Solana tokenomics: everything to know

Solana’s tokenomics is based on staking incentives, vesting schedules, and inflation controls. Here’s how it works.

Nic Tse

Nic Tse-in-crypto-2.webp)

Solana’s tokenomics is based on staking incentives, vesting schedules, and inflation controls. Here’s how it works.

Key takeaways

- The total supply of SOL tokens, the Solana blockchain’s native cryptocurrency, currently is around 587 million without a cap, and the circulating supply is approximately 470 million, influencing long-term value dynamics.

- Early investors, the Solana Foundation, and the community hold the majority of SOL tokens, with a vesting schedule to manage token release over time.

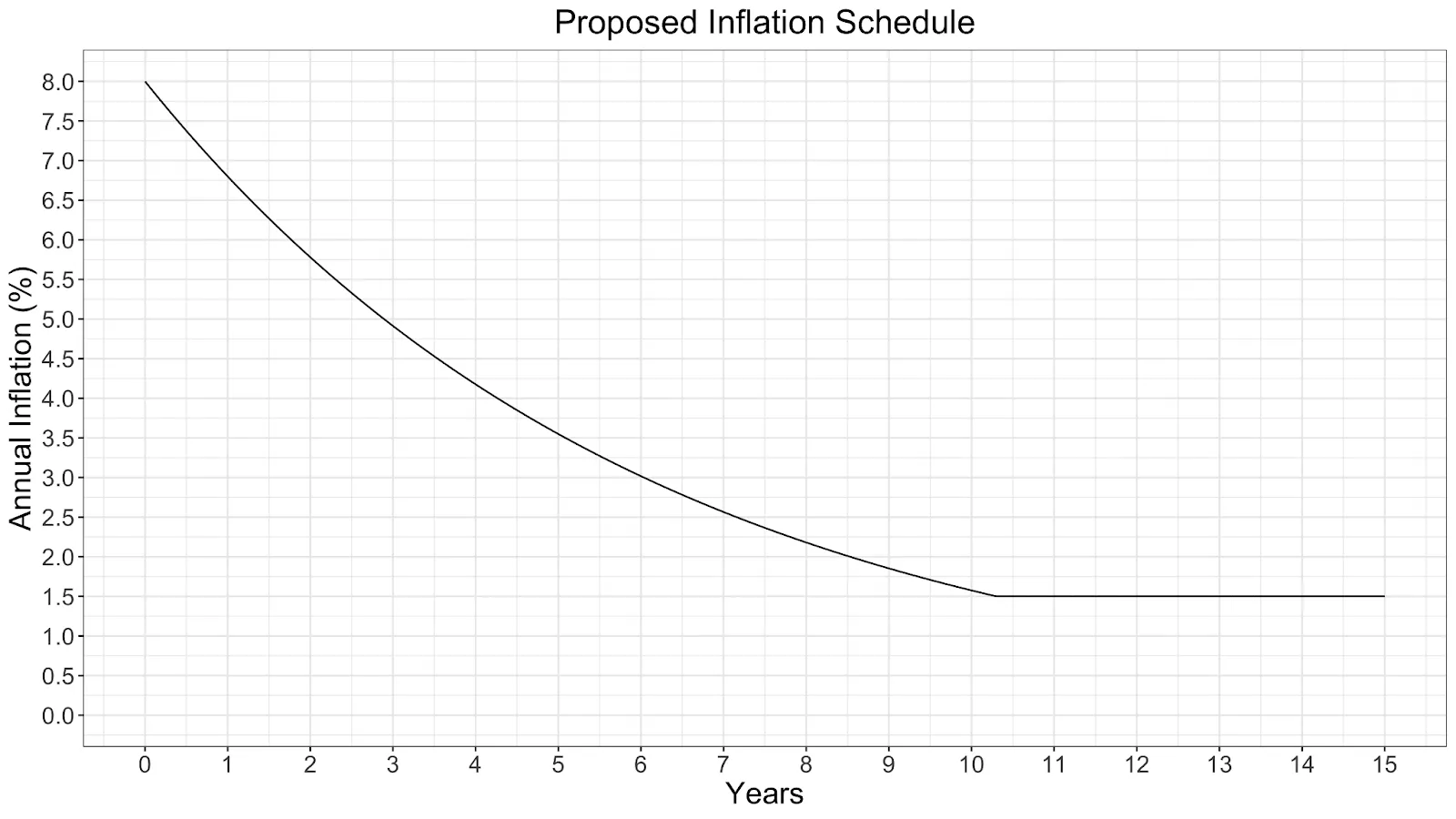

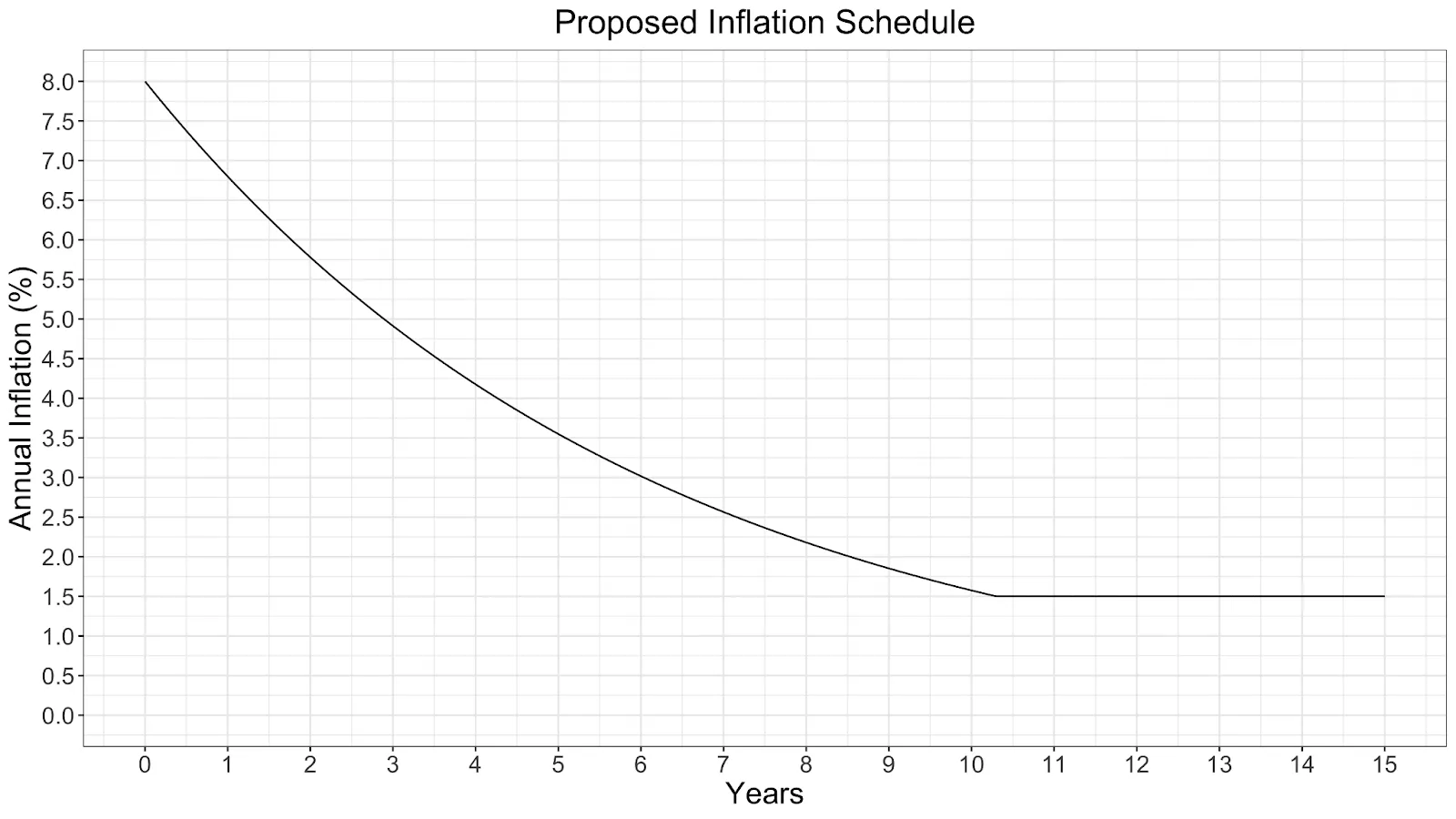

- SOL’s staking model offers rewards to encourage network participation through staking, with an initial 8% annual inflation rate that decreases over time to a fixed 1.5%, ultimately reaching a long-term fixed inflation rate of 1.5% annually.

- A token-burning mechanism burns 50% (initially) of each transaction fee; the remaining fee is retained by the validator processing the transaction, creating scarcity and counteracting inflation, which may positively impact SOL’s value.

- To support network security and participation, validators earn rewards in three ways: inflation commission, block reward, and Maximal Extractable Value (MEV).

Solana (SOL): What you need to know

As one of the fastest-growing blockchain platforms, Solana’s unique approach to distribution of its native SOL token, supply management, and economic incentives has sparked widespread interest. Understanding these aspects is key to grasping the potential and limitations of the Solana ecosystem.

