Market Pulse (Week 32, 08/08/2022 – 15/08/2022)

ETH options open interest at a high as traders pile on leveraged bets. Asset managers’ net-long position in CME BTC futures climbing. ETH enters short-term overbought territory

Chart of the Week: In the Mood for Leveraged Bets

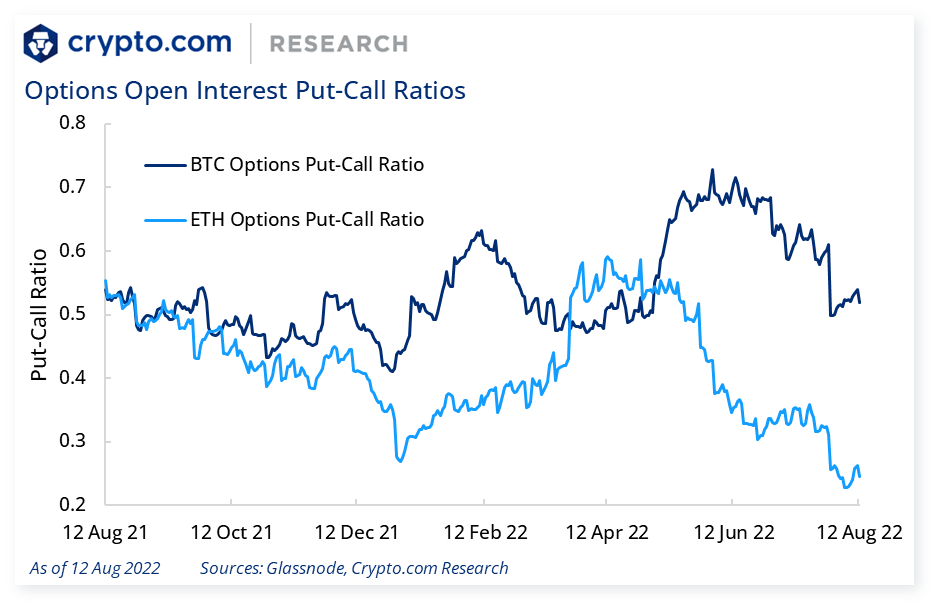

- ETH options open interest has reached a new high at around US$8B. Options are a leveraged play on ETH and traders are likely piling up the bets in anticipation of the mainnet merge in September. Last week, the final testnet merge, Goerli, was successfully completed, giving traders an extra confidence boost.

Fund Flow Tracker

- No significant movements in aggregated exchange balances for both BTC and ETH over the past week.

