Crypto Market Pulse (25/09/2023)

Federal Reserve holds interest rates steady. Nomura introduces a BTC exposure fund. Citigroup’s new blockchain service to facilitate payments and liquidity.

Weekly Market Index

Last week’s crypto market prices fell slightly by -0.42%. Volume and volatility also decreased by -11.27% and -31.67%, respectively.

Chart of the Week

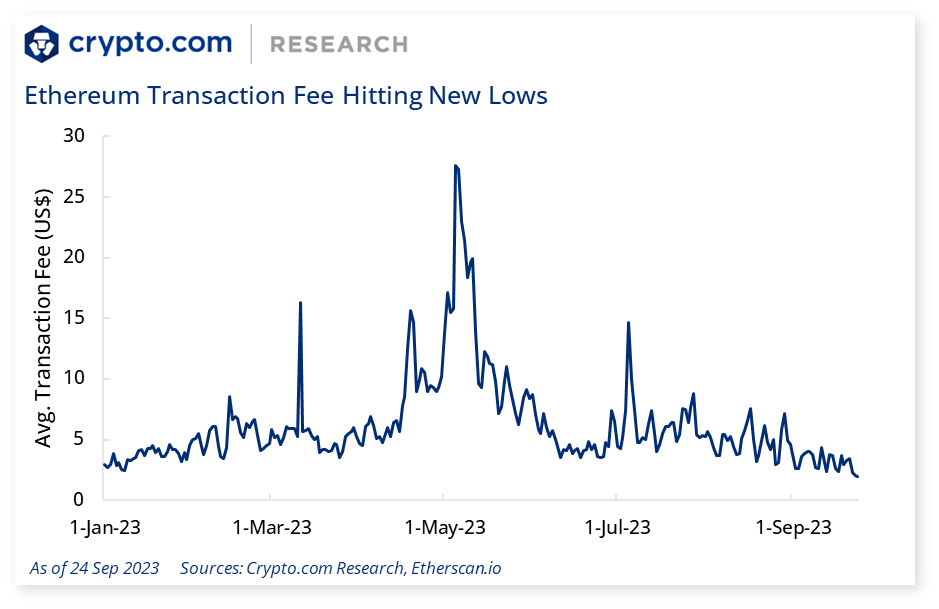

Ethereum’s average transaction fee has hit its lowest point this year, at US$1.94 (as of 24 Sep). Some market observers could interpret this as positive for Ethereum, as the lower fees might help to increase network utilisation.

Weekly Performance

Bitcoin (BTC) and Ethereum (ETH) prices fell slightly at -1.0% and -2.1%, respectively, in the past seven days. Price action for other selected top-cap tokens was mixed. Chainlink (LINK) was a notable outperformer, rising +17.1%.

Selected key categories were mostly up slightly in terms of market cap in the past seven days.

News Highlights

- The US Federal Reserve held interest rates steady last week but was interpreted by some market observers to have toughened its monetary policy stance in order to lower inflation. The interest rate may still be lifted one more time this year to a peak 5.50%-5.75% range, according to updated quarterly projections released by the Fed.

- Zodia Custody — the crypto-focused subsidiary of Standard Chartered — plans to allow its clients to earn yield on their crypto holdings. The yield offering will tokenise real-world assets like US Treasury bills.

- Japanese financial services giant Nomura’s digital assets subsidiary Laser Digital has introduced a new fund providing Bitcoin exposure to institutional investors.

- Citigroup has introduced Citi Token Services, a private, permissioned blockchain that offers cross-border payments, liquidity and automated trade finance solutions to institutional clients.

- Grayscale Investments, the crypto asset manager, filed for a new exchange-traded-fund (ETF) that tracks Ethereum futures.

- Payment processor PayPal has announced its PYUSD stablecoin is now available on Venmo.

Recent Research Reports

| Research Roundup Newsletter [August 2023] | Alpha Navigator: Quest for Alpha [August 2023] | Decentralised Stablecoins |

- Research Roundup Newsletter [August 2023]: We present to you our latest issue of Research Roundup, featuring trending market insights in August, charts of the month, and our latest research on decentralised stablecoins.

- Alpha Navigator: Quest for Alpha [August 2023]: Asset classes dipped in August; BTC and ETH underperformed. No surprises from the central bankers summit at Jackson Hole. China intensifies economic stimulus.

- Decentralised Stablecoins: Stablecoins are well positioned to facilitate broader adoption of cryptocurrencies. We explore the key decentralised stablecoin projects and their innovative mechanisms.

Recent University Articles

| What Is Polygon (MATIC)? | What Is Solana (SOL)? | What Is a Rug Pull and How Does It Work? |

- What Is Polygon (MATIC)?: Learn about Polygon’s mission to create a multichain, Ethereum-compatible blockchain ecosystem with the MATIC token.

- What Is Solana (SOL)?: One of the top market cap cryptocurrencies, Solana (SOL) is a high-performance blockchain platform known for its scalability, speed, and low transaction costs.

- What Is a Rug Pull and How Does It Work?: A rug pull is a term for a scam in the crypto space where traders are left hanging with worthless assets. Here’s how to avoid it.

Catalyst Calendar

Author

Research and Insights Team

Disclaimer:

The information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.

The brands and the logos appearing in this report are registered trademarks of their respective owners.

Share with Friends

Related Articles

NFT & Gaming — 🌟 Loaded Lions set a new Guinness World Record; ‘Crypto.com Land – Fractured Fate’ sold out in minutes

DeFi & L1L2 Weekly — 📈 The number of unique addresses interacting with Ethereum L2s reached a new high; Helium partnered with US telecommunications giant AT&T

📉 Bitcoin supply on centralised exchanges reached a 3-year low; Crypto.com signed a binding agreement with Trump Media to support Truth.Fi-branded ETFs

Ready to start your crypto journey?

Get your step-by-step guide to setting upan account with Crypto.com

By clicking the Submit button you acknowledge having read the Privacy Notice of Crypto.com where we explain how we use and protect your personal data.