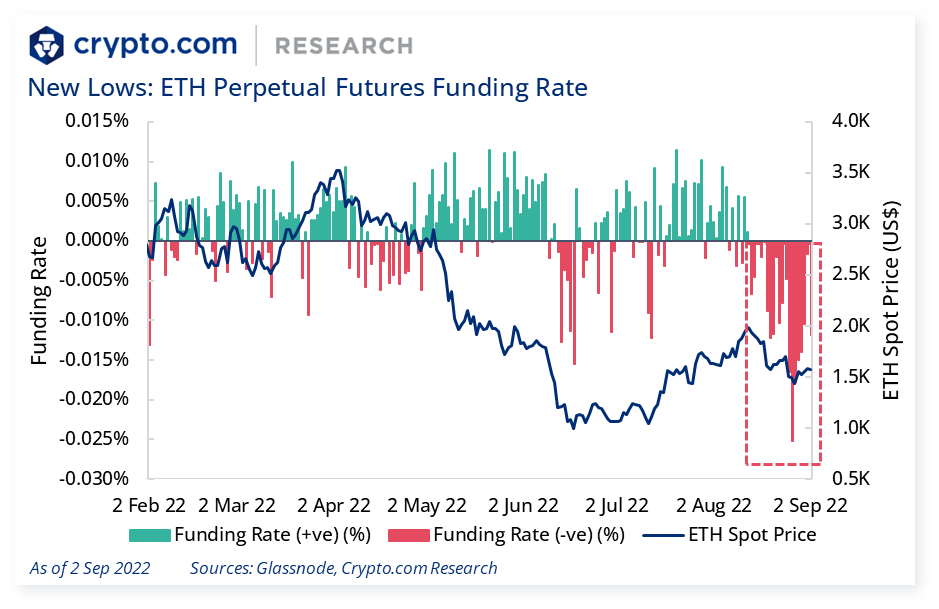

Chart of the Week: Perps Funding Rates at New Lows

- There has been a flurry of activity in ETH derivatives markets as the expected mid-September date of The Merge closes in. Perpetual futures funding rates are printing at record negative levels, potentially implying caution from traders as they look to hedge downside risks. Previous issues of Market Pulse highlighted record open interest in options and record negative futures basis.

Fund Flow Tracker

- Aggregated exchange balance of ETH fell sharply to new lows during the past week, while BTC’s saw a bounce.

Derivatives Pulse

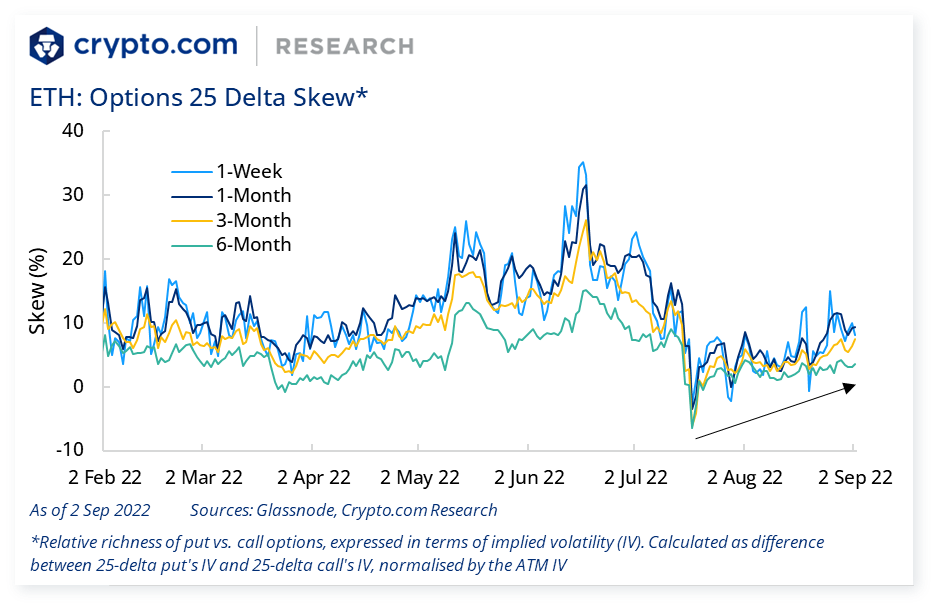

- The BTC put-call ratio and skews (puts-minus calls) rose over the past week, implying increased cautious sentiment. Implied vols for both BTC and ETH were mostly flat during the past week. 1-week implied vol currently stands at 60.3% (vs. 65.3% a week ago) and 89.1% (vs. 98.9% a week ago) for BTC and ETH, respectively.

- Asset managers’ net-long position in CME Bitcoin futures dropped to the lowest level since February 2022, and leveraged traders’ net-short position continues to reduce.

