Tutte le tue crypto, un'unica piattaforma

Compra, vendi e fai trading in sicurezza su BTC, ETH, CRO e oltre 400 criptovalute in EUR

Inizia ora

Progettato per le crypto, pensato per l’Italia

App Store Rating

Google Play Rating

Oltre 150 milioni

di utenti nel mondo

La piattaforma di fiducia per utenti e appassionati di crypto dal 2016

Licenza MiCA,

EMD e MiFID II

Autorizzati come Crypto-Asset Service Provider (CASP), Electronic Money Institution (EMI) e Investment Firm (CIF)

Depositi in EUR

senza commissioni

Deposita EUR all’istante tramite SEPA o Apple/Google Pay

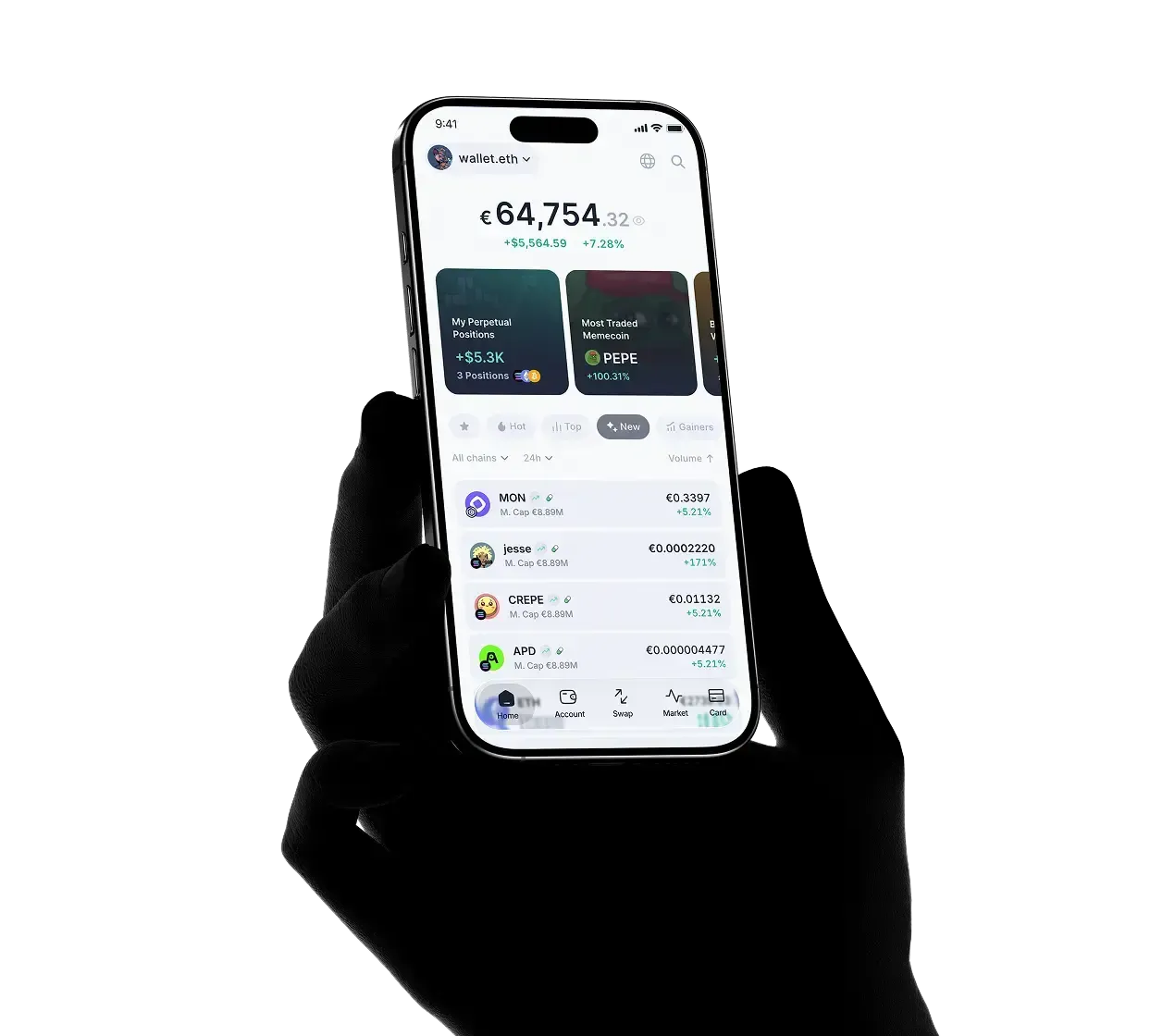

Monitora in tempo reale i prezzi crypto,

i movimenti di mercato e i token di tendenza

Monitora in tempo reale i prezzi crypto,

i movimenti di mercato e i token di tendenza

