There is a good chance you’ve come upon the term ‘DeFi’ in the media between 2019 and now. Since its first appearance, the term has become well-known even beyond the crypto community.

DeFi stands for decentralised finance, and with this new industry also comes its own jargon.

Here are five terms central to DeFi that you should know.

Article Overview:

- What is a Dapp?

- What is a DEX?

- What are Gas and Gas Fees?

- What is Impermanent Loss (IL)?

- What is Passive Income?

1) What is a Dapp?

A review of traditional apps

DeFi runs on decentralised applications (dapps). Before diving deep into the meaning of a dapp, let’s revisit what an ‘app’ is.

Apps (short for ‘applications’), such as those installed on your phone, are typically ‘centralised’, meaning they are built, maintained, and controlled by a centralised party, usually a company. An example of a centralised application would be Instagram, which is produced by Meta, which controls the servers on which the app’s data lives.

How dapps work

In the case of a dapp, rather than the app’s data living in a database on a server controlled by the company producing the app, the data lives on a blockchain, meaning it is decentralised to some degree.

To continue with our social media theme, centralised social media apps like Twitter are normally designed for the app developer to have control over which users may use the platform and what content may be posted there.

A decentralised structure, by comparison, allows for a design in which access to the app cannot be restricted, and users may moderate the content they see without impacting what others see.

However, decentralisation is not monolithic, and there are designs with different levels of decentralisation, meaning that some dapps are actually controlled and managed by third parties.

Examples of DeFi dapps

There are many examples of dapps (e.g., Tectonic and VVS Finance) that offer various financial features.

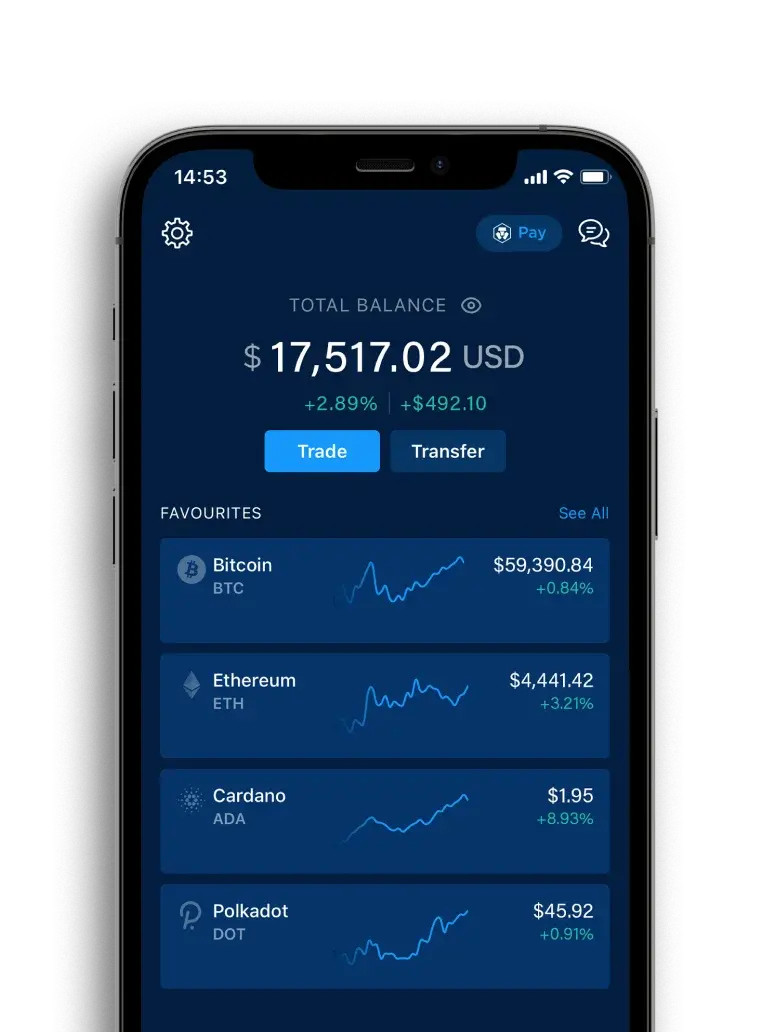

You can find these dapps and many more in the Crypto.com DeFi Wallet.

2) What is a DEX?

In DeFi, a dapp often takes the form of a decentralised financial marketplace, such as a decentralised exchange (DEX), in which trades between users are automated. Blockchains allow for a decentralised ledger of ordered transactions to be decided upon independently of any centralised authority.

How blockchain technology manages DEXes

In other words, rather than a company guaranteeing that a series of financial transactions occurred in a certain order (essentially requiring users to trust that their assessment is accurate), a blockchain allows a series of decentralised nodes to decide the order of transactions through one of a variety of consensus mechanisms (for example, Bitcoin uses a consensus mechanism known as Proof of Work, or PoW).

Blockchain networks also typically allow for transactions to be customised through a built-in programming language; these custom programs are usually known as ‘smart contracts’, and it is these in particular that allow DeFi platforms to function.

DEXes use smart contracts to allow users to lend and borrow funds to and from each other via liquidity pools, where funds are ‘pooled’ for trading.

DEX vs CEX

Rather than recording the transactions in an internal database like a centralised exchange (CEX), transactions on a DEX are settled on the blockchain. DEXes may be designed as open-source projects, meaning that the code is free to view for everyone, so that users can audit the codebase for themselves if they so wish.

