Earn up to 6.58%

with Solana

on-chain staking

Make the most of your SOL

Put your idle SOL assets to work and generate passive income with no lockup period.

With liquid staking, native coins of a PoS network are staked through staking service providers and delegated to one of many validators participating in the consensus protocol. The service provider then issues liquid synthetic tokens corresponding to the staked tokens.

Liquid staking takes the traditional staking model further by allowing token holders to extract utility from their staked assets and enabling use of their staked assets for other activities.

In traditional staking, once tokens are staked, they are locked up and cannot be used or traded until the staking period ends. However, with liquid staking, token holders can continue to utilise their staked assets in certain ways while still potentially receiving staking rewards.

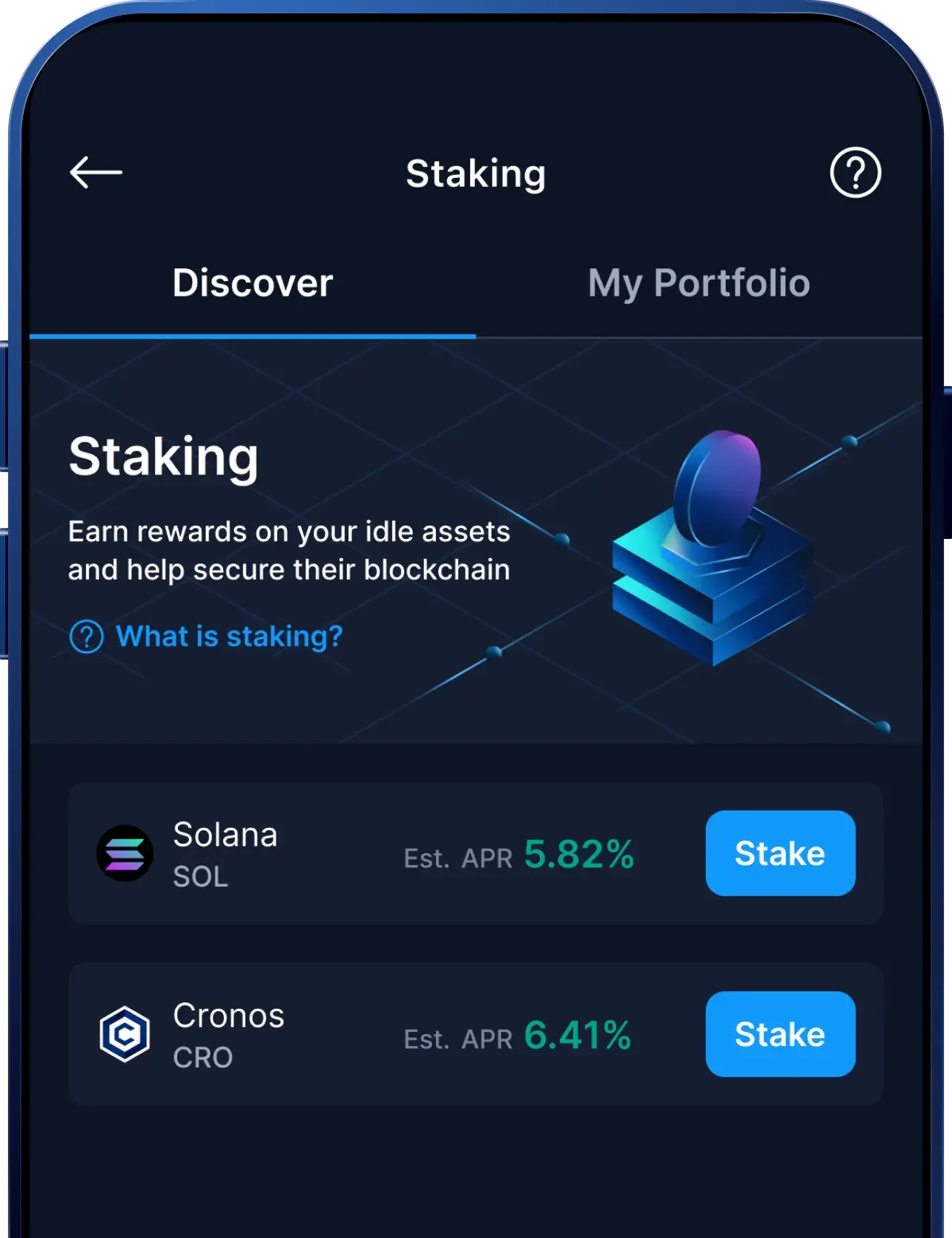

With Crypto.com, users can stake Solana and generate rewards while maintaining the flexibility to use their staked assets.

Crypto.com staked SOL (CDCSOL) is available at launch. Wrapped staked SOL (CDCSOL) is a tradable receipt token that represents users’ staked SOL, so users can still trade while they earn.

Eligible users can wrap their staked SOL for CDCSOL without conversion fees, even when it’s undergoing unbonding. They can then start using CDCSOL for various purposes such as trading CDCSOL with other cryptocurrencies — all with just a few taps.

