DeFi & L1L2 Weekly (23/08/2023)

New Ethereum testnet Holesky scheduled to launch in September. Tether stops support for USDC on three blockchains. Shibarium resumes block production after a brief pause after its mainnet launch.

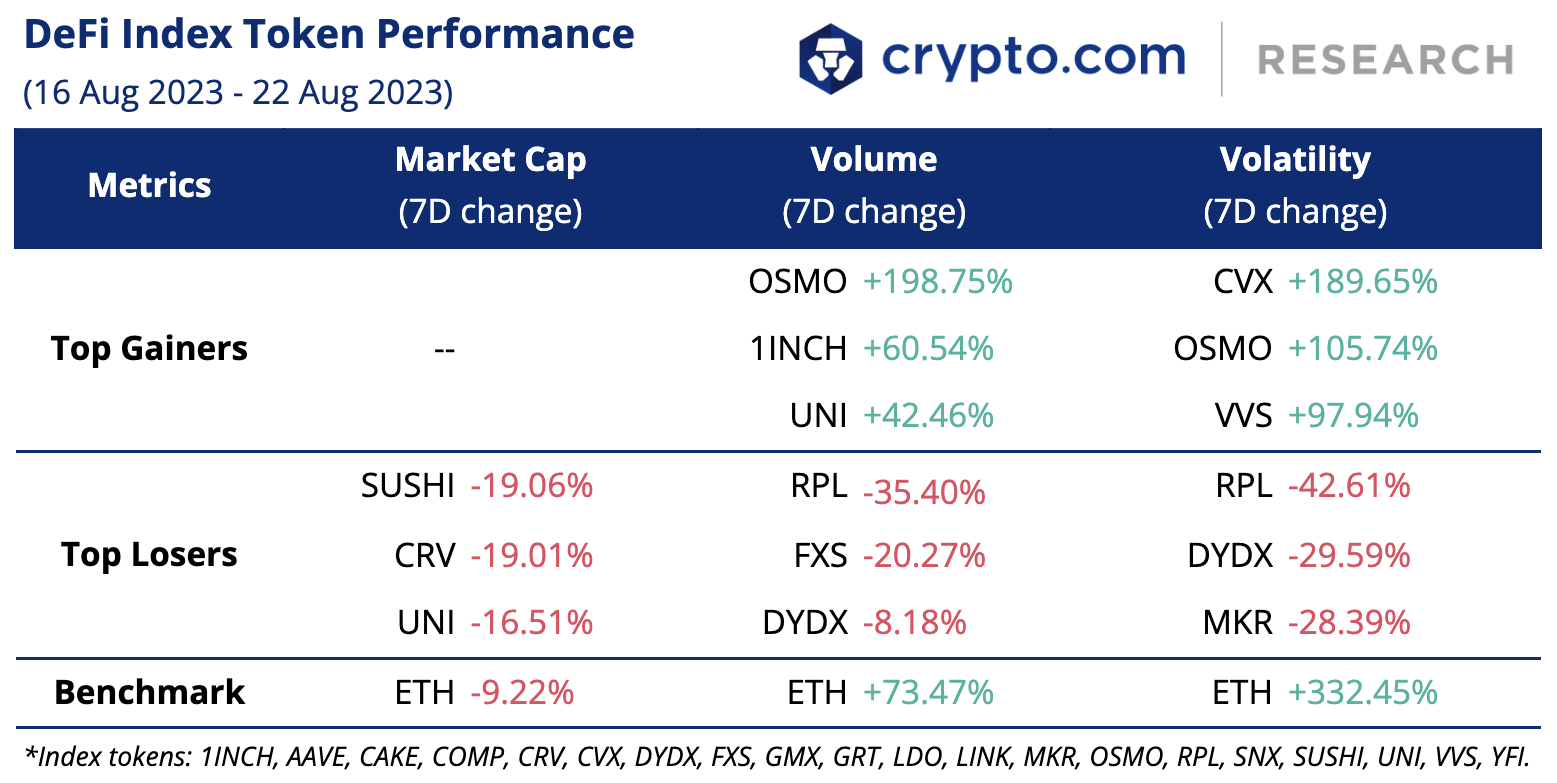

Weekly DeFi Index

This week’s market cap index was negative at -16.84%, while volume and volatility indices were positive at +10.48 and +65.70%, respectively.

Chart of the Week

Launched on 10 August, Friend.Tech (Beta) is an invite-only Web3 social app built on Layer-2 blockchain Base. Users have shares, or ‘Keys’, tied to their X (formerly Twitter) account, which can be bought or sold on the platform.

Shareholders can also access a private chat room owned by the account whose shares they bought. Aside from linking their X account, users are also required to provide their email via Google or Apple during registration.

Friend.Tech has reached over 100,000 users, and on 21 August, its fees climbed to US$1.68 million. This rapid growth can be attributed to a surge in trading volumes as of 18 August, accumulating over 19,000 ETH (worth approximately $34 million as of writing) in tokens bought. Within this period, the community has raised questions about issues relating to data retention, privacy, and regulation.

