DeFi & L1L2 Weekly – 💸 Hyperliquid leads perpetuals trading; PYUSD’s supply on Solana has surpassed that on Ethereum

Hyperliquid leads perpetuals trading. PYUSD’s supply on Solana has surpassed that on Ethereum. Ethena’s USDe integrates with Solana and adds SOL as collateral.

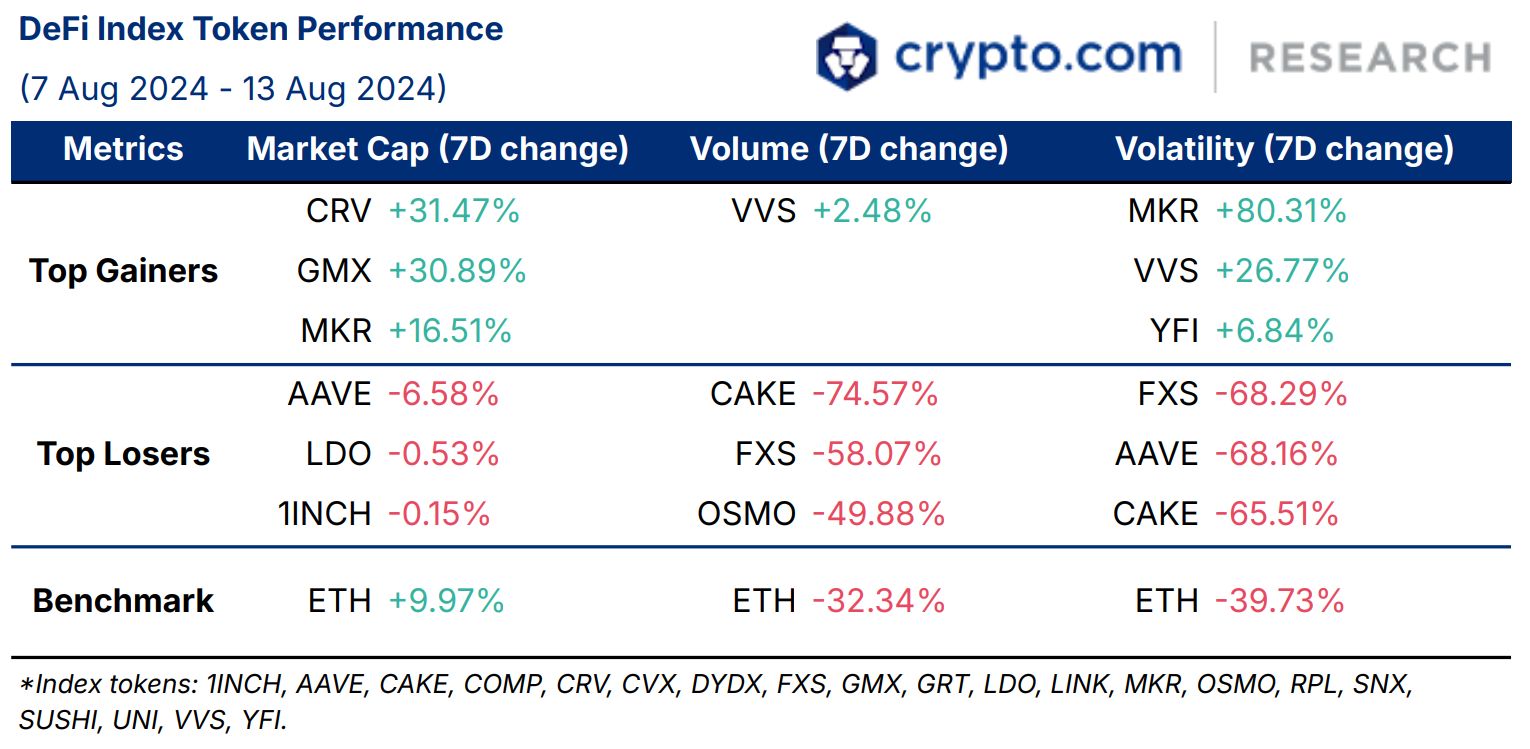

Weekly DeFi Index

The market capitalisation was positive at +2.18%, while the volume and volatility indices were negative at -41.94% and -52.86% respectively.