This is in contrast to CEXes, which are typically built using closed-source, proprietary codebases developed by the company operating the exchange. A DEX has the advantage of removing some measure of trust from exchange transactions, in the sense that one only needs to trust the code running the exchange rather than a company of people, which is very much in the spirit of crypto.

However, this understandably comes with the tradeoff that if something unexpected occurs, there may or may not be customer support to fall back on, as there would be with a centralised exchange, like Crypto.com.

A popular example of a DEX is MM Finance. This DEX offers some of the lowest fees for users to hodl, farm, and trade cryptocurrency on the Cronos blockchain.

3) What are Gas and Gas Fees?

In the crypto world, gas refers to the fee required to successfully conduct a transaction on the Ethereum blockchain.

Typically, we talk about gas fees in terms of how many ‘gwei’ it costs. Just as the dollar has a different name for its smallest base unit (the cent), cryptocurrencies typically also adopt new names for their smallest units.

In the case of Bitcoin, we talk about ‘sats’ (short for ‘satoshis’, named for the project’s pseudonymous founder), while the Ethereum equivalent is known as a ‘wei’ (short for Wei Dai, who formulated the concepts of all modern cryptocurrencies). Because this is such a small denomination of Ether (10^18), we use a smaller amount, namely 0.000000001 ETH, which we call a Giga Wei, or gwei for short.

The ‘gas fee’ is the amount of gwei a user has to spend on a transaction, which varies depending on how busy the network is.

Tools to help you save gas fees

As the amount of gas you might have to spend to process a transaction can vary, the Crypto.com DeFi Wallet provides the option to set a limit on the maximum gas price you are willing to spend for a transaction. The transaction will then be executed when traffic has come down enough to allow for your target gas fee price.

In order to avoid calculating the total cost of a transaction in ETH yourself, there are multiple tools you can use to check gas prices instead. The Crypto.com DeFi Wallet offers an ETH Gas Meter that lets you check the current volume of Ethereum network traffic and gas fees required.

In addition to this tool, when the network is congested, users are able to set up a gas price alert and receive an app push notification when gas fees decrease.

4) What is Impermanent Loss (IL)?

Impermanent Loss (IL) is one of the risks of DeFi. It refers to an unrealised loss incurred while providing liquidity on a DeFi platform, if the value of the tokens provided changes.

Impermanent Loss can occur in liquidity pools

Liquidity pools are one of the core elements of any DeFi platform. A liquidity provider (LP) deposits an asset into a liquidity pool, which then adds liquidity, the availability of funds for trading, to the platform. Liquidity pools are most commonly composed of two assets — pairs — but can contain more. Users usually become LPs hoping to earn liquidity pool fees.

The liquidity pool represents the different assets deposited into them, and users can interact with the pools through borrowing, lending, and staking. Token pairs are impacted more if one token increases in price while the other decreases.

We call this ‘impermanent’ because, provided the loss is not realised by converting the LP token back to the underlying tokens, the token prices may move back towards profitability.

To avoid Impermanent Loss, many users try to invest in liquidity pools with low-volatility tokens or diversify across multiple liquidity pools in order to hedge their risk.

5) What is Passive Income?

DeFi is of interest to many crypto holders for the opportunity to increase their token holdings: acquiring interest on deposited crypto assets without activity required.

In DeFi, there are several ways to earn passive income, which include:

- Lending

- Staking & Lock-ups

- Yield Farming

Read more about how passive income options in our beginner’s guide to DeFi.

Earn With DeFi Wallet

You can find the options listed above on DeFi Earn, available in the Crypto.com DeFi Wallet. DeFi Earn allows you to deposit your crypto assets for interest in over 20 DeFi protocols that are directly integrated in the app.

This means that you have direct access to various dapps via shortcuts in the DeFi Earn function, which allows you to monitor your funds, price movements, and interest earned directly in the DeFi Earn tab, without having to download multiple dapps.

The Crypto.com DeFi Wallet ecosystem has integrated Compound Lending, Yearn Earn V2, Crypto.org Chain Lock-up, Aave Lending V2 protocols, and VVS Finance — giving you access to 29 crypto assets, including popular tokens like ETH, VVS, MMF, TONIC, and BIFI.

Download Crypto.com DeFi Wallet.

Which passive income options are right for you?

The protocols and pools available vary in set-up. Some offer high annual percentage yields (also known as APY), while others offer lower volatility or shorter lock-up periods for funds, allowing users to choose the one that suits their goals.

Final Words

If you cannot wait to explore DeFi further, the Crypto.com DeFi Wallet is a great starting point. While you control your funds, we’ll keep them secure. The DeFi Wallet offers access to multiple DeFi platforms in one app and simplifies the process of accessing them.

Currently, the Crypto.com DeFi Wallet supports:

- More than 700 tokens

- 20 chains

- NFTs on the Ethereum, Cronos, and Crypto.org blockchains

For an intro on how to set up and use the DeFi Wallet, check out our in-depth guide for beginners.

And for more details on the Cronos ecosystem and the DeFi projects it hosts, see our introduction to Cronos.

Due Diligence and Do Your Own Research

All examples listed in this article are for informational purposes only. You should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained herein shall constitute a solicitation, recommendation, endorsement, or offer by Crypto.com to invest, buy, or sell any crypto assets. Returns on the buying and selling of crypto assets may be subject to tax, including capital gains tax, in your jurisdiction.

Past performance is not a guarantee or predictor of future performance. The value of crypto assets can increase or decrease, and you could lose all or a substantial amount of your purchase price. When assessing a crypto asset, it’s essential for you to do your research and due diligence to make the best possible judgement, as any purchases shall be your sole responsibility.