Liquid staking is available to users in the Crypto.com App in most jurisdictions.

Visit the FAQ for details or learn more about liquid staking here.

How does on-chain staking work?

Staking is an integral part of the Proof of Stake (PoS) protocol used by the Cronos blockchain. It allows users to participate in the network by locking up their tokens and becoming validators, who verify transactions and add them to the blockchain.

Validators earn rewards in the form of newly minted tokens, thus providing an incentive for users to stake their tokens and provide stability to the network. Additionally, staking helps navigate the volatility of the token's price by reducing the supply of tokens available for trading.

Before staking, it is important to know that every protocol has a different structure and mechanism. They are maintained and supported by various third-party projects that are distinct and separate from Crypto.com.

To learn more about how staking works, visit the Crypto.com Staking hub.

Stake your SOL

on your terms

Frequently Asked Questions

The Solana network has no minimums or maximums, so users can stake as much or as little as they want. That said, there may be a minimum imposed by SOL’s decimal precision. Crypto.com never imposes maximums or minimums. Staking SOL on Crypto.com allows crypto traders to increase their holdings while supporting the broader Solana community. Everyone should review the platform’s terms, reward structures, and fees before staking.

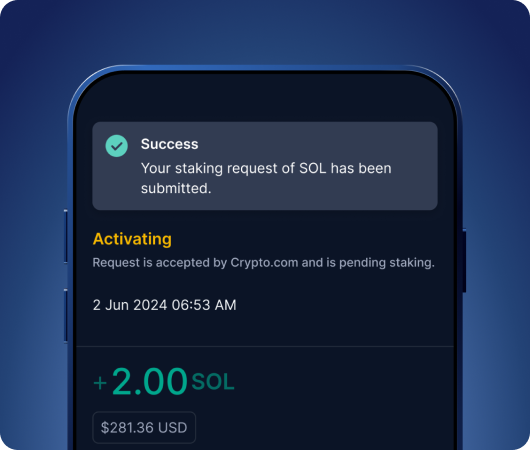

Solana protocols require all staked coins to join the network at the beginning of a new epoch, defined when a new block is added to the blockchain. A new epoch generally starts every 2-3 days based on network activity, so users may experience up to a three-day activation period before their stake is accepted. Solana refers to tokens in this state as “activating” or “warming up.”

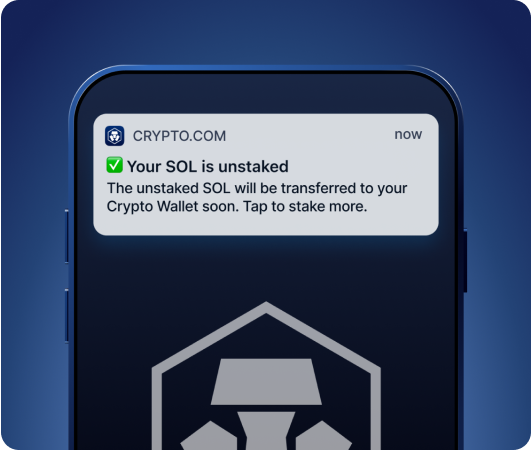

There is no lockup period for Solana. However, those staking tokens may only remove them when a new epoch begins. Stakers may experience an unbonding period of up to five days as a result. Solana refers to these tokens as “deactivating” or “cooling down.” Further, a maximum of 25% of the total SOL staked in the network can change state during a single epoch transition. Any excess is pushed proportionately to the next epoch transition, potentially introducing unexpected delays to the unbonding process.

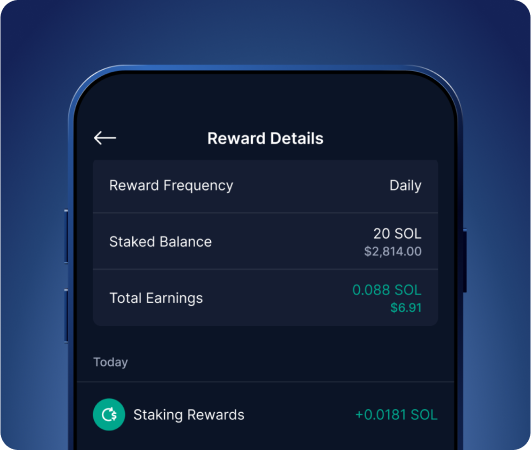

Users begin earning rewards for staked Solana after approximately seven days. After that, users earn rewards at the end of every epoch, or 2-3 days, depending on how busy the network is. Rewards earned depend on several factors, including the total amount of SOL staked in the network, the size of a user’s stake, and the yield. Activities surrounding SOL staking, such as choosing validators and unbonding tokens, incur fees to help maintain Solana. Users should consider holding some Solana in their wallet to cover these fees.

Staked Solana isn’t liquid, meaning users cannot trade it. SOL’s price may fluctuate while their tokens are staking, so the total value of their holdings may decline, even after they earn rewards. Additional risks included the potential of slashing fees and security breaches. Our guide to staking cryptocurrencies contains more info on the potential benefits and risks traders should know about.

Read more about on-chain staking in our crypto staking article.