In this deep dive, we explore circulating supply, maximum supply, and total supply, as well as Solana’s inflation rate, burn rate, and whether it is inflationary or deflationary. Additionally, we look at Solana’s unlock schedule, supply chart, and how its tokenomics supports its thriving decentralised finance (DeFi) ecosystem.

What is Solana (SOL)?

A blockchain platform known for its speed and efficiency, Solana aims to tackle the challenges of scalability and speed faced by many existing blockchains. Launched in 2020, Solana’s vision is a world where decentralised applications (dapps) and cryptocurrency projects can achieve higher throughput and lower latency without compromising on security. The platform offers a robust infrastructure that enables developers to build a wide range of applications, from DeFi protocols to non-fungible token (NFT) marketplaces.

To learn more about Solana, check out our in-depth article.

Learn how to buy Solana (SOL) on Crypto.com.

Solana’s tokenomics

Tokenomics is the economic model of a cryptocurrency that influences its value and utility, including its supply, distribution, and incentivisation mechanisms. Solana’s tokenomics is designed to support the platform’s growth and sustainability with participants’ incentives aligned to the security and decentralisation of the network.

SOL token distribution and allocation

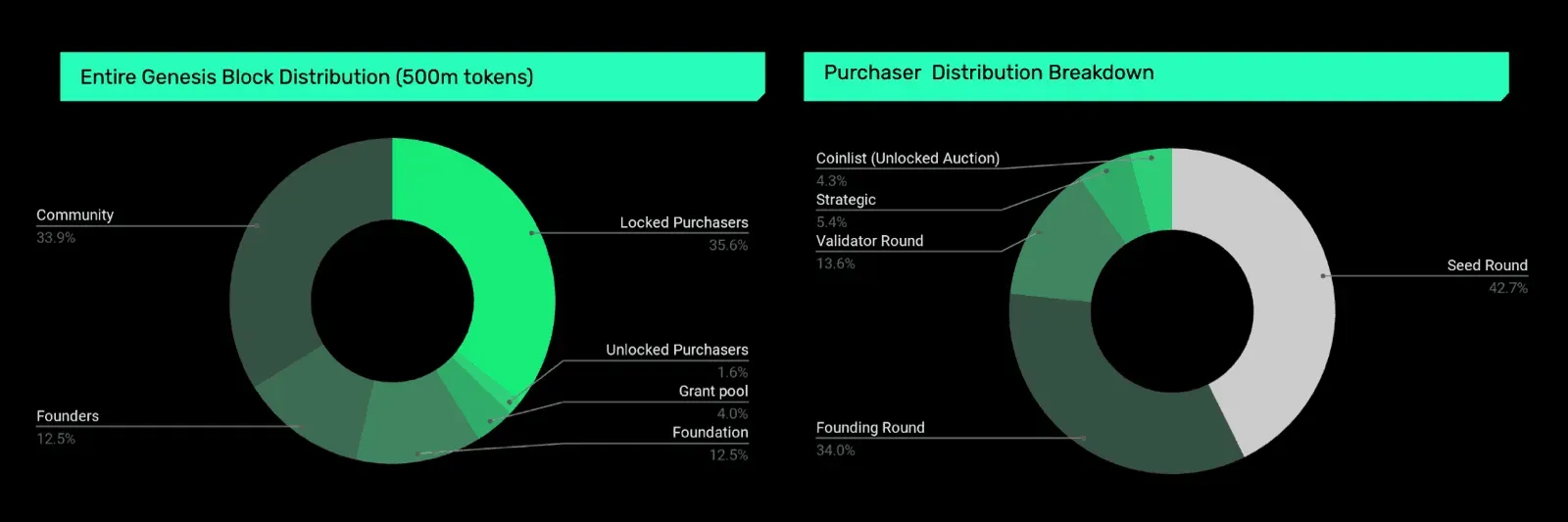

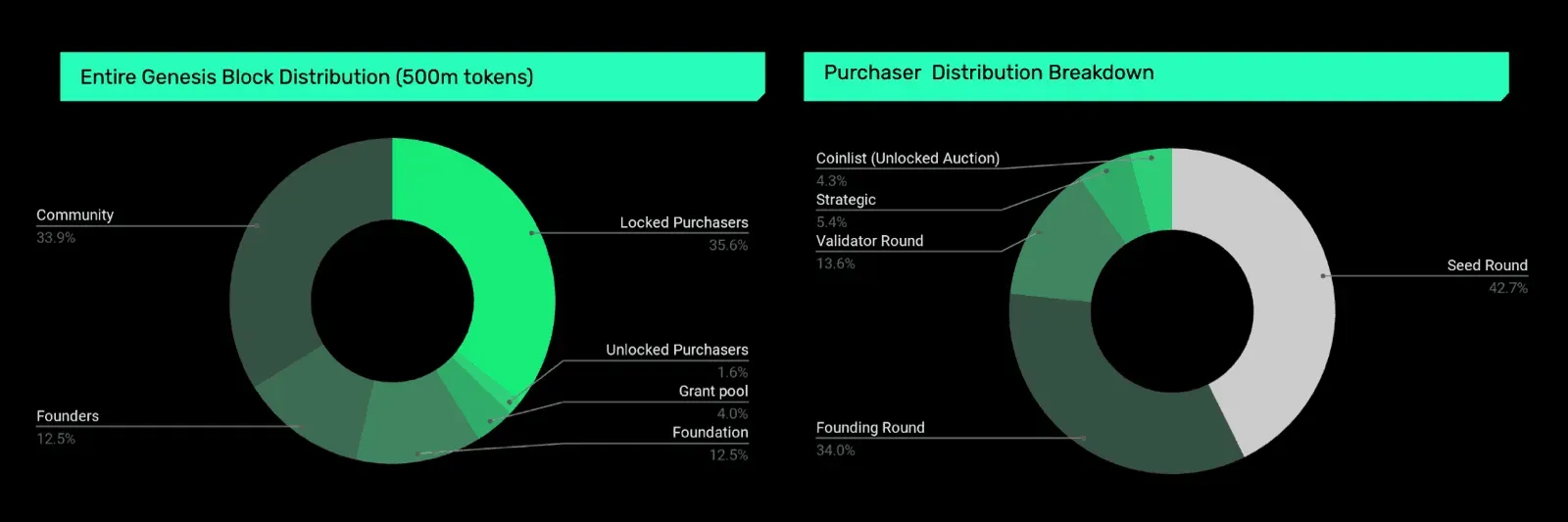

Understanding Solana’s token distribution and allocation is crucial to grasp the economics behind this blockchain platform. In the genesis block at Solana’s network launch, 500 million SOL were created. Since then, the total supply has declined due to the burning of transaction fees and token reduction events.

Source: https://icodrops.com/solana/

The total supply of SOL is calculated as the number of tokens (locked or unlocked) generated through the genesis block or protocol inflation minus any tokens that have been burned (via transaction fees or other means) or slashed. This predefined cap means no additional tokens will be generated beyond this limit, influencing the long-term value proposition of SOL.

