Crypto.com Tax Is Now Available in Finland

Bid farewell to manually calculating your crypto taxes

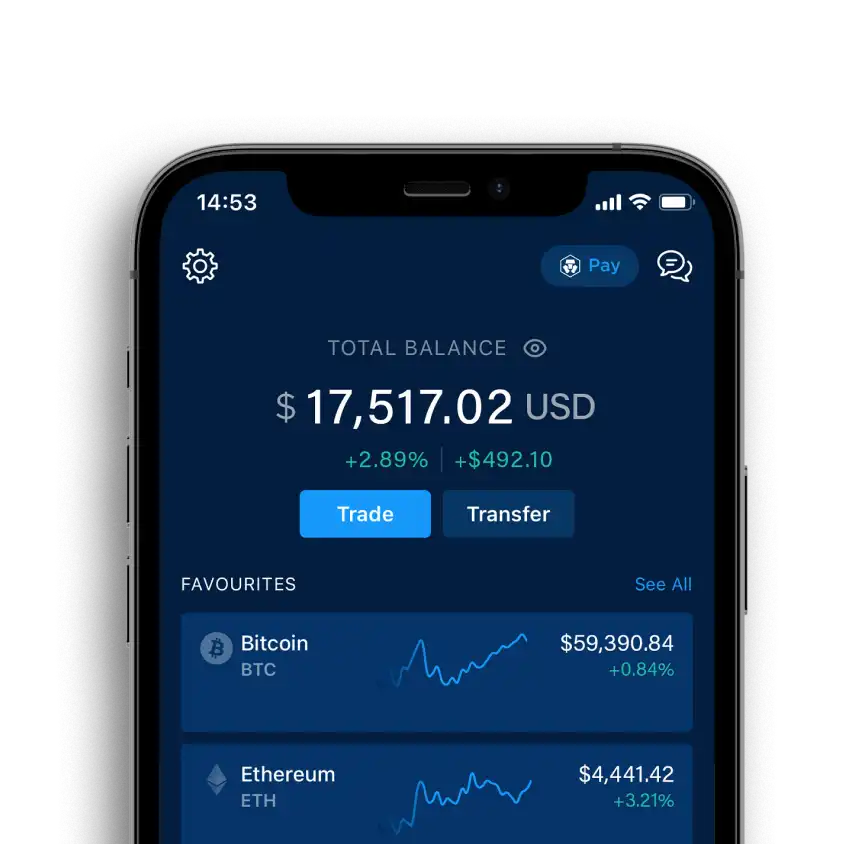

Following the launch of Crypto.com Tax in Norway and Denmark, we’re excited to announce that the platform is now available for users in Finland. Easily generate a full crypto tax report for free and complete your tax filing in just seconds. Say goodbye to spending hours on your notepad and calculator.

Crypto.com Tax supports over 30 popular exchanges and wallets, allowing users to import transactions via a CSV file or API sync. Additionally, taxable capital gains and losses are automatically calculated, saving users even more time and effort.

Once all transactions are loaded in, it takes a single click to generate a full tax report.

For more information about Crypto.com Tax, please visit the Help Centre or reach out to us via the in-app chat. We’re here to help.

Notes:

- The individual user of the Services is assumed to be an individual who has an obligation to pay tax as a resident in Finland. We would suggest you consult with your tax advisor for the details.

- The Finnish Tax Administration has provided detailed guidance covering the taxation of virtual currencies in personal taxation, corporate taxation and VAT in its instructions titled “Taxation of virtual currencies” published on 22 January 2020. The instructions state that cryptocurrency is considered an asset referred to in section 45 (1) of the Income Tax Act, but is not a security. As such, section 50 (3) of the Income Tax Act regarding deductible loss is not applicable, in that if a cryptocurrency diminishes its full value, it does not constitute a deductible loss for the taxpayer. Please note that the Finnish tax treatment is potentially subject to change. Therefore, individuals should take their own personal tax advice as required.

- The information is provided on the basis that the Services provided are intended exclusively for individuals who are not engaging in cryptocurrency transactions as business or commercial activities. This information is therefore not suitable for any individuals participating in cryptocurrency transactions that constitute business activities. The Finland tax authorities determine whether cryptocurrency activities amount to business activities based on a number of factors and individual circumstances. We would suggest you consult with your tax advisor for the details.

Arkadaşlarınla Paylaş

İlgili Makaleler

Crypto.com Launches Sports Event Trading

Crypto.com Launches Sports Event Trading

Crypto.com Launches Sports Event Trading

KSM Flash Rewards Campaign: Get 14% p.a.

KSM Flash Rewards Campaign: Get 14% p.a.

KSM Flash Rewards Campaign: Get 14% p.a.

Introducing Crypto.com Wrapped Bitcoin (CDCBTC)

Introducing Crypto.com Wrapped Bitcoin (CDCBTC)

Introducing Crypto.com Wrapped Bitcoin (CDCBTC)

Kripto yolculuğunuza başlamaya hazır mısınız?

Crypto.com ile bir hesap oluşturmakiçin ayrıntılı kılavuzu inceleyin

Gönder düğmesine tıklayarak bu belgeyi okuduğunuzu kabul etmiş olursunuz. Crypto.com Gizlilik Bildirimi kişisel verilerinizi nasıl kullandığımızı ve koruduğumuzu açıkladığımız yer.