DeFi & L1L2 Weekly (26/07/2023)

Wormhole Foundation launches Gateway for Cosmos appchains. Optimism moves forward with two proposals to add ZK-proofs. CLabs plans to migrate Celo blockchain to Ethereum Layer-2.

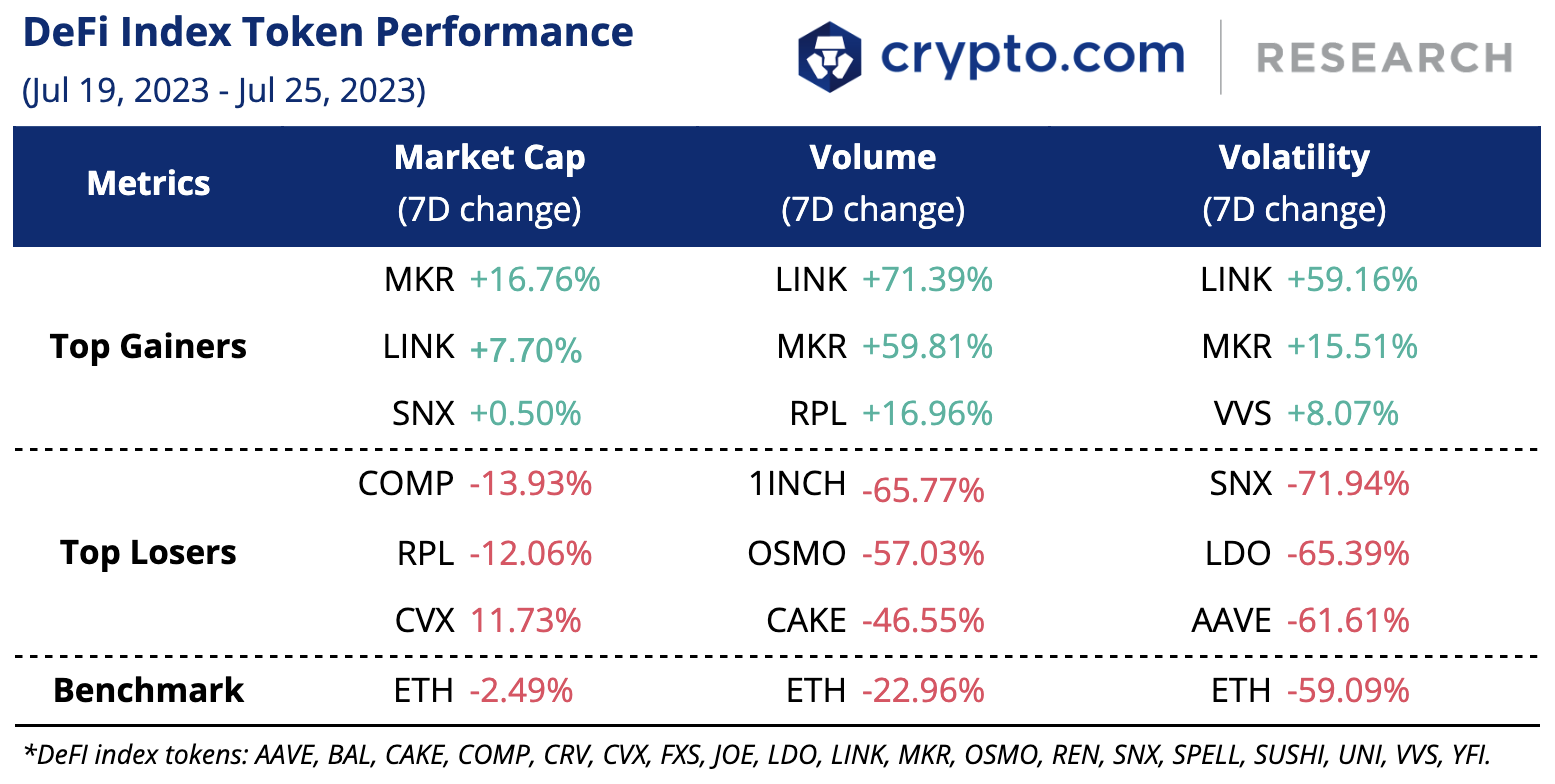

Weekly DeFi Index

This week’s market cap, volume, and volatility indices were negative at -0.11%, -12.71%, and -35.54%, respectively.

Chart of the Week

Real-world assets (RWAs) are tangible and intangible assets that can be tokenised or represented as digital tokens on the blockchain. The concept of RWA tokenisation has gained traction over the past few years, and its potential today can be seen in both the traditional finance (TradFi) and decentralised finance (DeFi) spaces.

The number of transactions for key RWA categories in the week of 10 to 17 July reached nearly 480,000. Leading the pack are the fixed-income and equity subcategories.

- MakerDAO’s (MKR) token buyback programme called Smart Burn Engine went live on Wednesday. It is designed to periodically remove MKR tokens from the market and allocate excess DAI stablecoins from Maker’s surplus buffer to purchase MKR from a UniSwap pool.