Source: https://icodrops.com/solana/

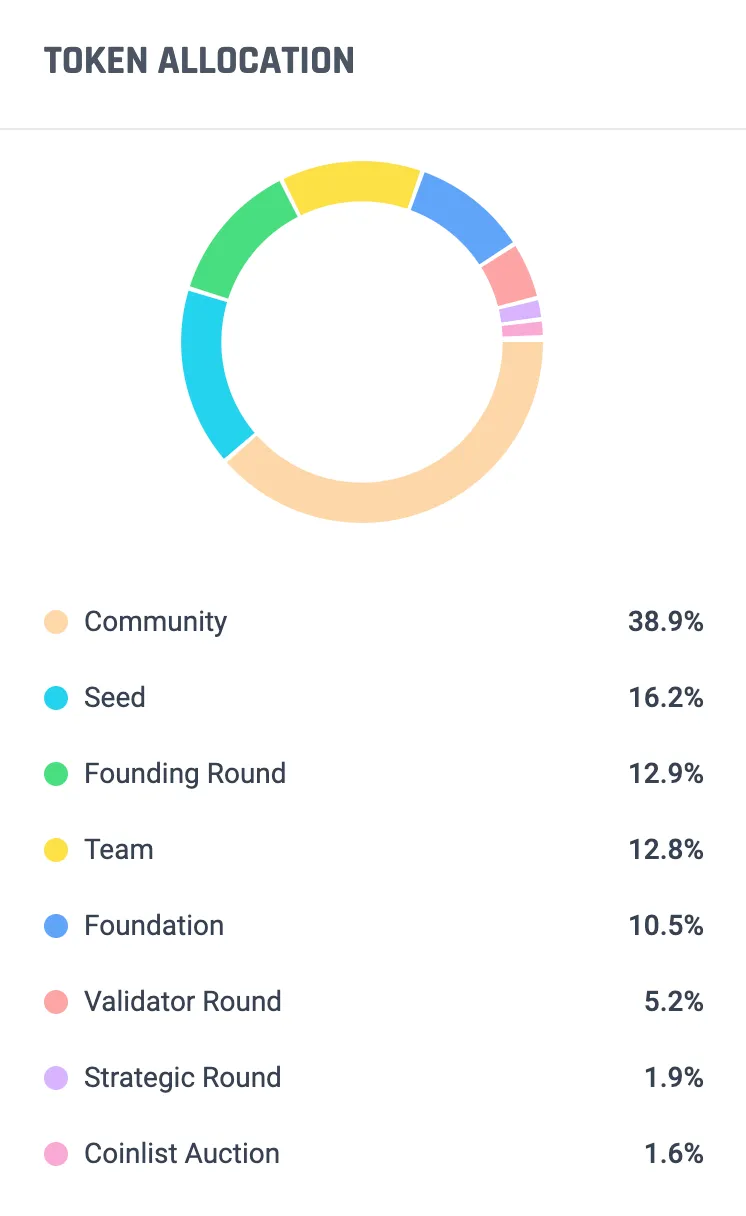

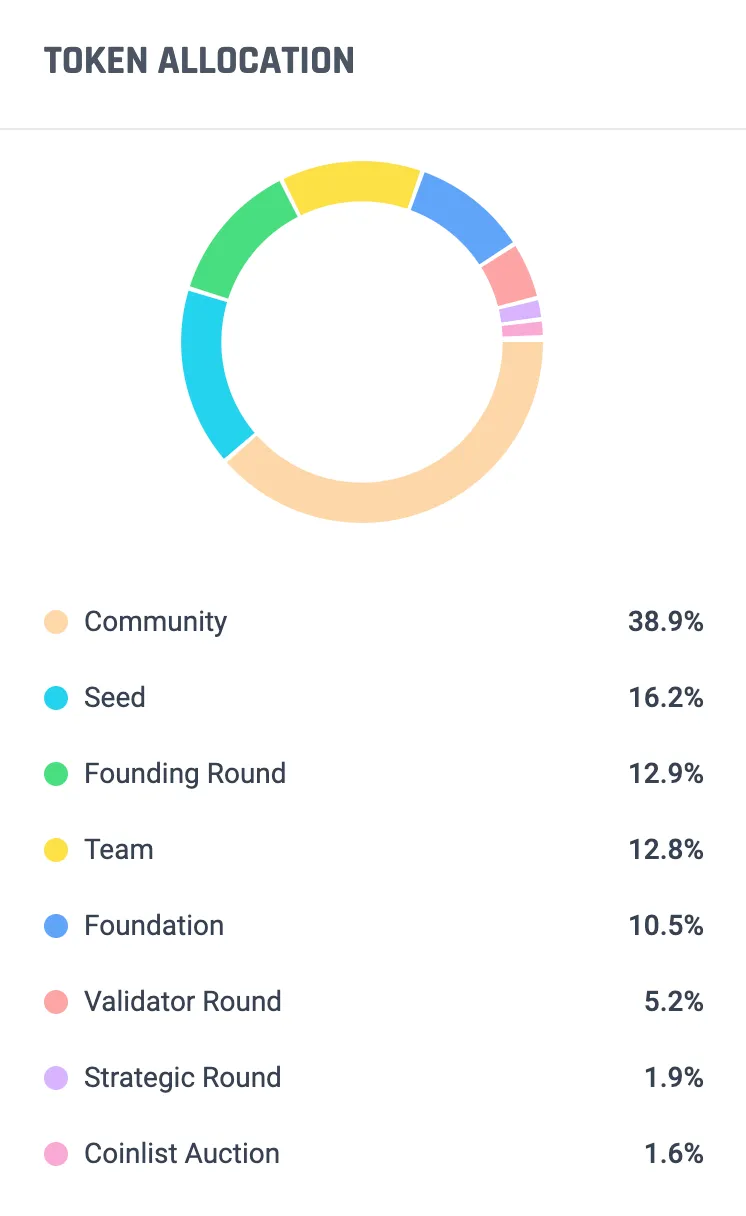

Community reserve and team allocations

A significant portion of SOL tokens was set aside for the community and the team behind Solana. The Community Reserve, managed by the Solana Foundation, received the largest allocation, at 38.89% of the total supply. This substantial allocation demonstrates Solana’s commitment to community-driven growth and development.

The team members and the Solana Foundation received 12.79% and 10.46% of the total supply, respectively. It’s worth noting that the distribution of SOL tokens has raised questions about Solana’s decentralisation. Some have expressed concerns about the large share of SOL’s supply held by venture capitalists and private investors.

To manage the release of tokens over time, Solana implements a vesting schedule. This approach helps control the circulating supply and potential sell pressure as the protocol matures. The vesting schedule typically spans several months or years, aligning stakeholder interests with the long-term success of the protocol.