Vedi i prezzi in tempo reale

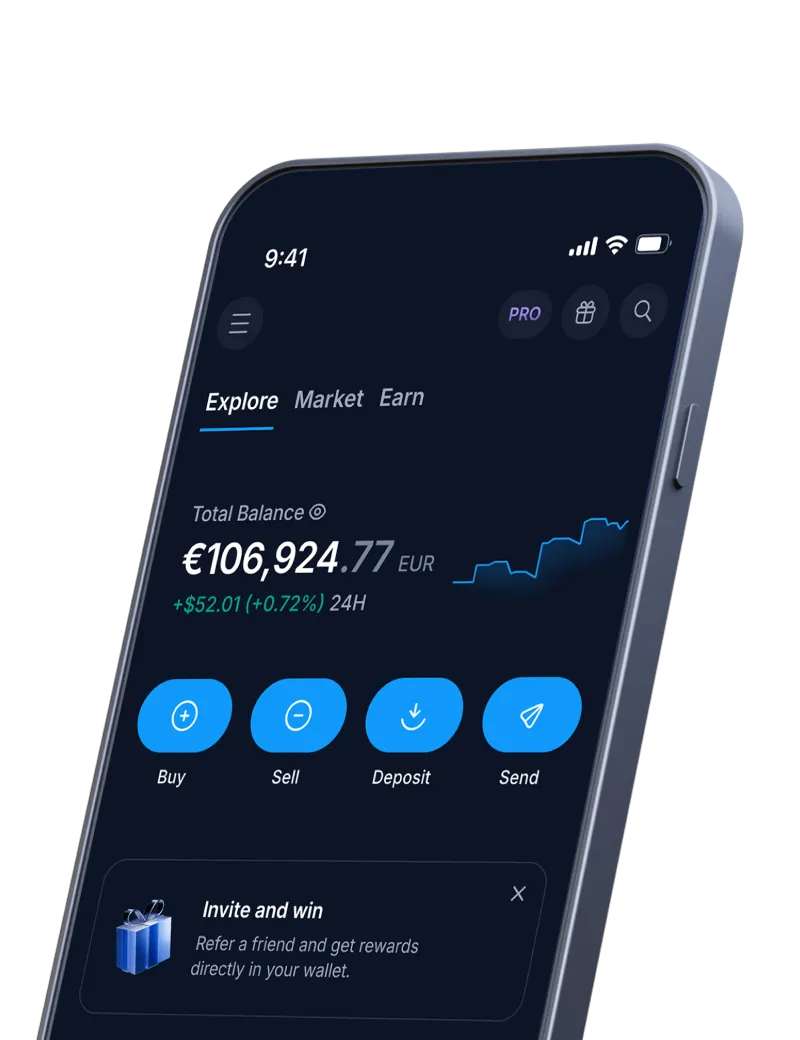

Crypto.com App

Il tuo percorso nel mondo crypto inizia qui

Compra, vendi e fai trading in modo semplice e a commissioni ultra-competitive

BTC, ETH, CRO e oltre 400 criptovalute

Compra, vendi e fai trading in EUR

Account Protection Programme

Fino a 250.000 USD di protezione contro transazioni non autorizzate

Commissioni di trading molto basse

Quando acquisti crypto con la carta

Sicurezza al primo posto

Leader di settore per licenze e certificazioni

Carta Visa Crypto.com

Ottieni fino al 5% in ricompense CRO su tutti i tuoi acquisti

Scegli la tua carta

Earn e Staking non sono regolamentati ai sensi del Regolamento 2023/1114 relativo ai mercati delle cripto-attività ("MiCA"), come implementato a Malta dal Markets in Crypto Assets Act.