News Highlights

- As part of the upcoming Polygon 2.0 upgrade, Polygon Labs introduced a new governance framework prioritising decentralisation. The framework will focus on protocol governance, system smart contracts governance, and community treasury governance.

- Ethereum Layer-2 scaling solution Optimism is moving forward with two proposals to add ZK-proofs to OP chains. The proposals, put forward by O(1) Labs and RISC Zero, aim to enable secure and efficient cross-chain communication between layers and directly between OP chains.

- On Friday, the Wormhole Foundation launched Gateway, the first application-specific blockchain (appchain) that connects liquidity and users from more than 20 different blockchains to any Cosmos appchain.

- The dYdX Foundation unveiled the public testnet for its latest iteration. The forthcoming v4 version aims to remove the limitations that come with utilising a centralised order book and matching system, and is expected to achieve full decentralisation.

- CLabs, the development team behind the carbon-negative, mobile-first blockchain Celo, proposed to transition from an EVM-compatible Layer-1 blockchain to an Ethereum Layer-2 solution. The Layer-2 protocol will initially leverage OP Stack during the migration and will feature a ”decentralised sequencer powered by Celo’s existing validator set” and “a design retaining Celo’s one-block finality.”

- Crypto payment platform Alphapo allegedly experienced a breach in its hot wallet. Alphapo has yet to confirm the details of the incident. The hack is estimated to have caused losses worth over US$60 million to date (previously reported at about $31 million), according to a 25 July report from on-chain sleuth ZachXBT.

- DeFi protocol Conic Finance lost approximately $3.2 million worth of WETH from two separate hacking incidents in the past week. The first incident was considered a reentrancy attack that exploited a vulnerability in Curve V2 pools, followed by another exploit a few hours later, which drained around $300,000 from the crvUSD Omnipool.

- Era Lend, a decentralised lending protocol operating on zkSync, was reported to have suffered from an exploit which resulted in a loss of about $3.4 million. By taking advantage of a faulty price oracle, the attacker exploited a read-only reentrancy vulnerability.

Recent Research Reports

| Research Roundup Newsletter [June 2023] | The Development of ZK Rollups | Layer-0: Infrastructure For Customised Blockchains |

- Research Roundup Newsletter [June 2023]: We present to you our latest issue of Research Roundup, featuring trending market insights in June, charts of the month, and our latest research exploring ZK rollups and Layer-0 protocols.

- The Development of ZK Rollups: Zero-knowledge rollups (ZK rollups) are still in their nascent stage. However, as the technology evolves, various methods to achieve compatibility with the Ethereum Virtual Machine (EVM) have emerged.

- Layer-0: Infrastructure for Customised Blockchains: Layer-0 protocols are the infrastructure that customised Layer-1 blockchains can be built on. We explore notable projects like Cosmos, Polkadot, Avalanche, LayerZero, and zkLink.

- Alpha Navigator: Quest for Alpha [June 2023]: Asset classes finished the first half of 2023 strongly, with crypto in the lead. Decelerating US inflation readings could ease market concerns for the time being, while BTC options implied volatilities remain muted.

Recent University Articles

| Crypto and IoT — How They Work Together, Plus IoT Tokens to Know | What Are Reddit’s MOON and BRICK Tokens? | What Is XRP (Ripple)? |

- Crypto and IoT — How They Work Together, Plus IoT Tokens to Know: Learn how the Internet of Things (IoT) and blockchain are working together to revolutionise the way we trade digital assets and tokens.

- What Are Reddit’s MOON and BRICK Tokens?: MOON and BRICK are examples of Reddit’s Community Points system. Learn what they are, what they’re used for, and how to buy them.

- What Is XRP (Ripple)?: One of the largest cryptocurrencies by market capitalisation, XRP is used by financial institutions, corporations, and end users across the globe for fast payments. Read on to learn more about this altcoin.

We’re all ears.

Your feedback has always helped us provide insightful crypto market trends. Tell us how we can improve this newsletter further by taking a quick survey below (it will only take less than a minute). Thank you!

Author

Research and Insights Team

Disclaimer

The information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.

The brands and the logos appearing in this report are registered trademarks of their respective owners.

Share with Friends

Related Articles

DeFi & L1L2 Weekly — 🤝 Crypto.com and Canary Capital launched the Canary CRO Trust; JPMorgan settled a tokenised US Treasury fund on-chain with Ondo Finance and Chainlink

🚀 Global crypto owners reached 700 million in April; Crypto.com obtained the restricted dealer registration in Canada

NFT & Gaming — 💰 Loaded Lions: Mane City Season 3 started with an initial US$20,000 prize pool; Doodles launched its ecosystem token, DOOD

Ready to start your crypto journey?

Get your step-by-step guide to setting upan account with Crypto.com

By clicking the Submit button you acknowledge having read the Privacy Notice of Crypto.com where we explain how we use and protect your personal data.