Overall, the total supply of SOL tokens at the time of writing is around 590 million without cap, and a circulating supply of around 479 million, which represents over 80% of the total supply. The non-circulating supply, amounting to around 117 million SOL, is either locked in stake accounts or owned by Solana Labs and the Solana Foundation.

Inflationary model

When SOL launched, it had an initial total supply of 500 million tokens, but there was no capped maximum supply. Instead, the Solana protocol has employed a unique inflation model (termed ‘Inflation Schedule’) to reward network validators and token holders, automatically creating new tokens on a predetermined inflation schedule. The model is designed to incentivise network participation while managing the overall supply of SOL.

Inflation schedule: The network’s inflation schedule outlines how the protocol issues SOL and serves as the deterministic description of token issuance over time, which is uniquely described by three parameters: Initial inflation rate, disinflation rate, and long-term inflation rate. Solana’s initial inflation rate was set at 8% annually, decreasing by 15% (called the disinflation rate) year-over-year, with a long-term fixed inflation rate of 1.5% annually. This disinflationary model aims to balance early network growth with long-term stability.

Source: Solana

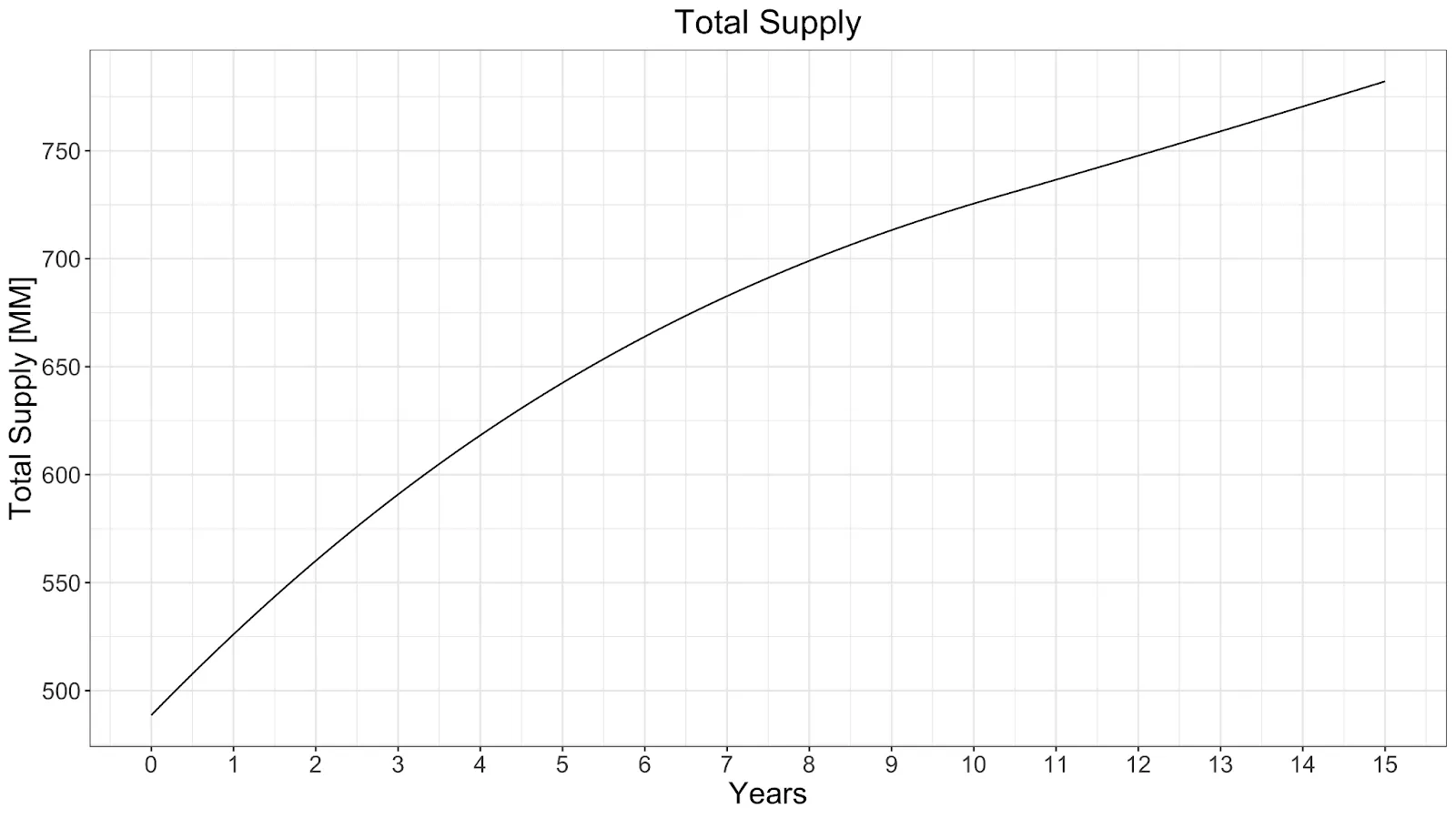

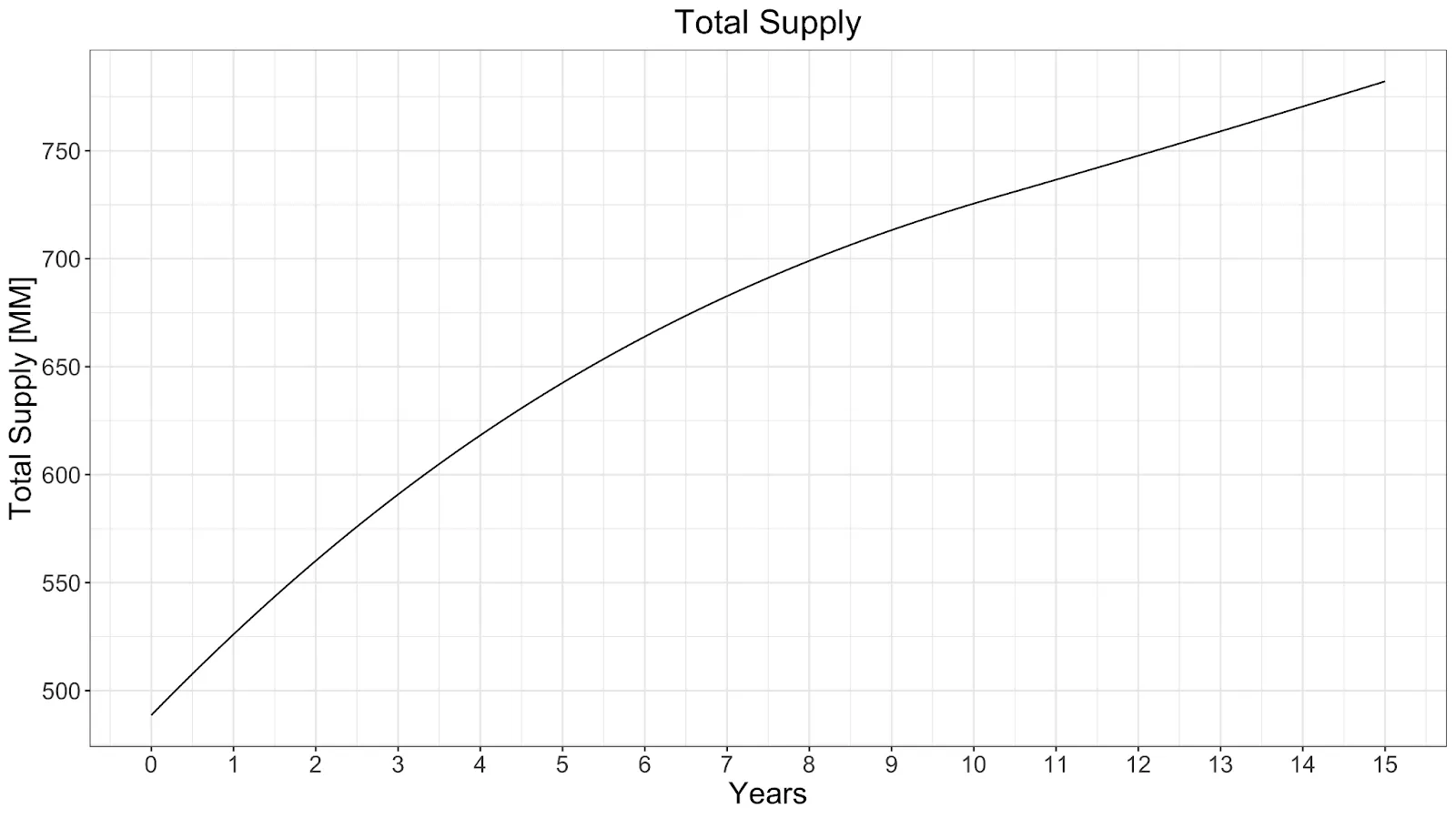

In the same vein, we observe the total supply of SOL (in millions) over time, beginning with an initial total supply of 488,587,349 SOL, which simulates inflation starting from the total supply as of 25 January 2020.