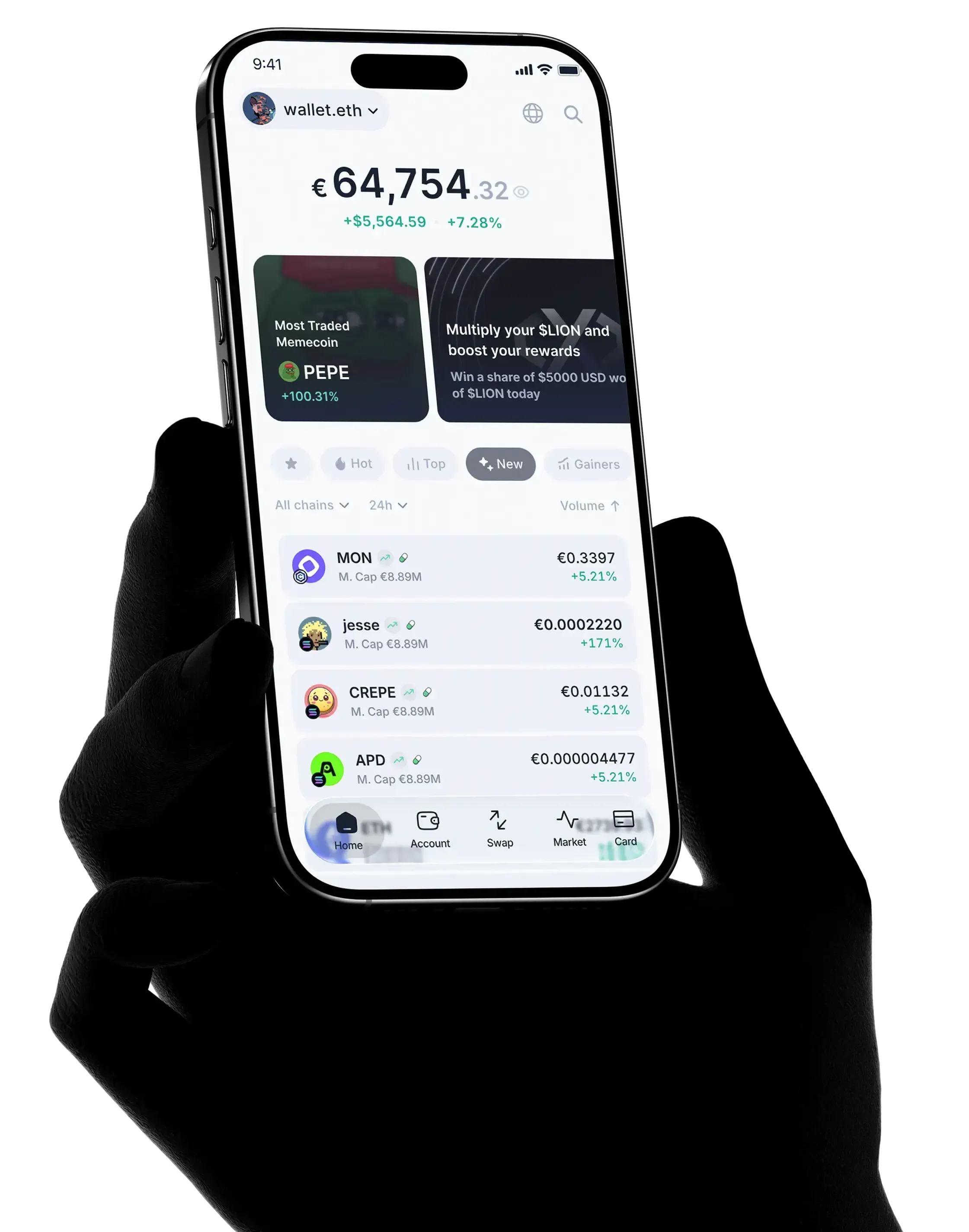

Onchain Wallet

Il tuo accesso onchain di fiducia

Mantieni il pieno controllo delle tue crypto e gestisci i tuoi asset in totale sicurezza

Self-custody totale

Mantieni sempre il controllo delle tue chiavi private e dei tuoi asset

Accesso multichain

Connettiti e interagisci senza difficoltà su più blockchain

Integrazione DeFi

Accedi a centinaia di DApp e protocolli da un unico punto

Scegli come accedere

Dall’app mobile o tramite l’estensione del browser

In partnership con brand e istituzioni leader per rendere le crypto alla portata di tutti

FAQ

La criptovaluta è una valuta digitale o virtuale che opera su una tecnologia ledger distributed denominata blockchain e utilizza la crittografia per garantire la sicurezza. È decentralizzata e opera indipendentemente da una banca centrale.

A differenza delle valute tradizionali, le criptovalute non sono garantite da un bene fisico o da un governo e il loro valore è determinato dalla domanda e dall'offerta del mercato. Inoltre, possono essere utilizzate per acquistare beni e servizi, trasferire fondi e fare trading sui mercati. Le criptovalute più popolari includono Bitcoin, Ethereum, Litecoin, Ripple e Cronos.

Molte crypto, come Bitcoin, vengono create attraverso un processo chiamato mining, che prevede la risoluzione di complesse equazioni matematiche per convalidare e registrare le transazioni su una blockchain. Questo meccanismo è anche chiamato Proof of Work (PoW). Un altro meccanismo di consenso diventato sempre più popolare, dato che offre una maggiore efficienza dal punto di vista energetico, è la Proof of Stake (PoS). A differenza del mining, la PoS si affida ai partecipanti alla rete che convalidano le transazioni. Ethereum, la seconda criptovaluta più grande, utilizza ora questo meccanismo di consenso.