- Curve Finance (CRV) announced a significant reduction in its CRV token emissions, decreasing from 274 million to 137 million annually. This marks the fifth consecutive year of emissions cuts since the token’s launch in 2020. The total supply of CRV tokens has dropped to 2.09 billion, with about 930 million locked as vote-escrowed veCRV. Notably, Curve DAO’s earnings have now surpassed its emissions for the first time, indicating a move towards sustainability. The platform also recently transitioned its fee distribution mechanism from CRV to its native stablecoin, crvUSD, enhancing user incentives and utility.

- MakerDAO (MKR) is considering offboarding Wrapped Bitcoin (WBTC) following BitGo’s announcement of a restructuring plan involving a joint venture with BiT Global and Justin Sun’s Tron ecosystem. A proposal suggested reducing WBTC vault debt ceilings to zero and halting WBTC borrowing to mitigate risks associated with Sun’s influence. Concerns about operational transparency have been raised since his involvement with other projects. The Maker community is divided, with some supporting the proposal and others expressing concerns. Currently, around 10% of DAI’s supply is backed by WBTC.

Chart of the Week

Hyperliquid, a decentralised perpetuals exchange, is in the spotlight thanks to its leading trading volume. The platform has surpassed competitors like dYdX and Jupiter since the end of January. Over the past month, Hyperliquid accounted for 26% of the total volume among the top 10 perpetual decentralised exchanges (DEXs), totaling more than US$37 billion. Recent upgrades have added spot trading features, and an ongoing points program is expected to culminate with the launch of Hyperliquid’s native token.

News Highlights

- PayPal’s PYUSD stablecoin, initially launched on Ethereum, has now surpassed its supply on the Solana blockchain. The PYUSD stablecoin on Solana has a supply of 377 million, while Ethereum-based PYUSD stands at 356 million. This shift highlights Solana’s growing prominence in the crypto space.

- Ethena Labs is expanding its USDe by integrating with Solana and adding SOL as a collateral asset. This move, facilitated by LayerZero, allows Solana users to transact with USDe and stake it for rewards. The initiative aims to address Ethena’s declining market capitalisation, which has fallen by 14% since July. USDe remains the fourth largest stablecoin, backed primarily by staked ETH. The expansion is expected to enhance adoption and provide new opportunities for users within the Solana ecosystem.

- Ripple is testing its stablecoin, Ripple USD (RLUSD), on Ethereum and XRP Ledger. Currently in its beta phase, RLUSD is aiming for high security and efficiency before its launch, pending regulatory approval. It will be backed by U.S. Treasuries and dollar deposits, with third-party audits. Ripple plans to offer both RLUSD and XRP for cross-border payments.

- Franklin Templeton launched its blockchain-based money market fund, FOBXX, on the Arbitrum network. This move aims to increase accessibility for retail investors amidst rising interest in tokenised real-world asset (RWA) funds. FOBXX primarily invests in U.S. government securities and held about $420 million in assets as of end July. The fund was first launched on the Stellar network in 2021.

- Arbitrum announced that bridged USDC will now serve as a custom gas token for Orbit chains. This integration allows users to pay transaction fees with USDC, enhancing convenience and stability by eliminating the need for multiple tokens.

- Optimism plans to launch native interoperability for its Superchain in 2025, making transactions across its networks as seamless as using a single blockchain. This will include universal token standards to improve fungibility and reduce costs. Optimism aims to simplify the user experience, allowing smoother interactions without worrying about underlying chains.

- Polymarket partnered with Perplexity AI to offer users AI-generated news summaries and probability predictions on various events. This collaboration aims to enhance user experience by providing real-time insights alongside predictive analytics. The partnership comes as Polymarket gains traction in the prediction market space, particularly ahead of the upcoming November elections, where significant betting activity is noted. However, the prediction market faces regulatory scrutiny from the Commodity Futures Trading Commission (CFTC), which could impact its operations.

