What is PancakeSwap?

PancakeSwap is a decentralised exchange (DEX) and yield farming project that facilitates the trade of BEP20 tokens on BNB Chain. PancakeSwap employs an automated market maker (AMM) concept where users trade against a liquidity pool. Users contribute to these pools with their funds and deposit them into the liquidity pool, becoming liquidity providers (LP). With their LP tokens in the pool, they can earn trading fees from the protocol. CAKE, a BEP20 token, is PancakeSwap’s native governance token.

A brief history of PancakeSwap

PancakeSwap was created in September 2020 by a group of unknown developers. It is unique as it is built on Binance Smart Chain (now BNB Chain), which allows for quicker and cheaper transactions than Ethereum. When PancakeSwap launched, Ethereum was plagued by pricey and delayed transactions as DeFi's popularity skyrocketed in 2020, creating tremendous demand on the network and prohibitive transaction costs. At the time, almost all DeFi apps ran on Ethereum.

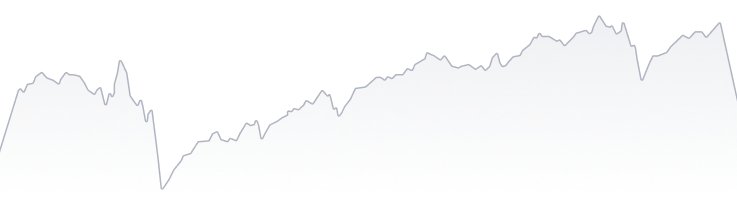

In addition to decreased network costs enabled by BNB Chain, PancakeSwap provided a lower swap charge of 0.2%, compared to the industry norm of 0.3%. This low-fee methodology led to PancakeSwap experiencing remarkable growth in trading volume and total value locked (TVL). In February 2021, it overtook AMM pioneer and Ethereum darling Uniswap to become one of the industry's leading DEXes by trade volume.

PancakeSwap's TVL increased dramatically in 2021 due to lower network costs, branding, and the introduction of new and creative services. PancakeSwap intends to broaden its scope to include prediction markets, lending and borrowing, and margin trading.

PancakeSwap reached a peak of US$7.8 billion in TVL on 3 May 2021. As of May 2022, the platform’s TVL is at around US$4 billion.

How PancakeSwap works

PancakeSwap is an automated market maker. AMMs do not use an order book to connect buyers and vendors. Instead, the platform uses LPs and advanced algorithms to connect these parties directly. AMMs improve speed and minimises slippage. As a result, many of today's leading platforms, such as Uniswap and SushiSwap, function as AMMs.

The token swap feature on PancakeSwap lets users exchange one BEP20 token for another using automated liquidity pools. LPs stake their tokens in 'Syrup Pools' to offer liquidity to the exchange. Users get FLIP (PancakeSwap Liquidity Provider) tokens, which you can stake in the 'farm' to generate CAKE tokens. Each Farm used by PancakeSwap has its own smart contract.

What is PancakeSwap (CAKE) used for?

PancakeSwap is an AMM, which means it is a decentralised liquidity protocol that allows the platform to work as a DEX. CAKE is the protocol’s native cryptocurrency. Users supply liquidity so that other users may swap tokens with ease.

Users can also stake their CAKE to earn various tokens that other projects have offered as incentives on the platform or stake their CAKE to earn SYRUP, which serves additional purposes such as a governance token and as a ticket in a lottery.