News Highlights

- In its latest meeting on 17 August, Ethereum core developers discussed updates around a new testnet named Holesky, scheduled to launch on 15 September. Holesky will initiate a new stage of experimentation within the Ethereum ecosystem as developers transition to the Sepolia tesnet after the Goerli testnet is retired in 2024.

- Stablecoin issuer Tether said that it will discontinue support for its stablecoin from 17 August on three blockchains — namely Omni Layer, Kusama, and Bitcoin Cash SLP — citing a lack of demand. Redemptions will continue for the next 12 months.

- Following its official mainnet launch on 16 August, Shiba Inu’s Layer-2 Shibarium Network has resumed block production following a pause that lasted nearly a day. This was reportedly triggered by an unexpected surge in traffic, which prompted the network to activate a fail-safe mode to protect user funds.

- Curve Finance has entered a strategic partnership with TRON DAO, which saw a $2 million CRV investment from TRON DAO Ventures and plans for Curve’s integration into the Tron Network. Curve has also stated that it will be launching on the BitTorrent Chain (BTTC), a peer-to-peer blockchain scaling solution for file and data sharing. The alliances follow a recent security breach on the Curve platform.

- Cryptocurrency exchange Coinbase took a minority stake in Circle Internet Financial. As part of the move, Circle will bring USDC issuance and governance fully in-house, dissolving the Centre Consortium partnership.

- On 22 August, Balancer notified its community of a critical vulnerability affecting a number of its v2 pools, pausing several pools as a proactive measure. The team then issued an update two hours later to confirm that the Balancer ecosystem had been secured and that no vulnerability had been exploited in the process.

- Crypto lending protocol Exactly and interchain stablecoin protocol Harbor were reportedly exploited on 18 August in two unrelated attacks. The attacker targeted the DebtManager periphery contract from Exactly, and 4,323.6 ETH (worth nearly $7.3 million at the time of writing) had been stolen. The Harbor attack led to the loss of funds in its stable-mint, as well as its stOSMO, LUNA and WMATIC vaults, with the total amount lost still yet to be confirmed.

Recent Research Reports

| Research Roundup Newsletter [July 2023] | Real-World Assets: Bridging Real-World Value to DeFi | Crypto Market Sizing Report H1 2023 |

- Research Roundup Newsletter [July 2023]: We present to you our latest issue of Research Roundup, featuring trending market insights in July, charts of the month, and our latest research exploring real-world assets.

- Crypto Market Sizing Report H1 2023: Global crypto owners reached 516 million by the first half of 2023.

- Real-World Assets: Bridging Real-World Value to DeFi: Real-World Assets is a promising application for blockchain technology that is gaining traction. We explore notable projects like Centrifuge, Ondo, Tangible, and Toucan.

- Alpha Navigator: Quest for Alpha [July 2023]: Risk assets continued their positive price action in July, although BTC dipped slightly. The macro calendar is quiet up until mid-August when we have the US CPI and release of FOMC minutes.

Recent University Articles

| 10 Bearish Crypto Trading Indicators to Know | Bitcoin as a Store of Value: A Comparison to Gold and Other Assets | What Is Ethereum’s EIP-4844 Update? How Proto-Danksharding Can Reduce Gas Fees |

- 10 Bearish Crypto Trading Indicators to Know: Discover 10 popular bearish crypto trading indicators that, when combined with other indicators, can help enhance the trading experience.

- Bitcoin as a Store of Value: A Comparison to Gold and Other Assets: Explore the potential of Bitcoin as a store of value — its durability, portability, and other characteristics.

- What Is Ethereum’s EIP-4844 Update? How Proto-Danksharding Can Reduce Gas Fees: Learn about Ethereum’s Cancun-Deneb upgrade, a major protocol update to reduce gas fees and enhance scalability through Proto-Danksharding.

We’re all ears.

Your feedback has always helped us provide insightful crypto market trends. Tell us how we can improve this newsletter further by taking a quick survey below (it will only take less than a minute). Thank you!

Author

Research and Insights Team

Disclaimer

The information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.

The brands and the logos appearing in this report are registered trademarks of their respective owners.

Share with Friends

Related Articles

NFT & Gaming — 🌟 Loaded Lions set a new Guinness World Record; ‘Crypto.com Land – Fractured Fate’ sold out in minutes

DeFi & L1L2 Weekly — 📈 The number of unique addresses interacting with Ethereum L2s reached a new high; Helium partnered with US telecommunications giant AT&T

📉 Bitcoin supply on centralised exchanges reached a 3-year low; Crypto.com signed a binding agreement with Trump Media to support Truth.Fi-branded ETFs

Ready to start your crypto journey?

Get your step-by-step guide to setting upan account with Crypto.com

By clicking the Submit button you acknowledge having read the Privacy Notice of Crypto.com where we explain how we use and protect your personal data.