Ci sono diversi modi per acquistare criptovalute, tra cui:

Servizi di intermediazione: i broker di criptovalute consentono agli utenti di acquistare e vendere criptovalute in modo semplice e intuitivo. Un esempio è l'App Crypto.com, scelta da oltre 80 milioni di utenti e disponibile su Apple App Store e Google Play Store.

Exchange di criptovalute: queste piattaforme online permettono agli utenti di acquistare, vendere e scambiare criptovalute utilizzando valuta fiat o altre criptovalute.

Mercati peer-to-peer (P2P): sono piattaforme dove acquirenti e venditori possono scambiare direttamente criptovalute senza l'intervento di un exchange di terze parti. Questo sistema è noto anche come DeFi, abbreviazione di finanza decentralizzata. È possibile accedere a più mercati P2P tramite l'app Crypto.com Onchain.

È importante fare ricerche approfondite e scegliere una piattaforma affidabile per acquistare e detenere criptovalute. Ad esempio, Crypto.com si impegna a garantire sicurezza e conformità normativa, con numerose certificazioni di sicurezza, registrazioni normative e licenze a livello globale, oltre a prove di riserva verificate.

Per acquistare criptovalute, segui questi passaggi generali:

Scegli una piattaforma di criptovalute, come l'App Crypto.com .

Crea un account sulla piattaforma scelta, fornendo le tue informazioni personali e completando la verifica dell'identità, conosciuta anche come procedura "Know Your Customer" (KYC).

Deposita valuta fiat o altre criptovalute nell'account appena creato. L'App Crypto.com supporta bonifici bancari, carte di credito/debito e trasferimenti di criptovalute, a seconda della giurisdizione.

Accedi alla sezione "Acquista" dell'App Crypto.com e seleziona la criptovaluta che desideri acquistare.

Inserisci la quantità di criptovaluta da acquistare e conferma la transazione.

La criptovaluta verrà depositata nel tuo crypto wallet. Da lì, potrai trasferirla ad altri wallet o riconvertirla in valuta fiat e trasferirla sul tuo conto bancario.

È importante fare ricerche approfondite e scegliere una piattaforma affidabile per acquistare e detenere criptovalute. Ad esempio, Crypto.com si impegna a garantire sicurezza e conformità normativa, con numerose certificazioni di sicurezza, registrazioni normative e licenze globali, oltre a prove di riserva verificate.

Per fare trading di criptovaluta, segui questi passaggi generali:

Scegli un exchange di criptovaluta che supporti il trading nella tua giurisdizione.

Crea un account sulla piattaforma scelta ed esegui la verifica dell'identità, nota come KYC.

Deposita fondi sul conto appena creato utilizzando un metodo di pagamento supportato.

Vai alla sezione trading della piattaforma e seleziona la coppia di criptovalute da scambiare.

Scegli se acquistare o vendere la criptovaluta e inserisci l'importo da scambiare.

Imposta il prezzo preferito e il tipo di ordine. Esistono diversi tipi di ordini, inclusi ordini market, ordini limite, ordini stop e opzioni crypto, che consentono agli utenti di acquistare o vendere a un prezzo specifico o a determinate condizioni.

Invia l'ordine i trading e attendi che venga eseguito. A seconda delle condizioni di mercato, lo scambio può essere eseguito immediatamente, o potrebbe richiedere del tempo per l'esecuzione.

Monitora il trading e regola le strategie secondo necessità.

È fondamentale notare che il trading di criptovaluta comporta rischi ed è importante investire solo quello che puoi permetterti di perdere.

Esistono diversi modi per guadagnare criptovalute, tra cui:

Mining: il mining di criptovalute prevede l'utilizzo di hardware informatico specializzato per risolvere complesse equazioni matematiche che convalidano le transazioni su una rete blockchain. I miner di successo vengono ricompensati con criptovalute appena coniate.

Staking/Lockup: lo staking e i lockup comportano il mantenimento o il blocco di una quantità di criptovalute in un wallet o su una piattaforma per supportare le operazioni della rete blockchain. Gli staker vengono ricompensati con nuove criptovalute per il loro contributo.

Trading: il trading di criptovalute consiste nell'acquisto e nella vendita di criptovalute su exchange o altre piattaforme di trading. Chi possiede una buona comprensione delle tendenze del mercato e prende decisioni di trading informate può ottenere profitti.

Airdrop: gli airdrop sono distribuzioni gratuite di criptovalute agli utenti che soddisfano determinati criteri o partecipano ad attività promozionali.

Progetti di criptovalute: alcuni progetti blockchain offrono ricompense o bounty per chi contribuisce al loro sviluppo o alla loro community. Questo può includere attività come il rilevamento di bug, i test o la creazione di contenuti.

Scopri di più sul mercato delle criptovalute su Crypto.com University.

Hai altre domande? Contattaci