Here are the seven key takeaways for this month:

1) Loan-to-Deposit ratios among DeFi lenders show strength (ability to lend more) in their financial positions (typically, the ideal LDR is 80% to 90%).

2) Borrowers hold on to their collateral positions on MakerDAO and AAVE while Compound’s deleveraging has continued for some time.

3) Floor prices of popular NFT projects such as BAYC and CryptoPunks continued to fall in June.

4) Tron’s USDD seems to have lost its peg, with USDT and MIM also struggling to maintain USD parity in choppy market conditions.

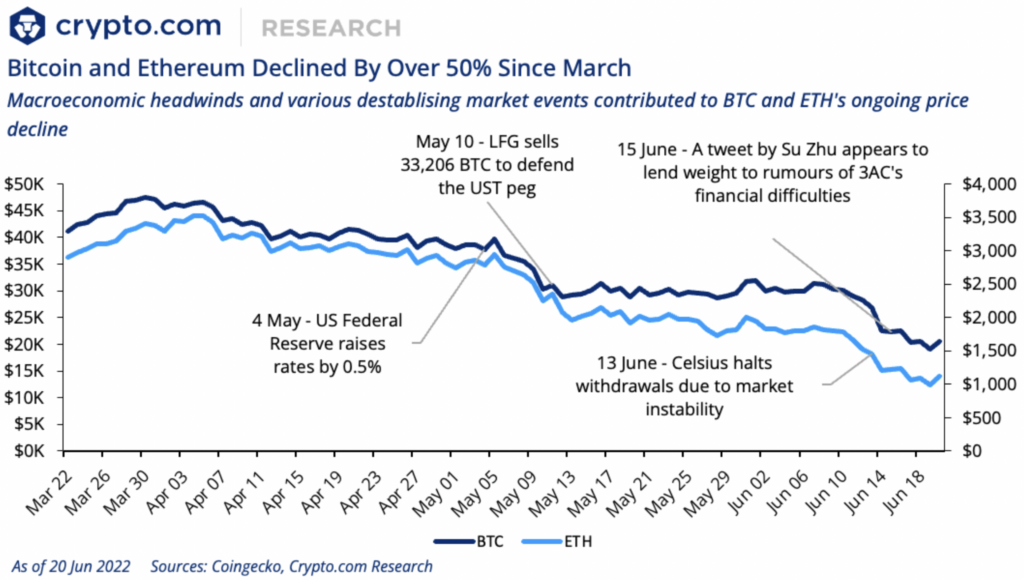

5) Battered by macroeconomic forces and various crypto market incidents, BTC and ETH have seen a significant price decline in recent weeks.

6) Staked ETH trades at a discount of more than 5% from $ETH.

7) Celsius halted withdrawals in mid-June amid uncertain market conditions and a decline in the price of CEL.

Authors

Michael Bolger (Senior Research Analyst)

Henry Hon PhD, CFA (Head of Research & Insights)

Jack Moore (Research Analyst)