DeFi & L1L2 Weekly – 🏇 The landscape of liquid staking on Solana has shifted; DTCC & Chainlink completed a pilot program

The landscape of liquid staking on Solana has shifted. ZkSync announces the final upgrade before it hands over the governance to the community. LayerZero concluded the sybil self-reporting phase.

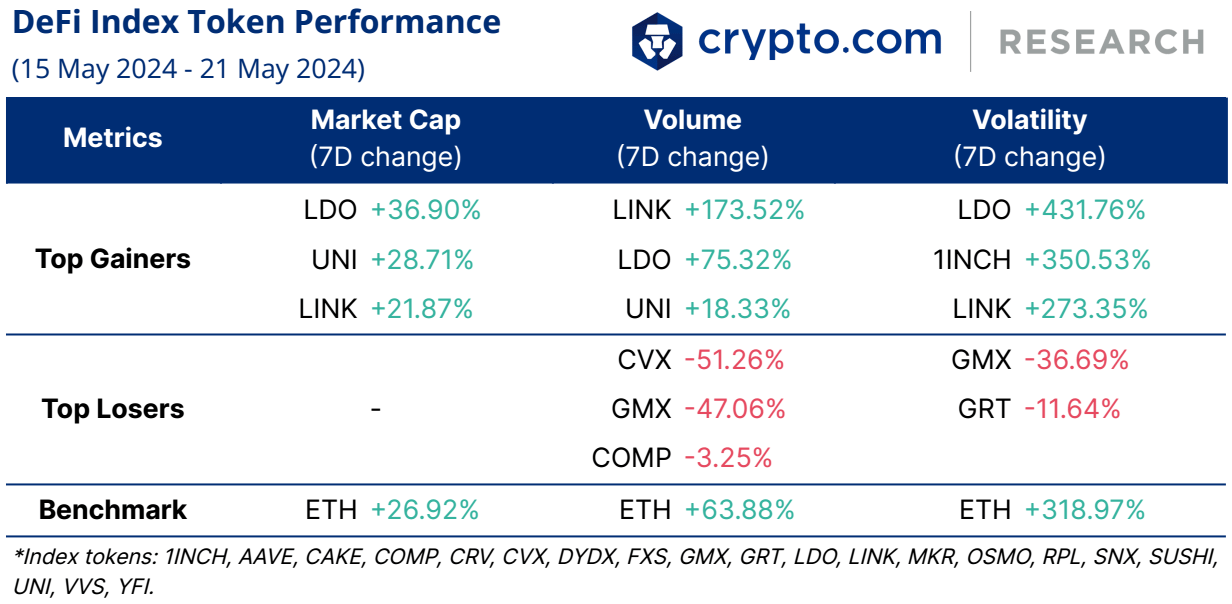

Weekly DeFi Index

This week’s market capitalisation, volume, and volatility indices were all positive at +24.25%, +69.40%, and +242.68% respectively. The surge of all indices was led by Lido (LDO) and Chainlink (LINK).

- Lido (LDO) price experienced a remarkable surge following the resolution of a security breach involving one of its node operators, Numic. Validator operations were not affected, and no user funds have been affected.

- The world’s largest settlement system, the Depository Trust and Clearing Corporation (DTCC), and blockchain oracle Chainlinkcompleted a pilot program with several major US banks to increase the tokenisation of traditional finance fund data. The Smart NAV Pilot program aimed to standardise a method for providing net asset value (NAV) data of funds across blockchains using Chainlink’s Cross-Chain Interoperability Protocol (CCIP).

Chart of the Week

The landscape of liquid staking on Solana has changed since 2023 and the competition among liquid staking tokens (LST) protocols is exhibiting a ‘winner-take-all’ pattern. Currently, Jito (jitoSOL) dominates the LST market with almost half (48%) of the share due to its strategic use of Maximal Extractable Value (MEV). New players like BlazeStake (bSOL) also showed significant growth, possessing 12% of the market share. Meanwhile, the traditional player Marinade (mSOL) has fallen consistently but still maintains a 28% share.

However, liquid staking on Solana only accounts for 5.3% of the total staking supply, lagging behind Ethereum (32.7%), where liquid staking is more widely adopted. This is due to differences in the staking mechanisms and value propositions between the two blockchains.

News Highlights

- ZkSync, an Ethereum layer-2 network, announced that the upcoming v24 upgrade will be the final protocol upgrade before it hands over network governance to the community. This transition is expected to be completed by the end of June 2024. ZkSync has hinted that it will be conducting a governance token airdrop by the end of June 2024 as part of this decentralisation process. Additionally, according to The Block, ZkSync is also planning a token generation event (TGE) this week.