Derivatives Pulse

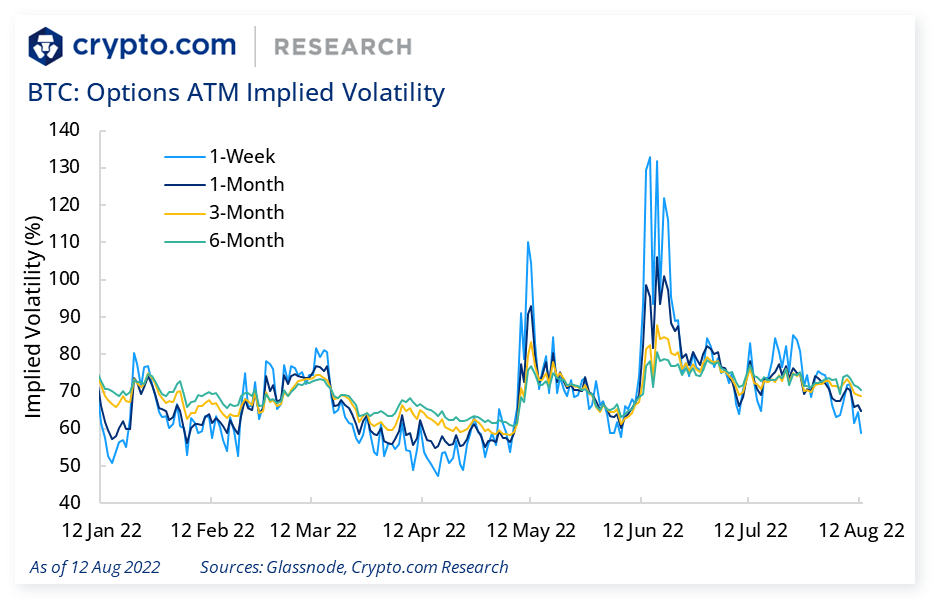

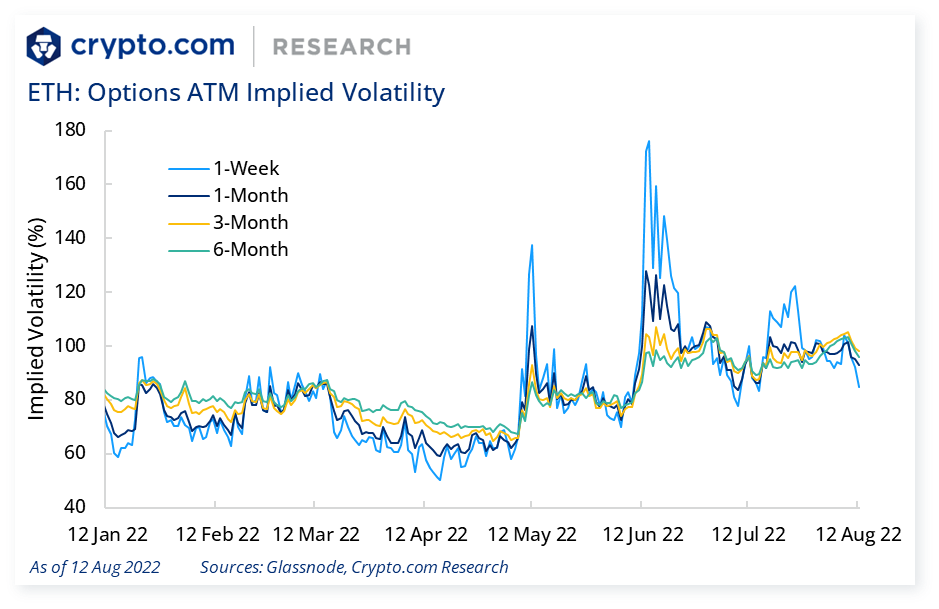

- Implied vols and skews (puts minus calls) are subdued. 1-week implied vol currently stands at 58.7% (vs. 63.1% a week ago) and 84.8% (vs. 91.9% a week ago) for BTC and ETH, respectively. Put-call ratios remain at low levels.

- Perpetual futures funding rates remain mainly in positive territory for both BTC and ETH over the past week.

- Asset managers’ net-long position in CME Bitcoin futures continues to crawl up, and leveraged traders’ net-short position keeps on reducing. Other reportables’ (which includes corporate treasuries) net-long position has flipped to net-short.

- Leveraged traders are typically hedge funds and various types of money managers, including commodity trading advisors and commodity pool operators. The traders may be engaged in managing and conducting proprietary futures trading, and trading on behalf of speculative clients.

- The asset manager category consists of institutional investors, including pension funds, endowments, insurance companies, mutual funds, and those portfolio/investment managers whose clients are predominantly institutional.

- The dealer category consists of participants typically described as the “sell-side” of the market. These include large banks and dealers in securities, swaps, and other derivatives. The other reportable category consists of traders mostly using markets to hedge business risk, and includes amongst others corporate treasuries.

Technically Speaking

- BTC and ETH both have momentum in their sails, reclaiming key levels US$24K and US$2K, respectively. However, the surge has driven ETH into short-term overbought territory based on the 14-day Relative Strength Indicator (RSI), with BTC closing in as well.

Price Movements

News Highlights

- Ethereum’s final testnet merge on Goerli was launched.

- Crypto.com obtains Electronic Financial Transactions Act and Virtual Asset Service Provider registration in South Korea by acquiring PnLink Co., Ltd and OK-BIT Co., Ltd.

- Coinbase’s credit rating gets cut by S&P to BB from BB+.

- BlackRock launches a spot Bitcoin private trust for U.S. institutional clients.

Catalyst Calendar

Disclaimer:

The information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.

The brands and the logos appearing in this report are registered trademarks of their respective owners.

Author

Research and Insights Team

Get fresh market updates delivered straight to your inbox:

Be the first to hear about new insights:

Share with Friends

Related Articles

DeFi & L1L2 Weekly — 🤝 Crypto.com and Canary Capital launched the Canary CRO Trust; JPMorgan settled a tokenised US Treasury fund on-chain with Ondo Finance and Chainlink

🚀 Global crypto owners reached 700 million in April; Crypto.com obtained the restricted dealer registration in Canada

NFT & Gaming — 💰 Loaded Lions: Mane City Season 3 started with an initial US$20,000 prize pool; Doodles launched its ecosystem token, DOOD

Ready to start your crypto journey?

Get your step-by-step guide to setting upan account with Crypto.com

By clicking the Submit button you acknowledge having read the Privacy Notice of Crypto.com where we explain how we use and protect your personal data.