Market Pulse (Week 31, 01/08/2022 – 08/08/2022)

CME Bitcoin futures net-short positions reducing. ETH put-call ratio makes a new low. ETH close to short-term RSI overbought.

Chart of the Week: Shorts Out of Fashion

- Longs are gaining the upper hand with asset managers’ net-long position in CME Bitcoin futures trending upwards and fast approaching the highest level YTD. Leveraged traders appear to also be on the same wavelength, as their net-short position has been reducing since mid-May and is currently at the lowest level YTD.

- Leveraged traders are typically hedge funds and various types of money managers, including commodity trading advisors and commodity pool operators. The traders may be engaged in managing and conducting proprietary futures trading, and trading on behalf of speculative clients.

- The asset manager category consists of institutional investors, including pension funds, endowments, insurance companies, mutual funds, and those portfolio/investment managers whose clients are predominantly institutional.

- The dealer category consists of participants typically described as the “sell-side” of the market. These include large banks and dealers in securities, swaps, and other derivatives. The other reportable category consists of traders mostly using markets to hedge business risk, and includes amongst others corporate treasuries.

Fund Flow Tracker

- Aggregated exchange balance for BTC made a new 1-year low, while ETH’s was stable over the past week.

Derivatives Pulse

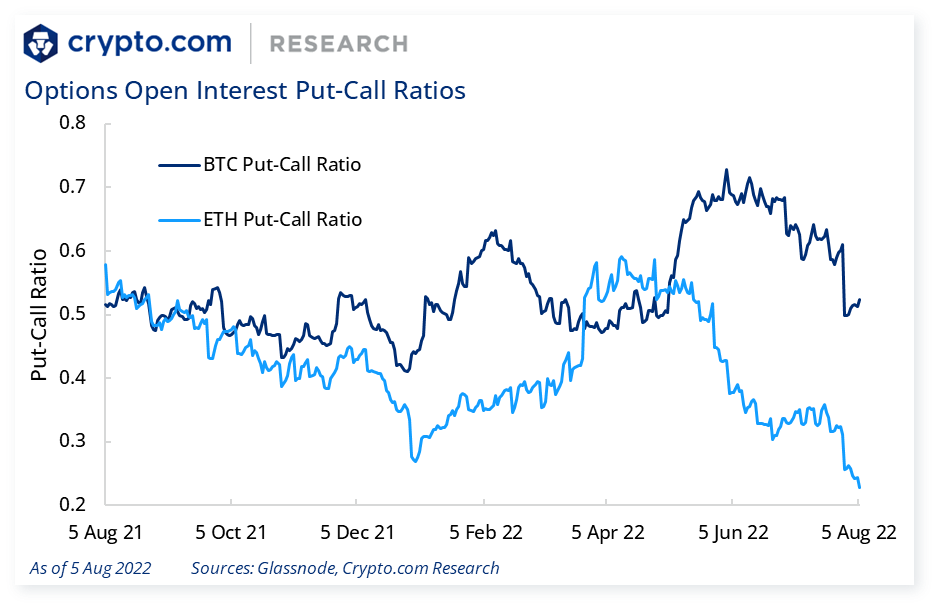

- 1-week implied vols dropped during the past week, while other expiries were generally stable. Skews (puts minus calls) continued to fall for BTC but rebounded for ETH over the past week. 1-week implied vol currently stands at 63.1% (vs. 68.4% a week ago) and 91.9% (vs. 115.6% a week ago) for BTC and ETH, respectively. The put-call ratio for ETH extended its downtrend and is at the lowest level during the past 1-year.

- Perpetual futures funding rates remain in positive territory for both BTC and ETH over the past week.

Technically Speaking

- ETH’s recent strong rally has pushed it closer to short-term overbought levels based on the 14-day Relative Strength Indicator (RSI).

Price Movements

As of 8 Aug 2022 Source: CoinGecko.com, Crypto.com Research

Source: Crypto.com

News Highlights

- Crypto startups raised U.S.$30.3B in 1H 2022, more than the total raised in all of 2021.

- Chicago Mercantile Exchange (CME) will launch Euro-denominated Bitcoin and Ethereum futures on 29 August, pending regulatory approval.

- The Solana network was exploited, with funds drained from around 8K wallets, and estimated loss of U.S.$8M.

Catalyst Calendar

Disclaimer:

The information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.

The brands and the logos appearing in this report are registered trademarks of their respective owners.

Author

Research and Insights Team

Partilha com amigos

Artigos relacionados

🚀 1-year trading volume across crypto CEXes reached $80 trillion; JP Morgan plans to offer clients the option to use crypto ETFs as collateral for loans

DeFi & L1L2 Weekly — 📈 Hyperliquid’s trading volume grew by 32% MoM; Tether launched gold-backed stable XAUt0 on TON

📈 Stablecoin transactions reached US$94 billion from Jan 2023 to Feb 2025; Canary Capital submits S-1 for first spot CRO ETF in the US

Pronto para iniciar a sua jornada com a crypto?

Obtenha o seu guia passo a passo para configuraruma conta com Crypto.com

Ao clicar no botão Enviar, o utilizador reconhece ter lido o Aviso de Privacidade da Crypto.com onde explicamos como utilizamos e protegemos os seus dados pessoais.