- Interoperability protocol LayerZero concluded the sybil self-reporting phase to address sybil activity, or ‘airdrop farming’. After initially flagging over two million potential sybil addresses, LayerZero refined the criteria and identified 803,093 potential sybil addresses. These sybil addresses will get 15% of their planned token allocation, with the rest redistributed to eligible users.

- MakerDAO founder Rune Christensen announced that the organisation will launch a new stablecoin called ‘PureDai’ in the next few years. PureDai will be fully decentralised and operate exclusively on the Ethereum blockchain, using ETH and stETH as collateral rather than fiat-backed assets. PureDai will have a free-floating peg, meaning it may not be pegged to the US dollar like MakerDAO’s current Dai stablecoin.

- Solayer, a startup building a Solana-based restaking protocol similar to EigenLayer, opened its invite-only deposit period on 16 May. The initial deposit period was capped at US$20 million, which was reached within just 45 minutes. Users could deposit native SOL tokens or liquid staking products like mSOL, bSOL, JITOSOL, and INF.

- Synthetix‘s decentralised stablecoin, sUSD, fell below its $1 peg, dipping as low as $0.92 on 17 May due to increased selling pressure on decentralised exchanges. The stablecoin later recovered the peg.

- Pump.fun, a platform that enables tokens launches without seed liquidity, was attacked on 16 May in an apparent flash loan attack and paused all trading. The Pump.fun team stated the bonding curve contracts on the platform were compromised resulting in a loss of at least 12,000 SOL (approximately $2 million), according to the research from Wintermute.

Recent Research Reports

|  |  |

| Alpha Navigator: Quest for Alpha [April 2024] | Expanding Ethereum’s Frontier: Restaking And EigenLayer’s Ecosystem | Tokenisation of RWAs & Yield-Bearing Stablecoins |

- Alpha Navigator: Quest for Alpha [April 2024]: Asset classes were mostly down in April. Cryptocurrency led the drop. US fighting inflation while ECB signals potential rate cuts.

- Expanding Ethereum’s Frontier: Restaking And EigenLayer’s Ecosystem (An Analysis of Restaking Dynamics): EigenLayer pioneers the ETH restaking narrative, driving the liquid restaking market to grow to $8 billion TVL. This report delves into EigenLayer’s ecosystem, its restaking mechanism, and the newly launched EIGEN token.

- Tokenisation of RWAs & Yield-Bearing Stablecoins: RWA tokenisation signifies a bridge between TradFi and the digital asset space. We explore the tokenisation of securities and its application in yield-bearing stablecoins, which have both gained much attention recently.

Recent University Articles

- What Is Offline Staking and How Does It Work?: Did you know that you can keep your tokens in cold storage and still stake them? Here’s how offline staking works.

- What Is Bitcoin Mining and How Does It Work?: BTC is mined on a Proof of Work network — here’s how the process works in detail.

- What Is Decentralised Compute? Plus the Most Popular Projects: Decentralised compute is a rising crypto narrative. Learn more about how decentralised compute works and the most popular projects.

We’re all ears.

Your feedback has always helped us provide insightful crypto market trends. Tell us how we can improve this newsletter further by taking a quick survey below (it will only take less than a minute). Thank you!

Author

Research and Insights Team

Disclaimer

The information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report, nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.

The brands and the logos appearing in this report are registered trademarks of their respective owners.

Share with Friends

Related Articles

₿ US-based entities hold 65% more BTC reserves than non-US entities; Crypto.com launched stocks and ETFs trading in the US

₿ US-based entities hold 65% more BTC reserves than non-US entities; Crypto.com launched stocks and ETFs trading in the US

₿ US-based entities hold 65% more BTC reserves than non-US entities; Crypto.com launched stocks and ETFs trading in the US

DeFi & L1L2 Weekly — 📈 Weekly active addresses on L2s were 5x higher than on Ethereum; Ethena plans to launch iUSDe in February

DeFi & L1L2 Weekly — 📈 Weekly active addresses on L2s were 5x higher than on Ethereum; Ethena plans to launch iUSDe in February

DeFi & L1L2 Weekly — 📈 Weekly active addresses on L2s were 5x higher than on Ethereum; Ethena plans to launch iUSDe in February

📈 US spot BTC and ETH ETFs saw a $35 billion and $2.7 billion net inflow in 2024, respectively; Crypto.com signed an MoU with Dubai Islamic Bank

📈 US spot BTC and ETH ETFs saw a $35 billion and $2.7 billion net inflow in 2024, respectively; Crypto.com signed an MoU with Dubai Islamic Bank

📈 US spot BTC and ETH ETFs saw a $35 billion and $2.7 billion net inflow in 2024, respectively; Crypto.com signed an MoU with Dubai Islamic Bank

Ready to start your crypto journey?

Get your step-by-step guide to setting upan account with Crypto.com

By clicking the Submit button you acknowledge having read the Privacy Notice of Crypto.com where we explain how we use and protect your personal data.