Your Crypto-native Custodian

Secure your digital assets with the industry leader in regulatory compliance, security, and privacy since 2016.

Optimised solutions for security and usability

Asset segregation

Client assets are stored in separate vaults with unique addresses for full transparency and auditability, ensuring they remain bankruptcy-remote from our operations.

Extensive asset coverage

Supporting the same comprehensive suite of tokens as the broader Crypto.com platform.

Dynamic policy engine

Flexibility to configure roles for team members, and set withdrawal limits on account and user level to meet your internal control requirements.

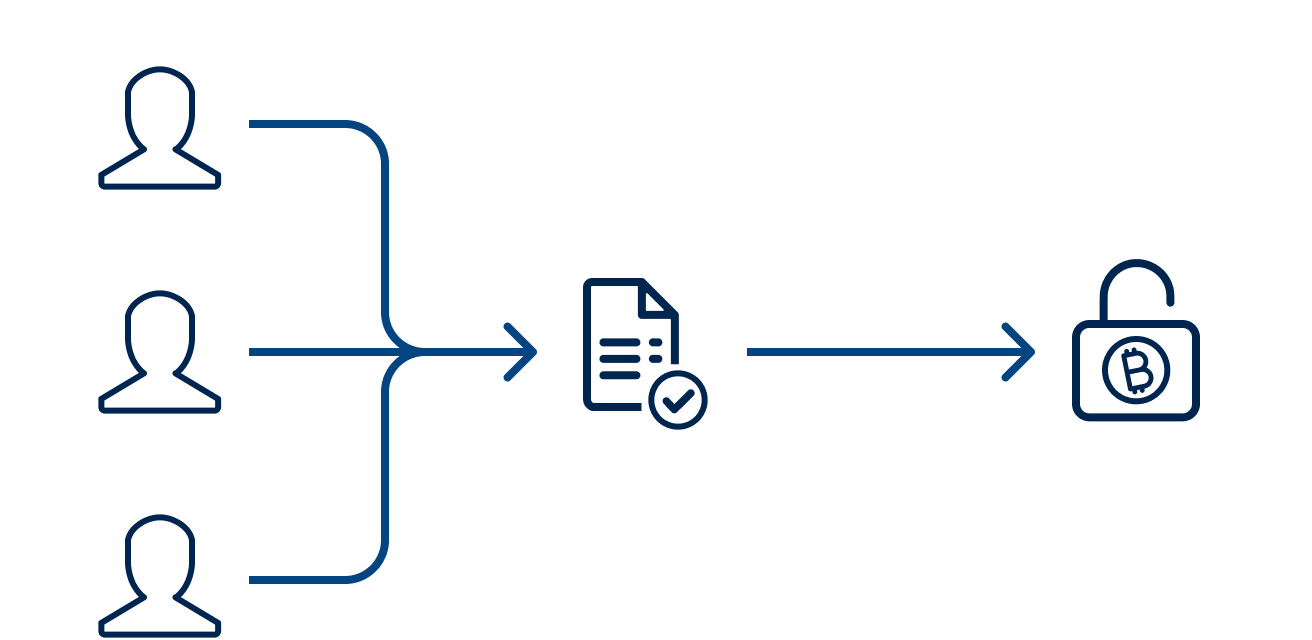

MPC implementation

A proprietary Multi-Party Computation (MPC) implementation, which secures private keys as part of a multi-layered security approach, protects user assets from even the most sophisticated attacks.

Collateral access for margin trading

Leverage custodied assets as collateral on select trading venues*, while earning yield.

Zero commingling on-chain yield

Access institutional-grade segregated custody staking with broad asset support on CRO, ETH, SOL, and many more.

Robust asset protection

Crypto.com Custody Europe service is offered by Foris DAX MT Limited, a Maltese entity holding a Crypto-Assets Service Provider license pursuant to the Markets in Crypto-Assets (MiCA) regulation from the Malta Financial Services Authority (MFSA).

Robust asset protection

Crypto.com Custody Europe service is offered by Foris DAX MT Limited, a Maltese entity holding a Crypto-Assets Service Provider license pursuant to the Markets in Crypto-Assets (MiCA) regulation from the Malta Financial Services Authority (MFSA).

Security certification

Our systems and processes undergo regular audits and are certified to meet international standards, including ISO/IEC 27001:2022, ISO/IEC 27701:2019, and ISO 22301:2019.

Key shares are fully encrypted at-rest with 512-bit Advanced Encryption Standard key and stored at backup devices in secure locations.

Layered infrastructure

Multiple controls in withdrawal workflow, plus multi-party computation (MPC) technology to protect private keys, mitigate the risk of a single point of failure.

Seamless integration

As part of Crypto.com’s end-to-end digital asset solutions strategy, Crypto.com Custody Europe users will soon be able to trade on the group’s industry-leading products, with their assets safe in client-segregated custodian wallets.

Increased capital efficiency

No pre-funding of trading accounts required; your capital is available for trading while remaining in a secure, yielding environment.

Segregated staking

Stake assets directly from your custodial wallets with 100% verifiable segregation on-chain.

Secure your digital assets with Crypto.com Custody

Secure your digital assets with Crypto.com Custody

Frequently Asked Questions

Have more questions? Contact Us

Disclaimer

* Staked assets may be posted as collateral in limited use cases. Please speak to your client representative to learn more.

The purpose of this website is solely to display information regarding the products and services available on Crypto.com Custody. It is not intended to offer access to any of such products and services. Please note that the availability of the products and services in relation to Crypto.com Custody is subject to jurisdictional limitations.

Foris DAX MT Limited, a company incorporated in Malta with Company registration number C 88392 and registered office at Level 7, Spinola Park, Triq Mikiel Ang Borg, SPK 1000, St. Julians, Malta, trading under the name Crypto.com is authorized as a Crypto-Asset Service Provider by the Malta Financial Services Authority pursuant to Regulation 2023/1114 on Markets in Crypto-Assets. Foris DAX MT Limited is authorised to provide the following services: 1. Exchange of crypto-assets for funds; 2. Exchange of crypto-assets for other crypto-assets; 3. Reception and transmission of orders for crypto-assets on behalf of clients; 4. Execution of orders for crypto-assets on behalf of clients; 5. Transfer services for crypto-assets on behalf of clients; and 6. Custody and administration of crypto-assets on behalf of clients.

Any other product or service offered and advertised on this website or the Crypto.com App is provided by other group companies and does not fall within the Foris DAX MT Limited regulated services.

Contact: chat.crypto.com | Office: Level 7, Spinola Park, Triq Mikiel Ang Borg, St Julians SPK 1000 Malta.