Welcome to the Crypto.com Monthly Research Roundup Newsletter!

1. Market Index

The monthly volume index was positive at +10.94%, while the price and volatility indices were negative at -3.43% and -3.24% , respectively.

2. The Merge

The Merge is finally complete. On 15 September 2022, Ethereum completed its transition from a proof-of-work to proof-of-stake consensus mechanism. Miners stepped down and validators stepped up.

Why it matters. Ethereum’s vision is to become more scalable—arguably the most important factor for reaching more users—and secure, while remaining decentralised. The Merge is expected to set the stage for improving scalability.

- Effects of The Merge. Ethereum’s energy consumption is expected to drop by ~99.95% after The Merge, as the conditions for a computational power arms race are removed. Some common misconceptions about The Merge are that it will reduce gas fees and significantly increase transaction speeds. It is important to understand that scalability issues will not be immediately solved after The Merge, as it’s only the first step toward potential future upgrades and scaling activities that will address these issues.

- ETH total supply. After The Merge, only around 1,600 ETH will be issued daily for staking rewards (rewards for validators who attest to and propose blocks) will remain. Thus, the total new issuance will decrease by around 90% after The Merge. The burn mechanism introduced by EIP-1559 would burn at least 1,600 ETH daily, assuming an average gas price of at least 16 gwei. This would effectively result in zero net ETH inflation or less (i.e., deflationary ETH) after the Merge.

