DeFi & L1L2 Weekly – 💸 Solana allocates 100% of priority fees to validators; Nomura explores stablecoin issuance in Japan

Solana passes a proposal to allocate all priority fees to validators. Nomura explores stablecoin issuance in Japan. Maple Finance launches Syrup providing institutional yield.

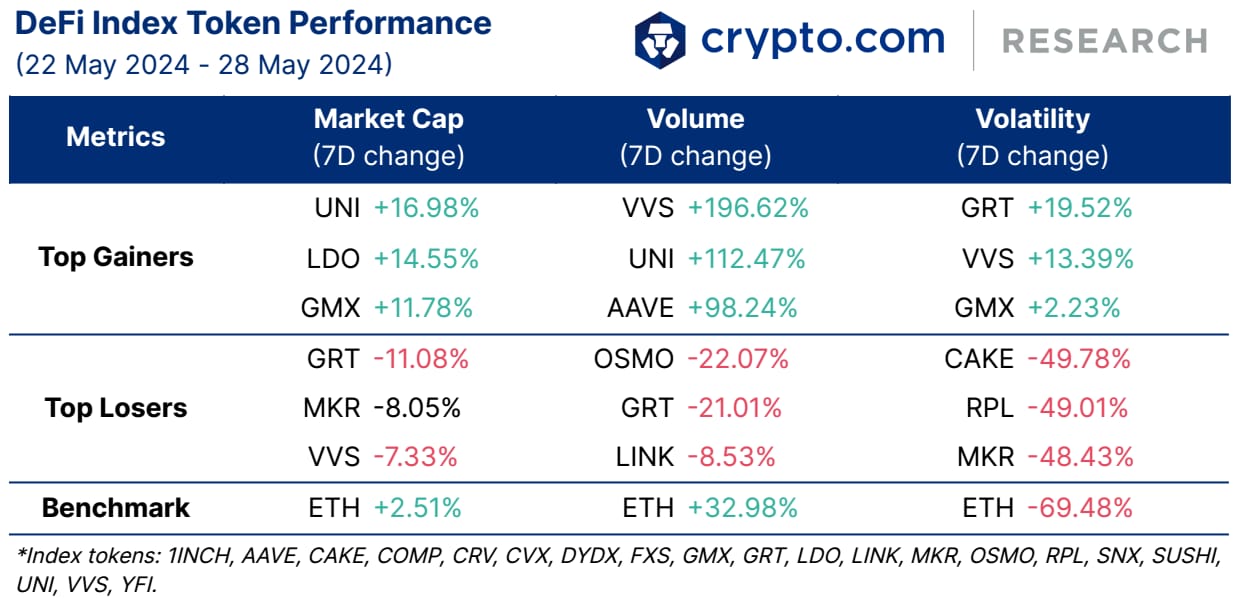

Weekly DeFi Index

This week’s market capitalisation and volume indices were positive at +5.20%, +14.30%, respectively, while volatility was negative at -37.49%.

