February Monthly Futures are live in Derivatives Exchange

Trade BTCUSD and ETHUSD with instant USD Coin (USDC) settlement

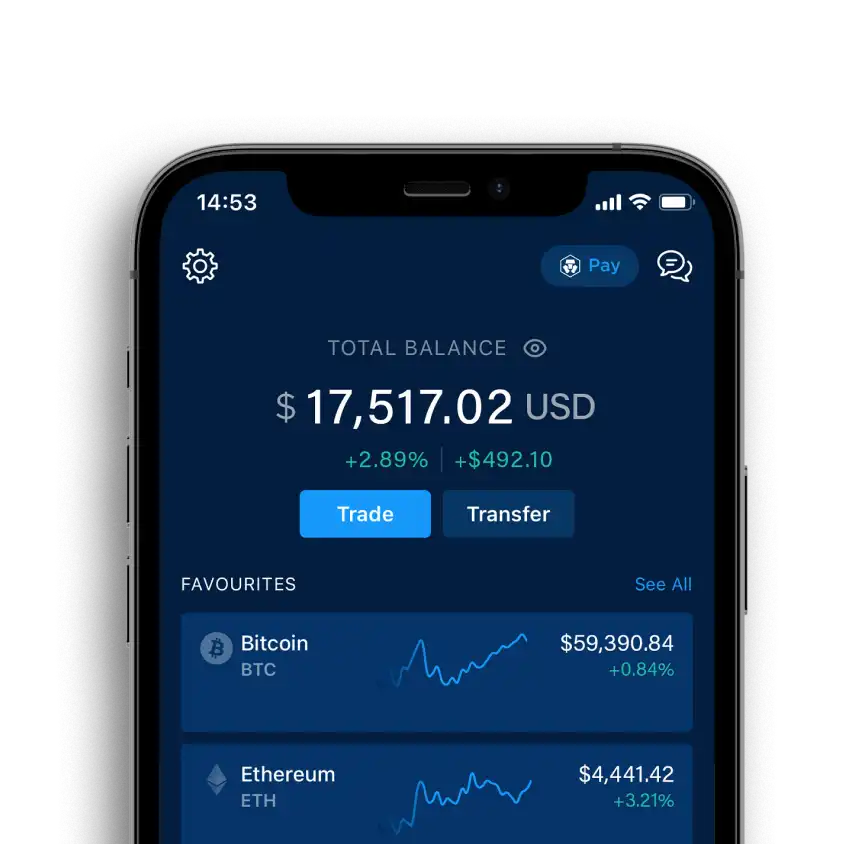

We’re pleased to announce that February Monthly ETHUSD and BTCUSD Futures Contracts are now available in the Crypto.com Derivatives Exchange, in addition to January Monthly Futures, Q4 Futures and 2022 Q1 Futures. Users can settle in USDC, control their account leverage, and enjoy discounted trading fees based on the amount of CRO they stake in the Exchange.

Futures Contracts offer traders exposure to an underlying asset at a preset price, much like Perpetual Contracts. But unlike Perpetual Contracts, Futures Contracts have a fixed expiration date. Monthly Futures will settle on the last Friday of each month at 08:00 UTC (e.g. January Futures expire on 22 February 2022).

Traders can freely long and short Monthly Futures Contracts before their expiry date. Margin is shared across all open positions in your Derivatives Wallet.

Key Highlights:

- Trade BTCUSD and ETHUSD Futures

- Control over your account leverage

- Instant USDC settlement

Follow these simple steps to get started:

- Create a Derivatives Wallet

- Transfer CRO/DAI/USDC/USDT from your Spot Wallet to your Derivatives Wallet

- Start trading!

How do derivatives work?

A derivative is a contract between two parties that is based on the value/price of an underlying asset. Common types of derivatives include futures, options, forwards, and perpetuals. Futures Contracts allow a trader to buy or sell an underlying asset at a preset price on a fixed date in the future (i.e. the expiration date).

For more information about Futures Contracts, settlement, margin policy, and fees, please visit our Help Centre.

User Eligibility

Crypto.com Exchange users need to complete Advanced level verification to trade derivatives. Citizens or residents of the excluded jurisdictions listed here are unable to use our derivatives services at this time.

Important Note on Derivatives Trading

You must seek professional advice regarding your particular situation before conducting derivatives trading. The risk of loss can be substantial. You may lose all or more than the Virtual Assets when trading. You may be called upon at short notice to make additional Virtual Asset contributions. If you do not make such contributions within the prescribed time, your Virtual Assets may be lost without further notice to you. You should therefore carefully consider whether such arrangements are suitable for you in light of your investment objectives, financial circumstances, your tolerance to risks and your investment experience. You should be capable of bearing a full loss of the amounts invested as a result of or in connection with any order and any additional loss over and above the initial amounts invested that may become due and owing by you. In considering whether to trade or invest, or use any derivative trading facility or other service, you should inform yourself and be aware of the risks generally, and in particular should note the specific risk factors which may apply.

Condividi con gli amici

Articoli correlati

Fantom (FTM) Staking Is Disabled for the Sonic Mainnet Launch

Fantom (FTM) Staking Is Disabled for the Sonic Mainnet Launch

Fantom (FTM) Staking Is Disabled for the Sonic Mainnet Launch

Get Free Apple Products or Emirates Tickets With Your Crypto.com Card

Get Free Apple Products or Emirates Tickets With Your Crypto.com Card

Get Free Apple Products or Emirates Tickets With Your Crypto.com Card

Crypto.com App Lists Pudgy Penguins (PENGU)

Crypto.com App Lists Pudgy Penguins (PENGU)

Crypto.com App Lists Pudgy Penguins (PENGU)

Sei pronto per avventurarti nel mondo delle criptovalute?

Ottieni subito la guida per configurareil tuo account Crypto.com

Cliccando sul pulsante Invia, riconosci di aver letto l' Informativa sulla privacy di Crypto.com dove illustriamo come usiamo e proteggiamo i tuoi dati personali.