- Canto‘s blockchain has been offline since 10 August due to a consensus issue, resulting in a halt for two days. The CANTO token price initially dropped by 21% over the weekend but later recovered. However, it experienced another halt just 90 minutes after restarting. The team cited “unforeseen secondary effects” related to a proposer priority issue following a scheduled upgrade. Despite the outage, Canto’s token price surged by 80% over the last 24 hours on 13 August.

Recent Research Reports

|  |  |

| Crypto Market Sizing Report H1 2024 | Ethereum L2 Interoperability – The Super Chains | Exploration of Web3 Socials |

- Crypto Market Sizing Report H1 2024: Global crypto owners reached 617 million by the first half of 2024.

- Ethereum L2 Interoperability – The Super Chains: Our latest report looks into how Ethereum L2-based solutions like ZKsync’s Elastic Chain, Polygon’s AggLayer, and Optimism’s Superchain address scalability and interoperability challenges.

- Exploration of Web3 Socials: We have seen a surge in interest in decentralised Web3 Socials in 2024. Our report looks into its recent developments, including Solana’s Actions and Blinks, as well as Farcaster and Lens on Ethereum.

Interested to know more? Access exclusive reports by signing up as a Private member, joining our Crypto.com Exchange VIP Programme, or collecting a Loaded Lions NFT.

Recent University Articles

|  |  |

| What Is Degen (DEGEN) and How to Buy DEGEN | What Is Milady Meme Coin (LADYS) and How to Buy LADYS | What Is Fully Diluted Valuation (FDV)? |

- What Is Degen (DEGEN) and How to Buy DEGEN: Discover how Degen, a cryptocurrency developed to bridge the gap between online contributions and real-world value, is transcending its meme coin origins.

- What Is Milady Meme Coin (LADYS) and How to Buy LADYS: Find out why Milady Meme Coin (LADYS), a cryptocurrency paying homage to the Milady Maker NFT collection, is generating buzz in the meme coin space.

- What Is Fully Diluted Valuation (FDV)?: Fully diluted valuation (FDV) is a key metric to look into before buying cryptocurrency — here’s what it means and how to gauge it.

We’re all ears.

Your feedback helps make our reporting more insightful. Tell us how we can improve this newsletter by taking the survey below. It will take less than a minute of your time. Thank you!

Authors

Research and Insights Team

Disclaimer

The information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.

The brands and the logos appearing in this report are registered trademarks of their respective owners.

Share with Friends

Related Articles

₿ US-based entities hold 65% more BTC reserves than non-US entities; Crypto.com launched stocks and ETFs trading in the US

₿ US-based entities hold 65% more BTC reserves than non-US entities; Crypto.com launched stocks and ETFs trading in the US

₿ US-based entities hold 65% more BTC reserves than non-US entities; Crypto.com launched stocks and ETFs trading in the US

DeFi & L1L2 Weekly — 📈 Weekly active addresses on L2s were 5x higher than on Ethereum; Ethena plans to launch iUSDe in February

DeFi & L1L2 Weekly — 📈 Weekly active addresses on L2s were 5x higher than on Ethereum; Ethena plans to launch iUSDe in February

DeFi & L1L2 Weekly — 📈 Weekly active addresses on L2s were 5x higher than on Ethereum; Ethena plans to launch iUSDe in February

📈 US spot BTC and ETH ETFs saw a $35 billion and $2.7 billion net inflow in 2024, respectively; Crypto.com signed an MoU with Dubai Islamic Bank

📈 US spot BTC and ETH ETFs saw a $35 billion and $2.7 billion net inflow in 2024, respectively; Crypto.com signed an MoU with Dubai Islamic Bank

📈 US spot BTC and ETH ETFs saw a $35 billion and $2.7 billion net inflow in 2024, respectively; Crypto.com signed an MoU with Dubai Islamic Bank

Ready to start your crypto journey?

Get your step-by-step guide to setting upan account with Crypto.com

By clicking the Submit button you acknowledge having read the Privacy Notice of Crypto.com where we explain how we use and protect your personal data.