Check the latest prices on Crypto.com/Price

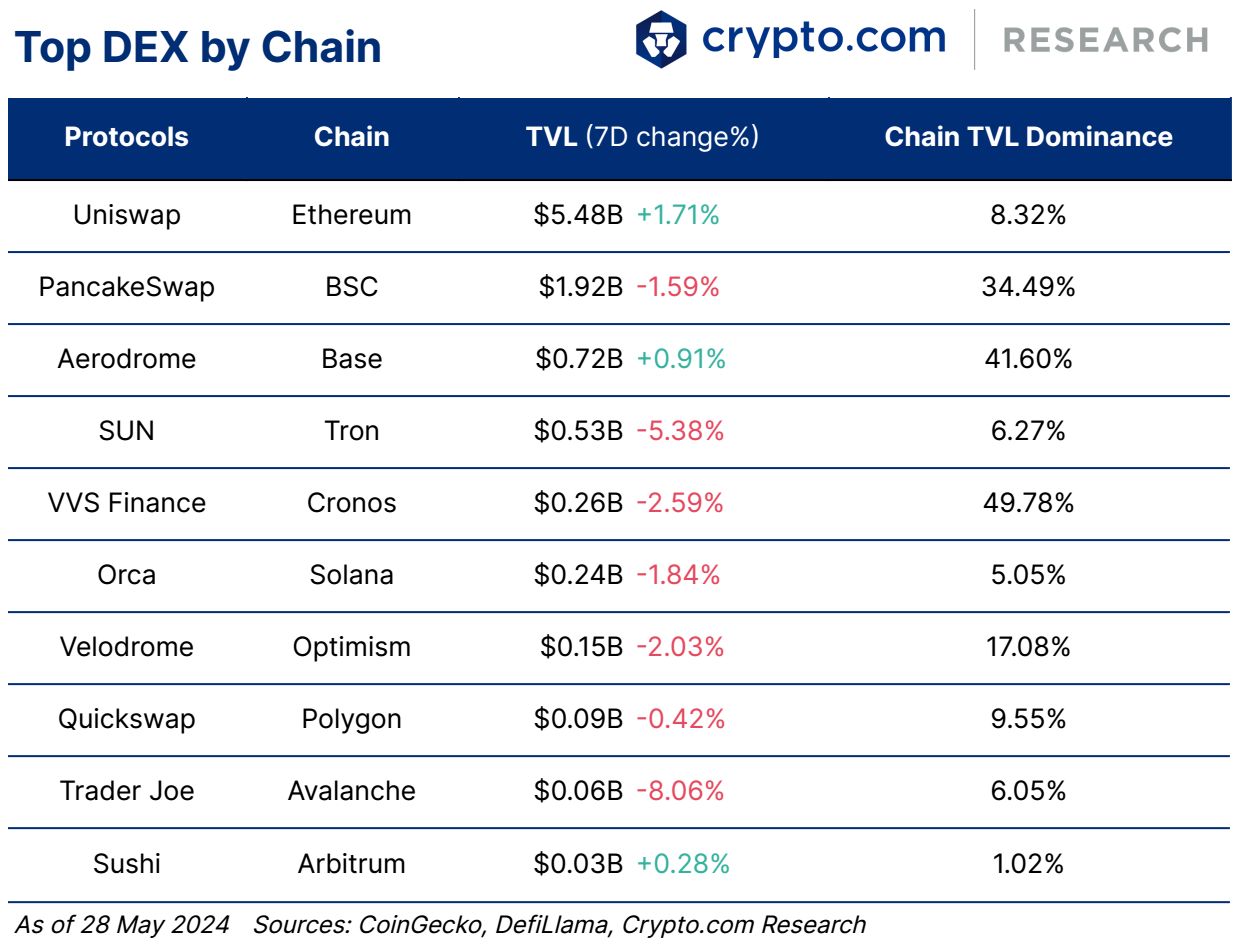

- Uniswap Foundation is sharing its financial details as it prepares for a community vote on Uniswap’s fee model while also gearing up for a legal battle with the SEC over the regulatory status of Uniswap’s tokens:

- As of the end of Q1 2024, the Uniswap Foundation held US$41.41 million in fiat and stablecoins, as well as 730,000 UNI tokens. The fiat and stablecoins are designated for grants and operations, while the UNI tokens are reserved for employee awards.

- The upcoming community vote will determine if some rewards will be shifted away from Uniswap’s liquidity providers and towards UNI token holders instead. Prior polls indicate the community is likely to approve this change.

- The Uniswap Foundation is also preparing to fight the U.S. Securities and Exchange Commission (SEC), which recently issued the foundation a Wells notice alleging that Uniswap’s UNI and LP tokens violate securities laws. The foundation disputes the SEC’s claims and argues it does not have jurisdiction over Uniswap.

Chart of the Week

Solana validators approved a proposal known as SIMD-0096 that allocates 100% of priority fees to the validators. Prior to this change, priority fees on Solana – optional fees users pay to prioritise their transactions – were split evenly, with 50% going to validators as rewards and 50% being burned to help control SOL’s annual inflation rate of 1.5% in the long-term. Currently, the inflation rate of SOL is around 4.3%.

This move is seen as beneficial to validators, as they will receive a larger share of the revenue. However, it also means there will be less deflationary pressure on SOL. Solana co-founder Anatoly Yakovenko addressed concerns about the change to priority fee allocation. He stated that the current system required users to pay double the priority fee, which goes entirely to validators and is not burned. He described the priority fee burn as a ‘bug’ in the system.

News Highlights

- Japanese banking giant Nomura and its digital asset arm Laser Digital have partnered with Japan-based GMO Internet Group to explore the issuance of yen-denominated and US dollar-denominated stablecoins in Japan.

- The Ethereum Foundation is set to introduce a formal conflict of interest policy after community backlash over two prominent researchers from the Foundation having advisory roles and token allocations from the EigenLayer project.

- Friend.tech‘s co-founder known as ‘Racer’ publicly expressed a desire to migrate the project off of the Base network. The price of Friend.tech‘s token (FRIEND) fell sharply, dropping over 20% after the post.

- Maple Finance, an uncollateralised lending protocol for institutional players, has launched a new DeFi protocol called Syrup that allows users to permissionlessly lend USDC to institutions. With Syrup, users can earn yield by depositing USDC and receiving liquidity provider tokens (syrupUSDC) in return. The USDC deposited is then used to fund secured loans to major institutions in crypto.

