get your step-by-step guide to setting upan account with Crypto.com

By clicking the Submit button you acknowledge having read the Privacy Notice of Crypto.com where we explain how we use and protect your personal data.