- Leveraged traders are typically hedge funds and various types of money managers, including commodity trading advisors and commodity pool operators. The traders may be engaged in managing and conducting proprietary futures trading, and trading on behalf of speculative clients.

- The asset manager category consists of institutional investors, including pension funds, endowments, insurance companies, mutual funds, and those portfolio/investment managers whose clients are predominantly institutional.

- The dealer category consists of participants typically described as the “sell-side” of the market. These include large banks and dealers in securities, swaps, and other derivatives. The other reportable category consists of traders mostly using markets to hedge business risk, and includes amongst others corporate treasuries.

Technically Speaking

- The drop in BTC price has it hovering around short-term oversold levels based on the 14-day Relative Strength Indicator (RSI).

Price Movements

Source: CoinGecko.com, Crypto.com Research

News Highlights

- Chicago Mercantile Exchange Group (CME Group), the world’s leading derivatives marketplace, has launched Euro-denominated Bitcoin and Ether futures.

- Meitu reported an impairment loss of over US$43M on its crypto holdings.

- Credit Suisse disclosed that it held US$31M in “digital assets” for clients as at the end of Q2 2022.

- Stacked, a Web3 streaming platform, has completed a US$12.9M Series-A funding round led by Pantera Capital.

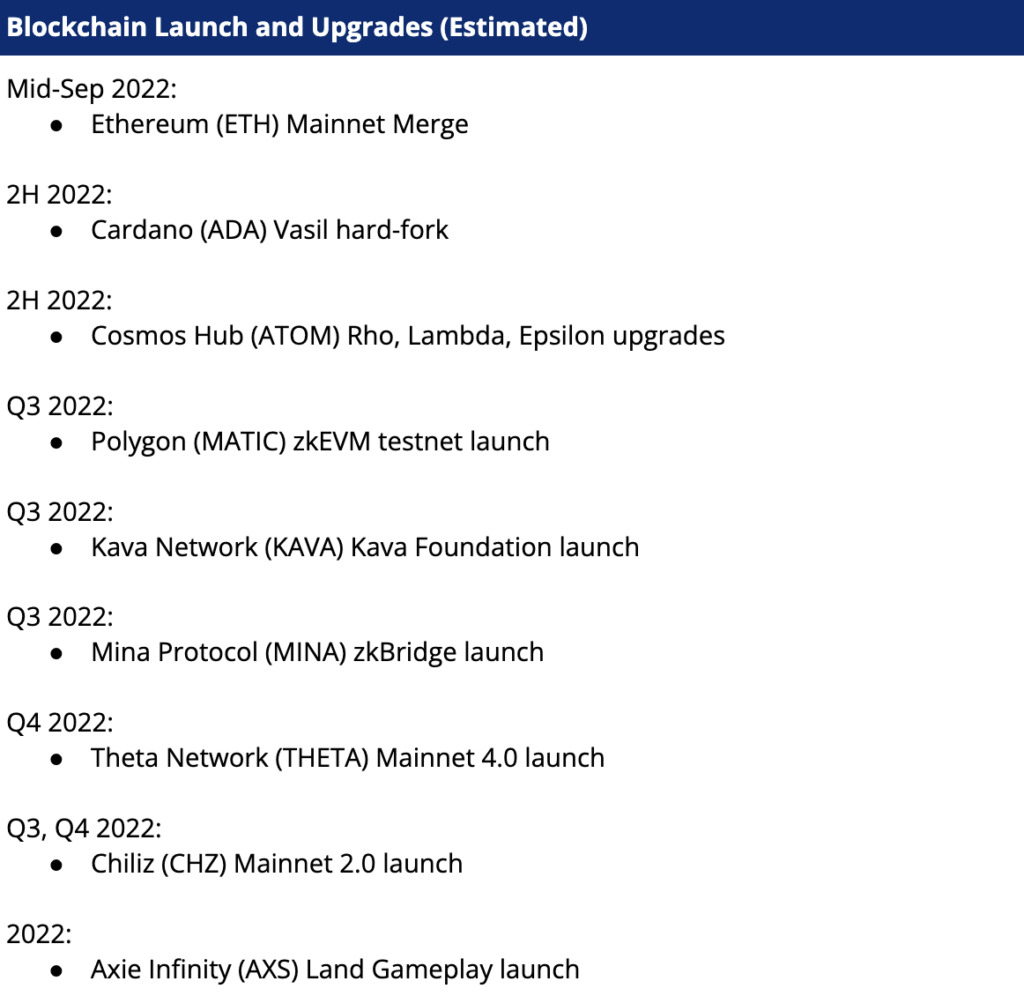

Catalyst Calendar

Disclaimer:

The information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.

The brands and the logos appearing in this report are registered trademarks of their respective owners.

Author

Research and Insights Team

Get fresh market updates delivered straight to your inbox:

Be the first to hear about new insights: