DeFi & L1L2 Weekly – 📈 Ethereum’s inflation rate at 0.69% per year; Polygon is set to migrate from its MATIC token to POL

Ethereum sees an inflation rate of 0.69% per year after Dencun Upgrade. Polygon is set to migrate from its MATIC token to POL. 21.co launches a Bitcoin wrapper on the Ethereum blockchain.

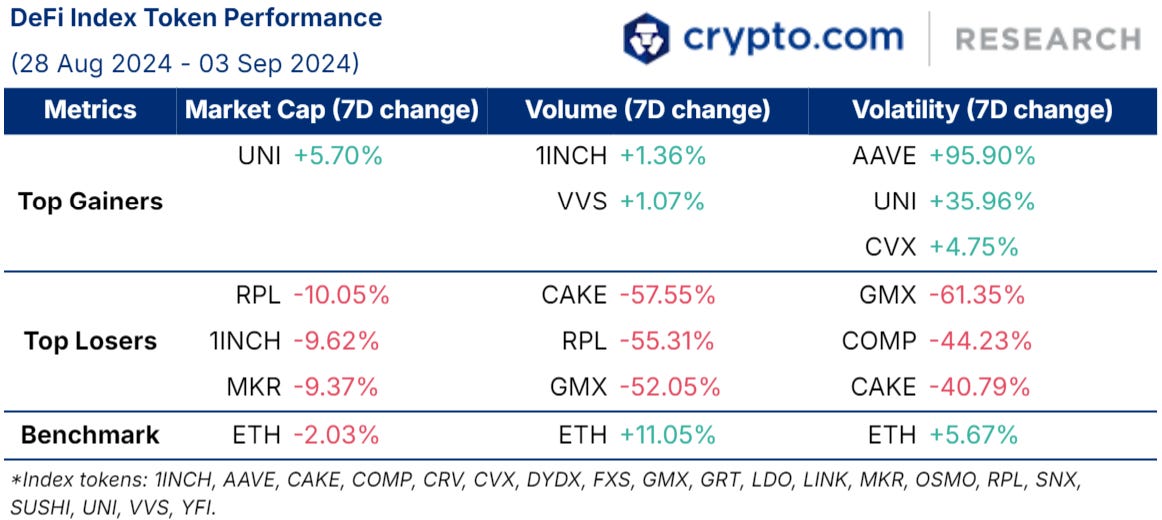

Weekly DeFi Index

The market capitalisation and volume indices were negative at -9.16% and -24.23% respectively, while the volatility index grew slightly by +0.71%.

- Aave and Sky (formerly Maker) are considering a partnership to bridge DeFi and TradFi, called “Sky Aave Force”, and aims to establish markets for DAI-replacement stablecoin USDS on Aave. It was proposed for SPK tokens to be issued to help establish a market for Sky’s USDS, SPK token incentivisation on Aave, and a USDS Direct Deposit Module to be introduced to Aave’s Lido Market.

- Aave plans to onboard BlackRock USD Institutional Digital Liquidity Fund (BUIDL) shares as collateral for its stablecoin, GHO. This move aims to expand collateral options and enhance liquidity within the platform. The integration is part of Aave’s strategy to strengthen its DeFi ecosystem and offer more flexibility to users.

Chart of the Week

Ethereum is currently experiencing its longest inflationary period since its transition to Proof-of-Stake (PoS), with over 251,920 ETH added to the supply from mid-April to August. Due to the Dencun Upgrade in March, where EIP-4844 and other updates have helped lower burn rates as more transactions occurred on Layer 2s, there is an increase in ETH supply, therefore affecting Ethereum’s deflationary status. Its inflation rate is currently at 0.69% per year.

News Highlights

- Polygon is set to migrate from its MATIC token to a new token, POL, in a planned upgrade on 4 September 2024. This change aims to provide greater flexibility in token issuance, with a new annual emission rate of 2%. The POL token will serve as the native gas and staking token for the Polygon PoS network and play a key role in the upcoming AggLayer, which aggregates affiliated blockchains.

- The Stacks network began the rollout of its Nakamoto upgrade, which is expected to significantly enhance transaction speeds by decoupling its block production from the Bitcoin blockchain. This change will increase block production by 120 times, reducing confirmation times from Bitcoin’s typical 10 minutes to just seconds.

- 21.co, the parent company of 21Shares, launched a Bitcoin wrapper (21BTC) on the Ethereum blockchain. 21BTC aims to provide institutional-grade security to wrapped BTC with features like cold storage and regulated third-party custodians. The launch comes as rival BTC wrapper, Wrapped Bitcoin (wBTC), faces backlash over its custodian BitGo’s partnership.

- Ondo Finance is expanding USDY, a yield token for stablecoins, to Arbitrum. USDY allows users to earn up to 5.35% annual percentage return and is backed by bank deposits and short-term treasury bills.

- OpenAI’s GPT-2, a 2019 AI model, has been successfully deployed on the ICP blockchain by an AI firm DecideAI. This achievement is a stepping stone towards more advanced on-chain AI models, which could be used in various industries. DecideAI plans to extend more sophisticated AI models to Ethereum and Solana blockchains, aiming for interoperable AI systems across multiple blockchain ecosystems.

- Vega Protocol plans to shut down its alpha mainnet chain within three months, focusing on developing its software and launching a new project called “Nebula”. Nebula will be a decentralised exchange with its own NEB token, and VEGA token holders can swap VEGA for this new token. The proposal includes suspending trading, redistributing the on-chain treasury to stakers, and providing incentives to validators.

- Pendle paused its contracts following a US$27 million exploit on Penpie, a yield protocol built on top of Pendle. This decision was made as a precautionary measure to prevent further vulnerabilities and protect users.

Recent Research Reports

- Research Roundup Newsletter [July 2024]: We present to you our latest issue of Research Roundup, featuring our deep dives into latest crypto market sizing, L2 Interoperability and Web3 Socials.

- Alpha Navigator: Quest for Alpha [July 2024]: Cryptocurrencies showed mixed performance in July, Fixed Income was up while Equities were down. US, EU maintain interest rates; UK cuts rates while Japan hikes rates for the second time since 2007.

- Crypto Market Sizing Report H1 2024: Global crypto owners reached 617 million by the first half of 2024.

Interested to know more? Access exclusive reports by signing up as a Private member, joining our Crypto.com Exchange VIP Programme, or collecting a Loaded Lions NFT.

Recent University Articles

| What Is the Wen Meme Coin and How to Buy WEN |

- What Does It Mean to Burn Crypto? Token Burns Explained: Crypto burns are a strategic mechanism to control inflation and potentially increase value by removing tokens from circulation. Here’s how burning works.

- What Is Maneki (MANEKI) and How to Buy MANEKI: Learn why Maneki, a cat meme coin based on the maneki-neko of Japanese folklore, is attracting attention in the cryptocurrency community.

- What Is the Wen Meme Coin and How to Buy WEN: From Dogecoin and Shiba Inu to lesser-known variants, learn all about meme coins, what they are, and

We’re all ears.

Your feedback helps make our reporting more insightful. Tell us how we can improve this newsletter by taking the survey below. It will take less than a minute of your time. Thank you!

Authors

Research and Insights Team

Disclaimer

The information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.

The brands and the logos appearing in this report are registered trademarks of their respective owners.

Share with Friends

Related Articles

DeFi & L1L2 Weekly — 🚀 21Shares launched a Cronos ETP in Europe; Polygon took the lead in the number of USDC active addresses by chain

📈 Global corporate bitcoin holdings increased by around 80,000 BTC in April; Selected merchants at the Formula 1 Crypto.com Miami Grand Prix will utilise Crypto.com Pay for payments

NFT & Gaming — 🌟 Loaded Lions set a new Guinness World Record; ‘Crypto.com Land – Fractured Fate’ sold out in minutes

Ready to start your crypto journey?

Get your step-by-step guide to setting upan account with Crypto.com

By clicking the Submit button you acknowledge having read the Privacy Notice of Crypto.com where we explain how we use and protect your personal data.