- Taiko, an Ethereum-based Layer 2 (L2) rollup, has launched on the mainnet. Taiko positions itself as an Ethereum-equivalent (Type 1) zkEVM with maximal compatibility with Ethereum’s core architecture.

- Starknet, an L2 blockchain, developed a zero-knowledge Ethereum Virtual Machine (zkEVM) called Kakarot. Kakarot will allow Starknet to become EVM-compatible, enabling developers to use Solidity to build on the Starknet network.

- Lending protocol AAVE planned to launch its own blockchain network after the completion of Aave’s V4 upgrade. The V4 upgrade for Aave is currently in development, and the launch of the new Aave blockchain could happen as early as next year.

- The Ethereum Name Service (ENS) is planning to migrate to a Layer 2 network as part of an update called ENSv2. This aims to lower gas fees and improve transaction speeds compared to operating on the Ethereum mainnet. The proposed ENSv2 will introduce a hierarchical registry system for managing .eth domain names, allowing name holders to manage subdomains and configure resolvers.

Recent Research Reports

|  |  |

| Alpha Navigator: Quest for Alpha [April 2024] | Expanding Ethereum’s Frontier: Restaking And EigenLayer’s Ecosystem | Tokenisation of RWAs & Yield-Bearing Stablecoins |

- Alpha Navigator: Quest for Alpha [April 2024]: Asset classes were mostly down in April. Cryptocurrency led the drop. US fighting inflation while ECB signals potential rate cuts.

- Expanding Ethereum’s Frontier: Restaking And EigenLayer’s Ecosystem (An Analysis of Restaking Dynamics): EigenLayer pioneers the ETH restaking narrative, driving the liquid restaking market to grow to $8 billion TVL. This report delves into EigenLayer’s ecosystem, its restaking mechanism, and the newly launched EIGEN token.

- Tokenisation of RWAs & Yield-Bearing Stablecoins: RWA tokenisation signifies a bridge between TradFi and the digital asset space. We explore the tokenisation of securities and its application in yield-bearing stablecoins, which have both gained much attention recently.

Recent University Articles

|  |  |

| 10 Most Popular Layer-1 Tokens of 2024 | What Is the Theta Crypto Token and How Does It Work? | What Is Offline Staking and How Does It Work? |

- 10 Most Popular Layer-1 Tokens of 2024: L1 blockchains form the backbone of the cryptocurrency space. Here’s an overview of the most important L1 crypto tokens to know in 2024.

- What Is the Theta Crypto Token and How Does It Work?: Theta Network has drawn big tech into the crypto space, with partnerships including Google, Samsung, and Sony. Here’s how the Theta crypto token (THETA) works.

- What Is Offline Staking and How Does It Work?: Did you know that you can keep your tokens in cold storage and still stake them? Here’s how offline staking works.

We’re all ears.

Your feedback has always helped us provide insightful crypto market trends. Tell us how we can improve this newsletter further by taking a quick survey below (it will only take less than a minute). Thank you!

Author

Research and Insights Team

Disclaimer

The information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report, nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.

The brands and the logos appearing in this report are registered trademarks of their respective owners.

Share with Friends

Related Articles

₿ US-based entities hold 65% more BTC reserves than non-US entities; Crypto.com launched stocks and ETFs trading in the US

₿ US-based entities hold 65% more BTC reserves than non-US entities; Crypto.com launched stocks and ETFs trading in the US

₿ US-based entities hold 65% more BTC reserves than non-US entities; Crypto.com launched stocks and ETFs trading in the US

DeFi & L1L2 Weekly — 📈 Weekly active addresses on L2s were 5x higher than on Ethereum; Ethena plans to launch iUSDe in February

DeFi & L1L2 Weekly — 📈 Weekly active addresses on L2s were 5x higher than on Ethereum; Ethena plans to launch iUSDe in February

DeFi & L1L2 Weekly — 📈 Weekly active addresses on L2s were 5x higher than on Ethereum; Ethena plans to launch iUSDe in February

📈 US spot BTC and ETH ETFs saw a $35 billion and $2.7 billion net inflow in 2024, respectively; Crypto.com signed an MoU with Dubai Islamic Bank

📈 US spot BTC and ETH ETFs saw a $35 billion and $2.7 billion net inflow in 2024, respectively; Crypto.com signed an MoU with Dubai Islamic Bank

📈 US spot BTC and ETH ETFs saw a $35 billion and $2.7 billion net inflow in 2024, respectively; Crypto.com signed an MoU with Dubai Islamic Bank

Ready to start your crypto journey?

Get your step-by-step guide to setting upan account with Crypto.com

By clicking the Submit button you acknowledge having read the Privacy Notice of Crypto.com where we explain how we use and protect your personal data.