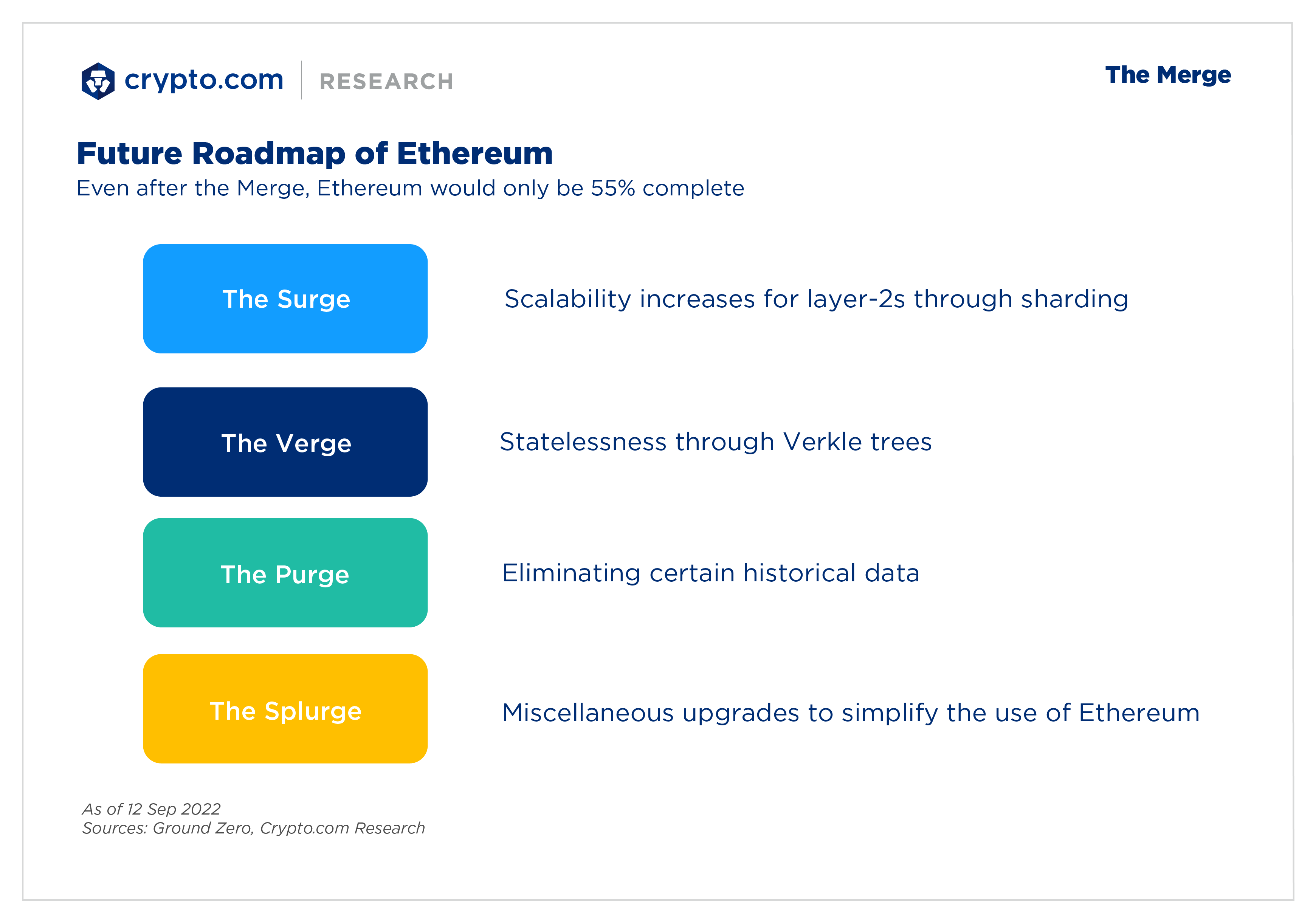

- What’s next for Ethereum? According to Vitalik Buterin, Ethereum will only be approximately 55% complete after The Merge. It will still undergo upgrades, including The Surge, Verge, Purge, and Splurge. These upgrades are expected to happen in parallel, according to Buterin.

Read the full report here: Ethereum: The Merge

3. Alpha Navigator

This institutional-focused report dives into macro trends, market-neutral pair trades, style-factor screens, thematic baskets, and event driven ideas. Read the full Alpha Navigator report here.

- Macro headwinds show no signs of abating, as the main theme in September was again interest rate hikes, driving all risk assets down across the board. Crypto outperformed equities. BTC was the best relative performer, down -1.09%.

- Our style-factor screens track momentum, value, growth, and risk for tokens in the Layers 1 & 2, DeFi, GameFi, and NFT categories. Below, we highlight our style-factor screen for the top tokens by market cap in the Layers 1 & 2 category. ATOM continues to show strong price momentum.

4. Feature | Welcome to Web3: Identity, Soulbound Tokens, and Decentralised Society

Read the high-level discussion here.

Key takeaways:

- Digital identity is a central issue that will be of great importance in the coming years, and blockchain technology is highly suited to solve problems around it.

- Evolving web identities. The web is evolving. In Web1, the typical identity model is centralised, where each platform stores the usernames and passwords of their users in a database. In Web2, the model shifted to ‘federated identity’, such as signing in with social media platforms like Google, Twitter, and Facebook. In Web3, the identity of a user is decentralised and based on blockchain wallets.

- Web3 domains. Web3 domains are a popular type of Web3 identity, taking the form of a human-readable address that represents a crypto wallet and can end with extensions such as .crypto, .dao, or .eth. A Web3 domain is also typically a non-fungible token, which means it can be minted and sold just like any other NFT. We go through some notable examples, including Ethereum Name Service (ENS), Unstoppable Domains, and Cronos ID.

- Soulbound Tokens (SBTs). A common criticism of the Web3 space is that everything is money-oriented or “hyper-financialised”. Chasing profits may become the only objective of Web3 residents and there is the risk that new technologies could cause wealth to be reshuffled, resulting in a centralised system wrapped in decentralised narratives. To avoid hyper-financialisation in today’s Web3 ecosystem, Ethereum Co-founder Vitalik Buterin proposed a way to move to a decentralised society that “encodes social ties of trust” via soulbound tokens (SBTs). The concept of “soulbound” assets on the blockchain was first discussed in a blog post by Buterin in January 2022 to solve the above identity and trust issues.

- Decentralised Society (DeSoc). Decentralised Society is a co-determined sociality, where Souls and communities convene in a bottom-up way, as emergent properties of each other to produce plural network goods across different scales. SBTs aim to be the cornerstone of DeSoc. The primitives of DeSoc, centred around non-transferable SBTs, represent the commitments, credentials, and affiliations of ‘Souls’ that can encode the trust networks of the real economy to establish provenance and reputation.

- Use cases, drawbacks, and the future of SBTs. SBTs can generally represent and manage any assets and goods that are on the spectrum between being fully private and fully public. Some of our key findings include:

- The prominent use cases of SBTs in Web3 include provenance, decentralised key management, undercollateralised lending, DAO governance, among others.

- One drawback is that SBTs could provide a way to automate redlining by being used to target and limit members of specific communities.

- Eric Glen Weyl, one of the co-authors (along with Vitalik Buterin) of the paper Decentralized Society: Finding Web3’s Soul, predicted that early use cases of SBTs will be available by the end of 2022.

Interested to know more? Join us and check our Private Member and Exchange VIP exclusive reports:

VIP Article 1 | Digital Identity and the Web3 World

VIP Article 2 | Soulbound Tokens and Decentralised Society

5. Crypto Conference & Economic Calendar from Market Pulse

Check out the latest Market Pulse update for more insights.

Looking for more? Check out our most recent reports and trending market updates:

Get fresh market updates delivered straight to your inbox:

Thank you for supporting Crypto.com

Best regards,

Research & Insights Team