Source: Solana

All inflationary issuances are distributed to token holders based on the amount of SOL they have staked, plus the validators who take a commission from the rewards generated by the delegated SOL, as discussed below.

Effective inflation Rate: The actual inflation rate is impacted by various factors, such as simultaneous reduction of tokens, where the main token-burning mechanism involves burning a portion of each transaction fee, with 50% (initially) of the fee being burned and the remainder kept by the validator processing the transaction. Additionally, factors like lost private keys and slashing events may also impact the inflation rate.

Staking rewards and validator economics

Solana’s Proof of Stake (PoS) consensus mechanism allows SOL token holders to stake their tokens to secure the network and validate transactions, potentially earning rewards in return. The staking yield is primarily determined by the fraction of SOL staked on the network. Notably, validators play a crucial role in Solana’s ecosystem, which is designed to ensure their sustainability in securing the network.

Types of staking rewards

Validators may generate income through three main sources: inflation commissions, block rewards, and Maximal Extractable Value (MEV) tips.

- Inflation commission: Solana seeks to reward stakers and validators for securing the network through new token issuance based on its inflationary model. Validators may receive rewards by submitting valid votes on blocks when they are chosen as the slot leader, and the value of the reward is based on the validator’s stake-weight at the end of each epoch.

- Block rewards: Block rewards consist of base fees and priority fees that may be awarded to a validator when they successfully propose a block as the slot leader. The base fee is set at 0.000005 SOL per signature (at time of writing), while the priority fee is determined by the sender and increases in response to transaction demand.

- MEV tips: MEV tips refers to the potential profit generated by reordering transactions within blockchain blocks.

- Staking yield: Staking yield refers to the rate of return earned on SOL staked on the network, which is based on the current inflation rate at the time, total number of SOL staked on the network, and an individual validator’s uptime and commission (fee).

- Validators’ expenses: The primary expense structure for validators consists of hardware costs, operational costs (including on-chain voting and data bandwidth), and the opportunity cost of capital. Notably, voting costs can be significant, with validators spending approximately 0.000005 SOL per voting transaction, or 2–3 SOL each epoch (432,000 slots) on voting transactions.

To support new validators, the Solana Foundation has established the Solana Foundation Delegation Program (SFDP), which aims to offset initial validation costs and improve network decentralisation. Under this system, the Foundation covers voting costs for validators in their first year, with a phased reduction over time.

It’s important to note that staking on Solana involves some risks. While slashing (the destruction of staked tokens as a punitive measure) is not automatic on Solana, it can occur under certain conditions; for example — and specifically — if a validator acts maliciously or fails to uphold their responsibilities, such as causing the network to halt or being consistently offline. This mechanism incentivises validators to maintain high performance and security standards.

Long-Term sustainability measures

Solana’s tokenomics model incorporates several measures to ensure long-term sustainability and network security. The platform’s low transaction fees, combined with its high throughput, aim to attract users and developers, potentially increasing network usage and value over time.

The burn mechanism, where 50% (initially) of each transaction fee is destroyed, provides a deflationary aspect to Solana’s tokenomics. This can help offset inflation and potentially increase the value of remaining tokens by creating scarcity.

However, it’s worth noting that Solana’s current economic model faces some challenges. Firstly, Solana’s current inflation rate is ~5%, with a planned decline to 1.5% over time. This is still high compared with Ethereum’s ~0.5% inflation rate. Additionally, although the network does not require a minimal staking amount, validators may need a much larger amount of staking funds than on Ethereum to cover their cost when the network usage is low.

To address these challenges, Solana is focusing on fostering ecosystem growth, encouraging developer adoption, and establishing strategic partnerships. These initiatives aim to increase network usage, potentially leading to higher fee revenue and a more sustainable economic model in the long term.

Solana tokenomics summed up

Solana’s tokenomics and network security measures are designed to create a balanced ecosystem that incentivises participation, ensures network security, and aims for long-term sustainability. While challenges remain, ongoing developments and adjustments to the economic model seek to address these issues and strengthen Solana’s position in the blockchain landscape.

Important information: This is informational content sponsored by Crypto.com and should not be considered as investment advice. Trading cryptocurrencies carries risks, such as price volatility and market risks. Before deciding to trade cryptocurrencies, consider your risk appetite. Services, features and other benefits referenced in this article may be subject to eligibility requirements, token holdings, and may change at the discretion of Crypto.com.

Past performance may not indicate future results. There's no assurance of future profitability, and content may not reflect current opinions.

Share with Friends

Ready to start your crypto journey?

Get your step-by-step guide to setting upan account with Crypto.com

By clicking the Submit button you acknowledge having read the Privacy Notice of Crypto.com where we explain how we use and protect your personal data.